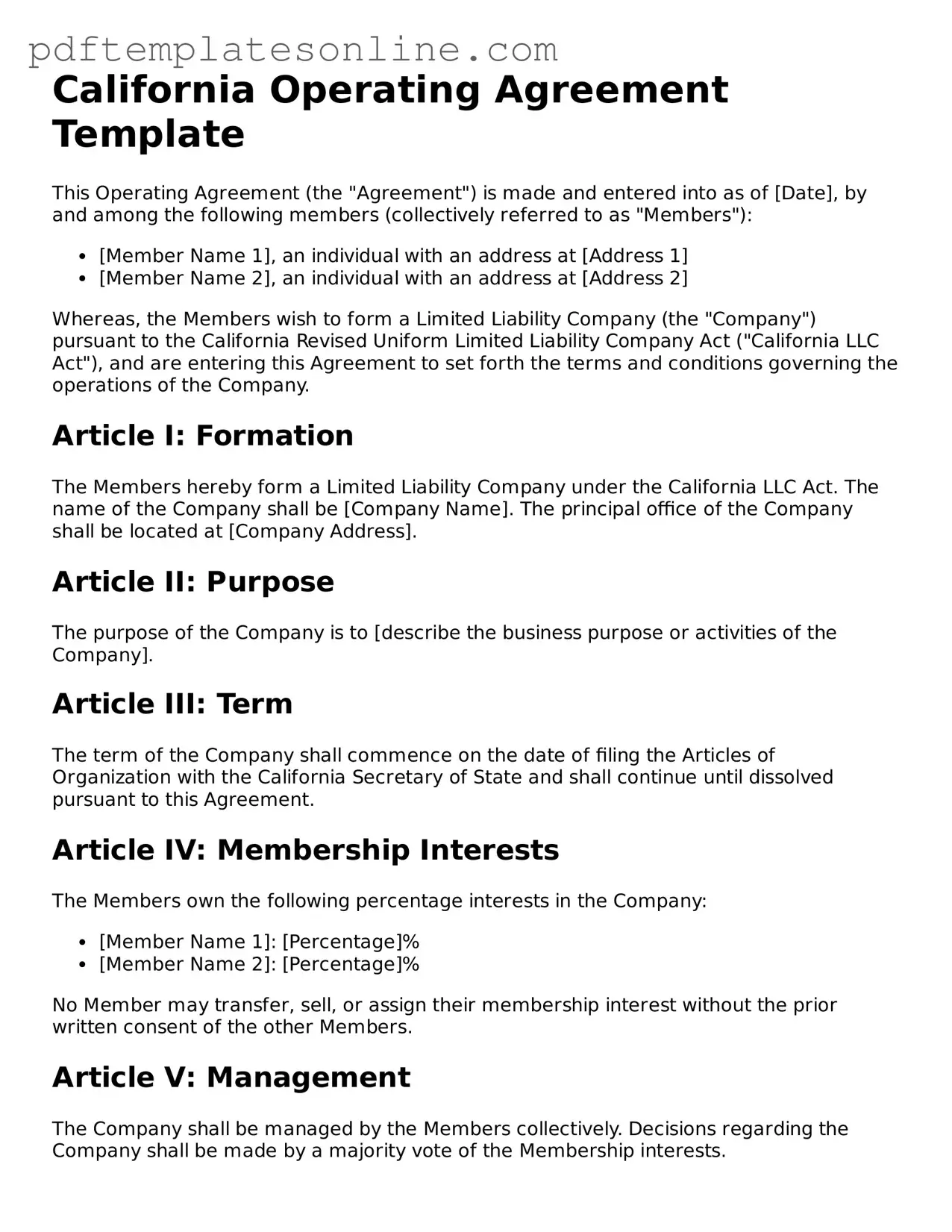

Official California Operating Agreement Document

Key takeaways

When filling out and using the California Operating Agreement form, it's essential to keep a few key points in mind. Here are some takeaways that can help guide you through the process:

- Understand the Purpose: The Operating Agreement outlines the management structure and operating procedures for your LLC. It serves as a foundational document for your business.

- Include Essential Details: Make sure to include the names of all members, their ownership percentages, and the roles they will play in the business.

- Define Management Structure: Clearly state whether your LLC will be managed by its members or by appointed managers. This helps prevent confusion down the line.

- Outline Voting Rights: Specify how decisions will be made. Will voting be based on ownership percentage, or will each member have an equal vote? Clarifying this is crucial.

- Address Profit and Loss Distribution: Clearly outline how profits and losses will be shared among members. This can help avoid disputes in the future.

- Include an Amendment Process: Life changes, and so may your business. Having a process in place for amending the agreement can be beneficial.

- Consult with Professionals: While you can fill out the form on your own, consulting with a lawyer or accountant can provide valuable insights and ensure compliance with California laws.

- Keep it Accessible: Store the Operating Agreement in a safe but accessible place. All members should have access to it for reference and clarity.

By keeping these takeaways in mind, you can create a comprehensive Operating Agreement that supports your LLC's success.

Common mistakes

When filling out the California Operating Agreement form, many individuals encounter common pitfalls that can lead to complications down the line. One frequent mistake is failing to clearly define the roles and responsibilities of each member. Without this clarity, misunderstandings may arise, leading to disputes that could have been easily avoided.

Another common error is neglecting to specify the percentage of ownership for each member. This information is crucial, as it determines profit distribution and decision-making authority. If left ambiguous, it can create friction among members and complicate financial arrangements.

