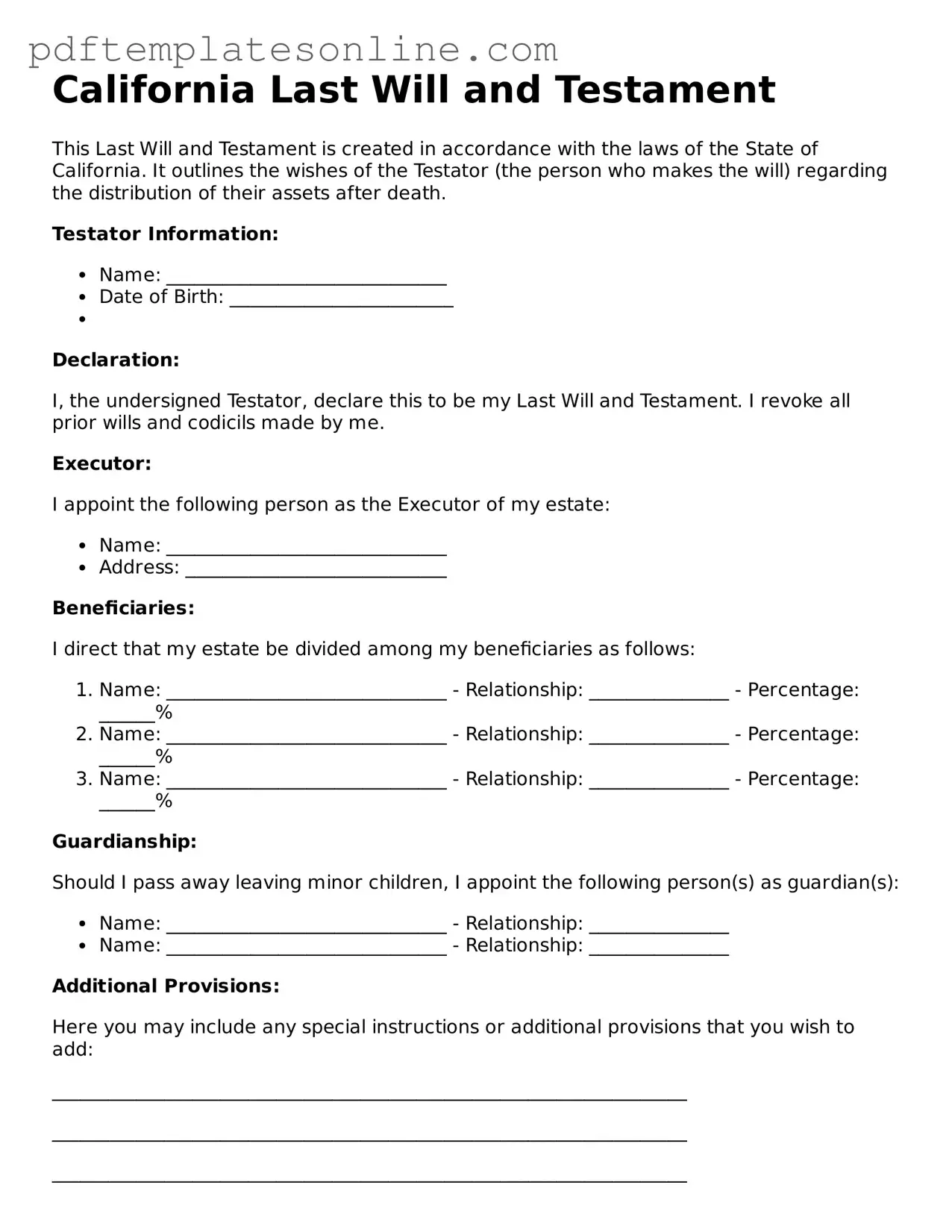

Official California Last Will and Testament Document

Key takeaways

When filling out and using the California Last Will and Testament form, it’s important to keep several key points in mind to ensure your wishes are clearly expressed and legally recognized.

- Understand the Purpose: A Last Will and Testament outlines how your assets will be distributed after your passing. It also allows you to appoint guardians for minor children.

- Choose an Executor: Select a trustworthy person to act as your executor. This individual will be responsible for carrying out the terms of your will.

- Be Clear and Specific: Clearly state your wishes regarding asset distribution. Ambiguities can lead to disputes among heirs.

- Sign and Date: Ensure that you sign and date the will in front of at least two witnesses. This step is crucial for the document's validity.

- Consider Legal Advice: While it’s possible to create a will on your own, consulting with a legal professional can help avoid potential pitfalls.

- Review Regularly: Life changes such as marriage, divorce, or the birth of a child may require updates to your will. Regular reviews ensure your document remains current.

