Official California Loan Agreement Document

Key takeaways

When filling out and using the California Loan Agreement form, it’s essential to keep several key points in mind. This ensures that the agreement is clear, legally binding, and protects the interests of both parties involved.

- Identify the Parties: Clearly state the names and addresses of both the lender and the borrower. This helps to avoid any confusion about who is involved in the agreement.

- Loan Amount: Specify the exact amount being loaned. Be precise to prevent any misunderstandings later on.

- Interest Rate: Include the interest rate being charged on the loan. This should be clearly defined, whether it is a fixed or variable rate.

- Repayment Terms: Outline how and when the borrower will repay the loan. Include the payment schedule, due dates, and any late fees that may apply.

- Default Conditions: Define what constitutes a default on the loan. This can include missed payments or failure to meet other obligations outlined in the agreement.

- Governing Law: Indicate that the agreement will be governed by California law. This is important for resolving any disputes that may arise.

- Signatures: Ensure both parties sign and date the agreement. This step is crucial for the agreement to be legally enforceable.

- Keep Copies: Each party should retain a signed copy of the agreement. This serves as a reference and proof of the terms agreed upon.

By paying attention to these key takeaways, you can create a solid foundation for your loan agreement that protects both the lender and the borrower.

Common mistakes

Filling out the California Loan Agreement form can be a straightforward process, but many people make common mistakes that can lead to complications. One frequent error is failing to provide accurate personal information. Borrowers must ensure that their names, addresses, and contact details are correct. Inaccuracies can delay the loan process and create confusion.

Another mistake is neglecting to read the terms and conditions carefully. The Loan Agreement outlines important details such as interest rates, repayment schedules, and fees. Skipping this step can result in misunderstandings and unexpected costs down the line.

Some individuals also overlook the importance of specifying the loan amount. It is crucial to clearly state how much money is being borrowed. Ambiguity in this section can lead to disputes between the lender and borrower regarding the actual loan amount.

People often forget to include the purpose of the loan. Stating the reason for borrowing can provide context and help both parties understand the agreement better. This information can also be useful in case of any future questions or issues.

Another common error is not signing the document. A signature is a vital part of the agreement, as it signifies acceptance of the terms. Without a signature, the loan agreement is not legally binding, which can result in significant problems later.

Additionally, borrowers sometimes fail to date the form. Including the date is essential for establishing when the agreement was made. This information is important for tracking the timeline of the loan and any associated obligations.

Some individuals neglect to discuss the repayment terms with the lender. It is important to have a clear understanding of how and when payments will be made. Miscommunication can lead to missed payments and potential penalties.

Lastly, people may not keep a copy of the completed Loan Agreement. Retaining a copy is crucial for reference in the future. Having a record of the agreement can help resolve any disputes that may arise and ensures that both parties are aware of their obligations.

Misconceptions

Understanding the California Loan Agreement form is crucial for anyone involved in lending or borrowing. However, several misconceptions can lead to confusion and potential issues. Here are five common misconceptions about this important document:

- It is a one-size-fits-all document. Many people believe that the California Loan Agreement form can be used universally for all types of loans. In reality, different loans require specific terms and conditions tailored to the situation.

- It does not need to be notarized. Some individuals think that a loan agreement does not require notarization. While notarization is not always mandatory, having a notary can provide an extra layer of security and validation for the agreement.

- Verbal agreements are sufficient. A common misconception is that verbal agreements are enough to secure a loan. However, without a written agreement, it can be difficult to enforce the terms and protect the interests of both parties.

- All loan agreements are the same. People often assume that all loan agreements, including the California Loan Agreement form, contain the same clauses. Each agreement can vary significantly based on the lender's requirements and the borrower's needs.

- Once signed, it cannot be changed. Many believe that once the California Loan Agreement form is signed, it cannot be modified. In truth, both parties can agree to amend the terms, but this should be documented properly to avoid misunderstandings.

Being aware of these misconceptions can help ensure that both lenders and borrowers navigate the loan process more effectively and with greater confidence.

Dos and Don'ts

When filling out the California Loan Agreement form, it’s important to approach the task with care and attention. Here are some dos and don'ts to keep in mind:

- Do read the entire agreement thoroughly before filling it out.

- Do provide accurate and complete information to avoid delays.

- Do double-check all figures and terms to ensure they are correct.

- Do sign and date the form in the designated areas.

- Don't leave any required fields blank; fill in all necessary information.

- Don't use abbreviations or shorthand that could lead to misunderstandings.

- Don't rush through the process; take your time to ensure everything is clear.

By following these guidelines, you can help ensure that your loan agreement is processed smoothly and efficiently.

Browse Popular Loan Agreement Forms for US States

New York Promissory Note - A well-drafted Loan Agreement can be essential in preserving trust.

A California Real Estate Purchase Agreement form is a crucial document used in the process of buying or selling real estate in California. It outlines the terms and conditions of the sale, including the purchase price, financing details, and inspection rights. This legal document ensures that both parties, the buyer and the seller, understand their rights and obligations, and you can find helpful resources and templates, such as those available at California PDF Forms.