Some individuals overlook the importance of including provisions for decision-making processes. Without a clear outline of how decisions will be made—whether by majority vote or unanimous consent—members may find themselves at an impasse during critical moments.

Additionally, failing to address what happens if a member wants to leave the business can lead to significant challenges. It is essential to include buyout provisions or procedures for transferring ownership to ensure a smooth transition and protect the interests of remaining members.

Many people also forget to update the Operating Agreement as the business evolves. As circumstances change, such as the addition of new members or shifts in business direction, the agreement should be revised to reflect those changes accurately.

Another mistake is not considering the tax implications of the chosen business structure. Members should be aware of how their decisions regarding the Operating Agreement can affect their tax responsibilities, as this can have lasting financial consequences.

Some individuals may skip the step of having the agreement reviewed by a legal professional. This oversight can lead to unintentional errors or omissions that could have been easily identified and corrected with expert guidance.

Moreover, neglecting to include a dispute resolution process is a significant oversight. Establishing a method for resolving conflicts can save time, money, and relationships, ensuring that issues are addressed in a constructive manner.

Another frequent error is failing to sign and date the agreement. An unsigned document may not hold up in legal situations, rendering the agreement ineffective. Each member’s signature is a vital part of validating the terms laid out in the Operating Agreement.

Lastly, individuals often underestimate the importance of thoroughness. Rushing through the completion of the form can lead to incomplete information or inaccuracies. Taking the time to carefully review and ensure all sections are properly filled out is essential for the integrity of the agreement.

Misconceptions

- Misconception 1: An Operating Agreement is only necessary for large businesses.

- Misconception 2: The Operating Agreement is filed with the state.

- Misconception 3: An Operating Agreement is not legally binding.

- Misconception 4: Once created, the Operating Agreement cannot be changed.

- Misconception 5: The Operating Agreement is just a formality and doesn’t really matter.

This is not true. Even small businesses or single-member LLCs benefit from having an Operating Agreement. It helps clarify ownership and operational procedures, which can prevent misunderstandings later on.

Many people think they must submit their Operating Agreement to the state. In reality, this document is kept internally. It serves as a private contract among members and is not required to be filed.

Some believe that an Operating Agreement holds no legal weight. However, it is a binding contract among the members of the LLC. Courts generally uphold the terms outlined in the agreement, as long as they comply with state laws.

This is a common misunderstanding. An Operating Agreement can be amended as needed, provided that all members agree to the changes. Flexibility is key to adapting to new circumstances.

While it might seem like a formality, the Operating Agreement is crucial. It outlines the roles, responsibilities, and rights of each member, helping to avoid disputes and ensuring smooth operations.

Dos and Don'ts

When filling out the California Operating Agreement form, it is essential to approach the task with care and attention to detail. This document serves as a foundational agreement for your business, outlining the roles, responsibilities, and operational procedures of your limited liability company (LLC). Below is a list of ten important do's and don'ts to consider during this process.

- Do ensure that all members of the LLC are included in the agreement.

- Do clearly define each member's ownership percentage.

- Do specify the management structure, whether it be member-managed or manager-managed.

- Do outline the procedures for adding or removing members.

- Do include provisions for handling disputes among members.

- Don't leave any sections blank; complete every part of the form.

- Don't use vague language that could lead to misunderstandings.

- Don't forget to include the effective date of the agreement.

- Don't ignore state-specific requirements; familiarize yourself with California laws.

- Don't rush through the process; take the time to review and revise the document.

By adhering to these guidelines, you can create a comprehensive and effective Operating Agreement that will serve your LLC well into the future.

Browse Popular Operating Agreement Forms for US States

What Is an Llc Business - A well-structured Operating Agreement reflects the professionalism of the LLC to external parties.

The California Transfer-on-Death Deed form allows homeowners to pass on their property to a beneficiary without the complexities of going through probate court. This legal document offers a straightforward way for property owners to ensure their real estate transitions smoothly after they pass away. For more information about this essential form, you can visit California PDF Forms, which provides resources to assist homeowners in navigating this beneficial process.

How to Make an Operating Agreement - An Operating Agreement may also specify tax treatment preferences.

Texas Llc Operating Agreement - This document may include confidentiality clauses to protect sensitive information.

Detailed Guide for Writing California Operating Agreement

Once you have gathered the necessary information, you are ready to fill out the California Operating Agreement form. This document is essential for outlining the management structure and operational procedures of your business. Follow the steps below to complete the form accurately.

- Begin by entering the name of your LLC at the top of the form. Make sure it matches the name registered with the California Secretary of State.

- Next, provide the principal office address of your LLC. This should be a physical location, not a P.O. Box.

- List the names and addresses of all members of the LLC. Include their ownership percentages to clarify each member's stake in the business.

- Outline the management structure. Indicate whether the LLC will be managed by its members or by appointed managers.

- Detail the voting rights of members. Specify how decisions will be made, including any required majority for different types of votes.

- Include provisions for adding new members or handling the departure of existing members. This section should cover buyout procedures and any restrictions on transfers of ownership.

- Address the distribution of profits and losses. Clearly state how these will be allocated among members.

- Finally, review the entire document for accuracy. Ensure that all sections are complete and that there are no errors before signing.

After completing the form, you will need to have it signed by all members. Keep a copy for your records and consider filing it with your state if required. This agreement serves as a foundational document for your LLC's operations.