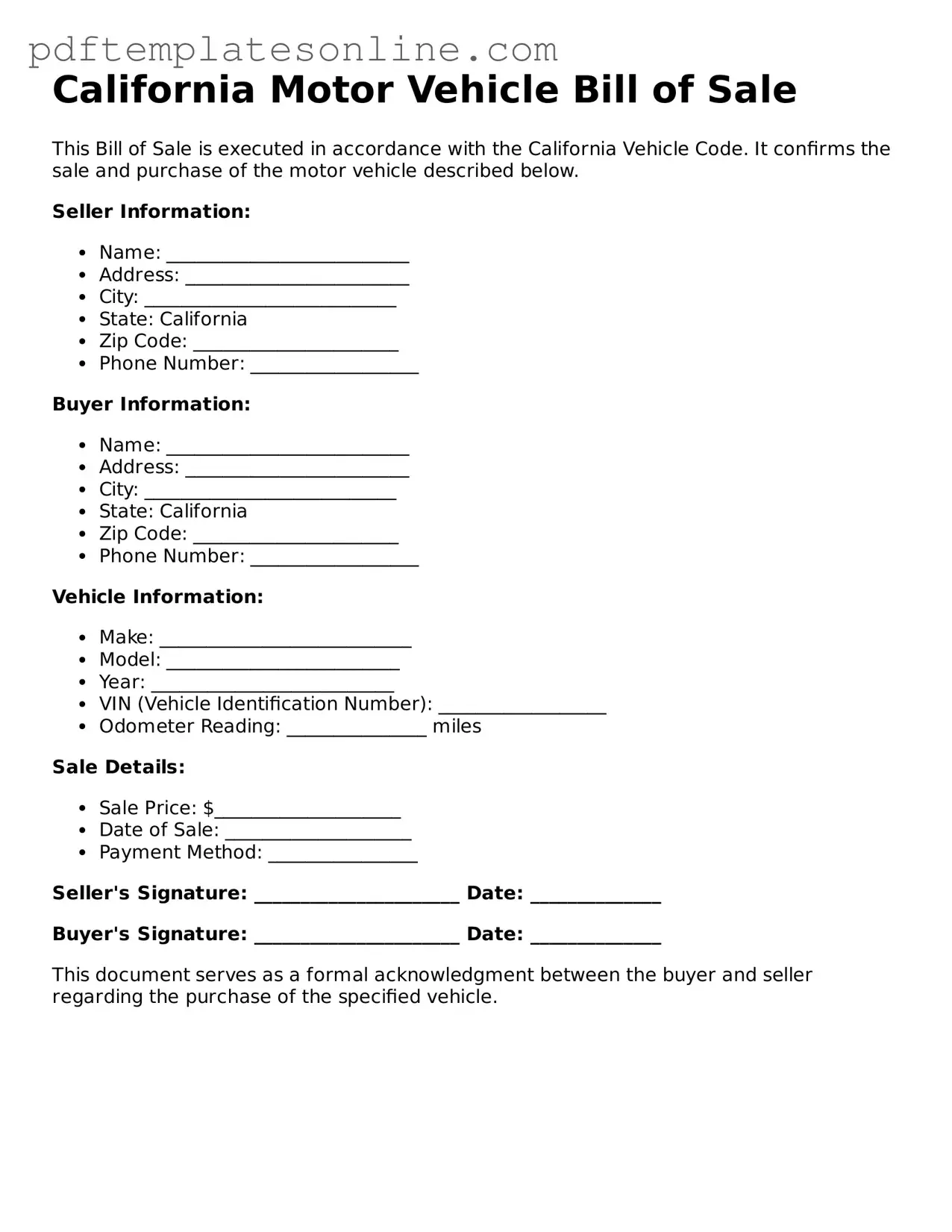

Official California Motor Vehicle Bill of Sale Document

Key takeaways

When filling out and using the California Motor Vehicle Bill of Sale form, it’s essential to keep several key points in mind. This document serves as proof of the transaction between the seller and buyer of a vehicle. Here are some important takeaways:

- Accurate Information: Ensure that all information is filled out accurately. This includes the names, addresses, and contact information of both the seller and buyer.

- Vehicle Details: Include specific details about the vehicle, such as the make, model, year, VIN (Vehicle Identification Number), and odometer reading at the time of sale.

- Sale Price: Clearly state the sale price of the vehicle. This amount is crucial for tax purposes and future registration.

- Signatures Required: Both the seller and buyer must sign the bill of sale. This signature confirms that both parties agree to the terms of the sale.

- Date of Transaction: Record the date when the sale takes place. This information is important for both parties’ records.

- Notarization: While notarization is not required for all transactions, having the bill of sale notarized can provide additional security and validation.

- Keep Copies: Each party should keep a copy of the completed bill of sale for their records. This document can be useful for future reference, especially for registration and tax purposes.

- Use for Registration: The bill of sale is often required when registering the vehicle with the Department of Motor Vehicles (DMV). Ensure that it is readily available during the registration process.