Free Promissory Note Template Texas - Provides for the possibility of loan modifications if needed.

Detailed Guide for Writing California Loan Agreement

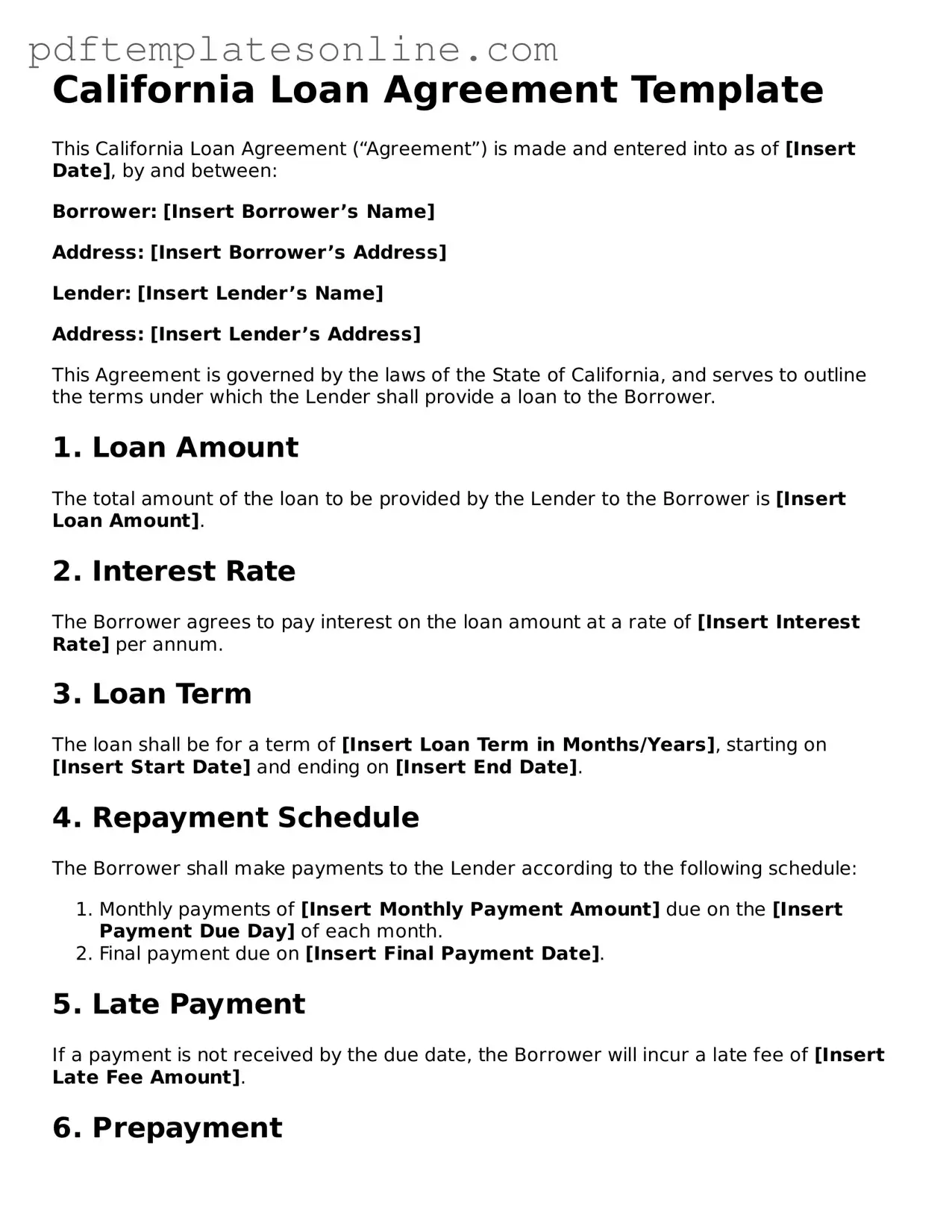

After obtaining the California Loan Agreement form, you are ready to fill it out. This process involves providing specific information about the loan, the parties involved, and the terms of repayment. Follow these steps carefully to ensure accuracy and completeness.

- Read the form thoroughly. Familiarize yourself with each section before you begin filling it out.

- Enter the date. Write the date on which the agreement is being executed at the top of the form.

- Provide borrower information. Fill in the full name, address, and contact information of the borrower.

- Provide lender information. Fill in the full name, address, and contact information of the lender.

- Specify the loan amount. Clearly state the total amount of money being loaned.

- Detail the interest rate. Indicate the annual interest rate applicable to the loan.

- Outline repayment terms. Describe how and when the borrower will repay the loan, including payment frequency and due dates.

- Include any additional terms. If there are specific conditions or clauses, such as late fees or prepayment penalties, include them in this section.

- Sign the form. Both the borrower and lender must sign and date the agreement to make it legally binding.

- Make copies. After signing, create copies for both parties to retain for their records.