Common mistakes

Filling out a California Last Will and Testament form can be a straightforward process, but there are common mistakes that individuals often make. One frequent error is not being clear about the distribution of assets. It's important to specify who will receive what. Vague language can lead to confusion and potential disputes among beneficiaries.

Another mistake is failing to update the will after major life events. Changes such as marriage, divorce, or the birth of a child can significantly affect how assets should be distributed. If a will is not updated, it may not reflect the current wishes of the individual.

People sometimes overlook the requirement for witnesses. In California, a will must be signed by at least two witnesses who are present at the same time. If this step is skipped, the will may be deemed invalid. It’s essential to ensure that witnesses are not beneficiaries themselves to avoid conflicts of interest.

Some individuals forget to include a residuary clause. This clause explains what should happen to any assets not specifically mentioned in the will. Without it, there could be uncertainty about how leftover assets will be handled, leading to potential legal issues.

Another common mistake is not signing the will properly. A will must be signed at the end of the document. If it is not signed or if the signature is placed incorrectly, the will may not be considered valid. It’s crucial to follow the signing requirements carefully.

People may also neglect to provide clear instructions for the executor. The executor is responsible for carrying out the wishes outlined in the will. Without clear guidance, the executor may struggle to fulfill their duties, leading to delays and misunderstandings.

Lastly, many individuals fail to store the will in a safe but accessible location. If the will cannot be found after the individual passes away, it may not be honored. Keeping it in a secure place, while ensuring that trusted individuals know where to find it, is essential for ensuring that the will is executed as intended.

Misconceptions

Understanding the California Last Will and Testament form is essential for effective estate planning. However, several misconceptions can lead to confusion. Here are seven common misconceptions:

- A will is only for wealthy individuals. Many people believe that only those with significant assets need a will. In reality, anyone can benefit from having a will to ensure their wishes are followed after death.

- Wills are only necessary if you have children. While having children may make a will more critical, anyone can create a will to dictate how their assets should be distributed, regardless of their parental status.

- Oral wills are legally binding in California. California law does not recognize oral wills. A valid will must be in writing and meet specific requirements to be enforceable.

- Once a will is created, it cannot be changed. This is not true. Individuals can revise their wills at any time, as long as they follow the legal requirements for amendments.

- Having a will avoids probate. A will does not prevent probate. It simply provides instructions for the probate process, which is still required to validate the will and distribute assets.

- All assets automatically go to the beneficiaries named in the will. Some assets, like those held in joint tenancy or with designated beneficiaries, may bypass the will and go directly to other parties.

- You can write a will on any piece of paper. While it is possible to create a handwritten will, California has specific requirements regarding format and witnesses that must be followed for the will to be valid.

Clearing up these misconceptions can help individuals make informed decisions about their estate planning needs.

Dos and Don'ts

When filling out the California Last Will and Testament form, it’s essential to follow certain guidelines to ensure your wishes are clearly expressed. Here’s a list of what you should and shouldn’t do:

- Do ensure that you are of sound mind when completing the form.

- Do clearly identify yourself, including your full name and address.

- Do specify your beneficiaries and what they will receive.

- Do sign the document in the presence of at least two witnesses.

- Don’t use unclear or vague language that might lead to confusion.

- Don’t forget to date the will when you sign it.

- Don’t alter the form after it has been signed without proper procedures.

By adhering to these guidelines, you can create a valid and effective will that reflects your intentions.

Browse Popular Last Will and Testament Forms for US States

Free Ny Will Template - Acts as a safeguard for ensuring that financial responsibilities are settled respectfully.

The California Small Estate Affidavit form is a legal document used to simplify the process of estate distribution for estates valued below a certain threshold. Through this form, eligible individuals can bypass the often lengthy and complex probate court procedures. This expedited process allows for a more efficient transfer of assets to heirs or beneficiaries. For more information, you can visit California PDF Forms.

Sample of Last Will and Testament - A formal agreement that outlines any specific wishes for property you own individually.

Detailed Guide for Writing California Last Will and Testament

After obtaining the California Last Will and Testament form, it's essential to fill it out accurately to ensure your wishes are clearly expressed. The following steps will guide you through the process of completing the form effectively.

- Gather necessary information: Collect personal details such as your full name, address, and date of birth. Also, have the names and addresses of your beneficiaries ready.

- Identify your executor: Choose a trustworthy person to manage your estate after your passing. Write down their name and contact information.

- List your assets: Create a comprehensive list of your assets, including property, bank accounts, investments, and personal belongings.

- Specify distributions: Clearly state how you want your assets distributed among your beneficiaries. Be specific about who gets what.

- Include guardianship provisions: If you have minor children, designate a guardian for them and include their name in the will.

- Sign the document: After filling out the form, sign it in the presence of at least two witnesses. They should also sign the document to validate it.

- Store the will safely: Keep the signed will in a secure location, such as a safe or with your attorney, and inform your executor of its location.