By following these key points, both buyers and sellers can ensure a smooth transaction and maintain proper documentation for their vehicles.

Common mistakes

When filling out the California Motor Vehicle Bill of Sale form, individuals often encounter several common pitfalls that can lead to complications down the road. One prevalent mistake is failing to provide accurate vehicle information. This includes the vehicle identification number (VIN), make, model, and year. If these details are incorrect, it can create significant problems when registering the vehicle or transferring ownership.

Another frequent error involves neglecting to include the correct purchase price. The Bill of Sale should reflect the actual amount paid for the vehicle. Inaccuracies in this section can lead to issues with tax assessments and may even raise questions during a potential audit by the California Department of Motor Vehicles (DMV).

Many people also overlook the necessity of both the buyer’s and seller’s signatures. This form is a legal document, and without the proper signatures, it may not be considered valid. It is essential that both parties review the form carefully and sign it in the designated areas to ensure that the transaction is officially recognized.

Additionally, individuals sometimes forget to date the Bill of Sale. The date of the transaction is crucial, as it establishes when ownership was transferred. Without this date, there may be confusion regarding the timeline of ownership, which can complicate future transactions or registrations.

Another mistake often made is not keeping a copy of the completed Bill of Sale. After signing the document, both the buyer and the seller should retain a copy for their records. This serves as proof of the transaction and can be invaluable in case any disputes arise later on.

Lastly, some individuals fail to understand the importance of including any disclosures regarding the vehicle’s condition. If the vehicle has any known defects or issues, these should be clearly stated in the Bill of Sale. Not disclosing such information can lead to legal complications, as the buyer may have grounds for a complaint if they discover undisclosed problems after the sale.

Misconceptions

The California Motor Vehicle Bill of Sale form is often surrounded by misunderstandings. Here are four common misconceptions that people may have about this important document:

- It is only necessary for private sales. Many believe that a Bill of Sale is only required when selling a vehicle privately. In reality, it can also be useful in transactions involving dealerships, as it serves as proof of purchase.

- It must be notarized to be valid. Some individuals think that notarization is a requirement for the Bill of Sale to be legally binding. However, notarization is not mandatory in California, although it can add an extra layer of authenticity.

- It is the same as a title transfer. There is a common belief that the Bill of Sale and the title transfer process are one and the same. In fact, while the Bill of Sale documents the transaction, the title transfer is a separate process that officially changes ownership with the Department of Motor Vehicles (DMV).

- Only the seller needs to sign it. Some people assume that only the seller's signature is necessary for the Bill of Sale to be valid. In truth, both the seller and the buyer should sign the document to ensure that both parties acknowledge the transaction.

Dos and Don'ts

When filling out the California Motor Vehicle Bill of Sale form, it is important to follow certain guidelines to ensure the process goes smoothly. Here are nine things you should and shouldn't do:

- Do provide accurate information about the vehicle, including the make, model, year, and VIN.

- Don't leave any required fields blank. Incomplete forms can lead to delays.

- Do include the sale price clearly to avoid any misunderstandings.

- Don't use abbreviations or slang. Use clear and precise language.

- Do sign and date the form in the appropriate sections.

- Don't forget to have the buyer and seller both sign the document.

- Do keep a copy of the completed form for your records.

- Don't ignore the need for a notary if required by local regulations.

- Do verify that the odometer reading is accurate and included on the form.

Browse Popular Motor Vehicle Bill of Sale Forms for US States

Trailer Bill of Sale Georgia - Using a bill of sale reflects professionalism and seriousness in the transaction process.

Car Bill of Sale Printable - Buyers can use the Bill of Sale to confirm the ownership and history of a vehicle.

Auto Bill of Sale Template - It can clarify any terms of sale, including payment methods and timelines.

Ohio Vehicle Bill of Sale - Indicates the method of payment agreed upon by both parties.

Detailed Guide for Writing California Motor Vehicle Bill of Sale

Once you have the California Motor Vehicle Bill of Sale form in front of you, it’s time to fill it out accurately. Completing this form correctly is essential for both the buyer and the seller, as it provides proof of the transaction. Here’s how to do it step by step.

- Gather Necessary Information: Before you start, make sure you have all relevant details at hand, including the vehicle’s make, model, year, VIN (Vehicle Identification Number), and the sale price.

- Fill in Seller Information: Enter the full name and address of the seller. This is the person or entity selling the vehicle.

- Fill in Buyer Information: Next, provide the full name and address of the buyer. This is the person who will be purchasing the vehicle.

- Enter Vehicle Details: Write down the vehicle’s make, model, year, and VIN. This information helps identify the vehicle being sold.

- Indicate Sale Price: Clearly state the agreed-upon sale price for the vehicle. This is important for both parties and for tax purposes.

- Sign and Date: Both the seller and buyer must sign and date the form. This signifies that both parties agree to the terms of the sale.

- Make Copies: After completing the form, make copies for both the buyer and seller. This ensures that both parties have a record of the transaction.

After filling out the form, both parties should keep their copies for future reference. This documentation will be helpful for registration and potential disputes down the line.