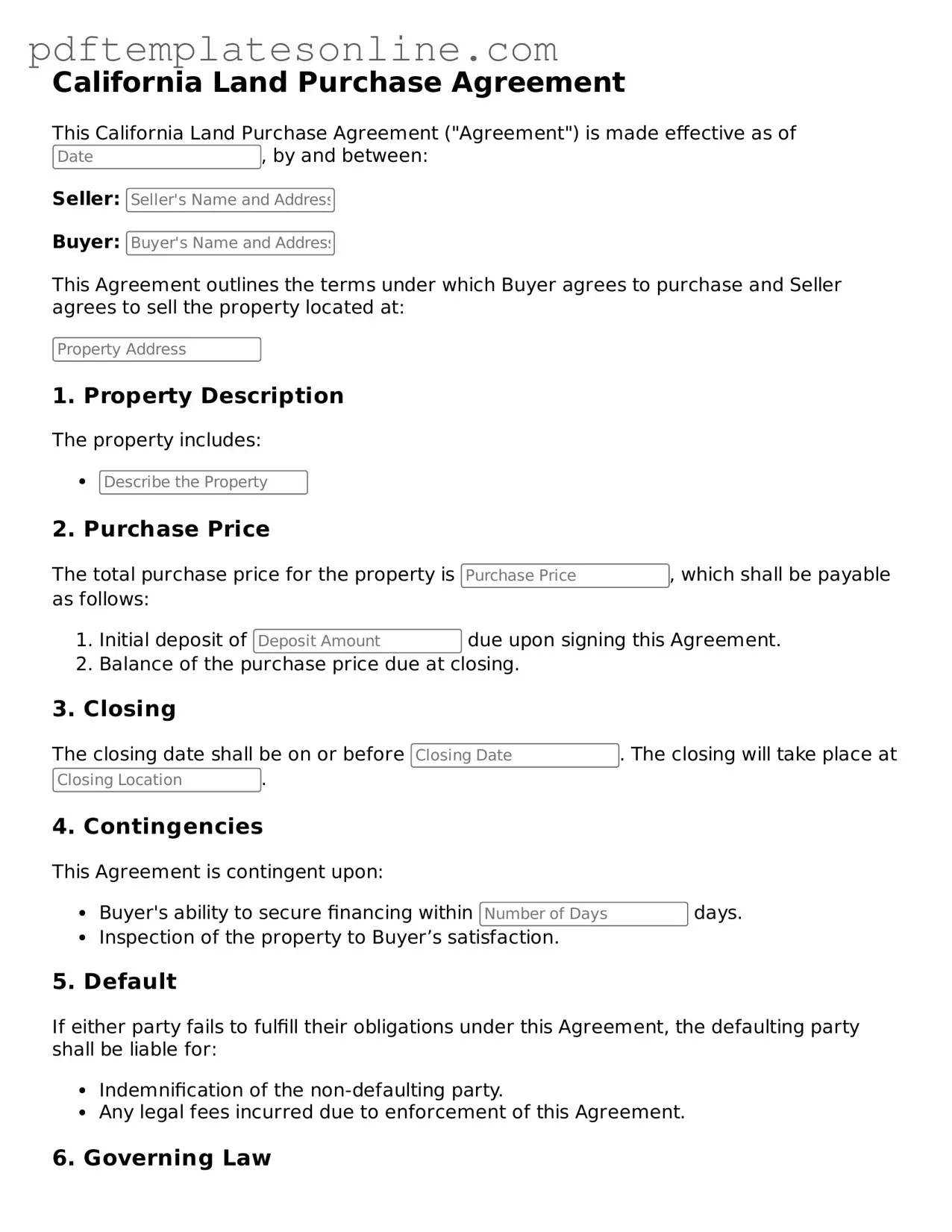

Official California Land Purchase Agreement Document

Key takeaways

When engaging in a real estate transaction in California, understanding the California Land Purchase Agreement form is essential. Here are four key takeaways to consider:

- Clarity in Terms: Ensure that all terms of the sale are clearly defined. This includes the purchase price, property description, and any contingencies that may apply.

- Disclosure Requirements: California law mandates certain disclosures. Sellers must provide information about the property's condition and any known issues that could affect its value.

- Contingencies: Consider including contingencies that allow the buyer to back out of the agreement under specific conditions, such as failing to secure financing or unsatisfactory inspection results.

- Legal Review: It is advisable to have the agreement reviewed by a legal professional. This can help ensure that all legal requirements are met and that the interests of both parties are protected.

Common mistakes

Filling out the California Land Purchase Agreement form can be a daunting task. Many people make mistakes that can lead to complications down the line. Understanding these common pitfalls can help ensure a smoother transaction.

One frequent mistake is failing to provide accurate property descriptions. It's essential to include the correct address and legal description of the property. Omitting or misrepresenting this information can lead to disputes later.

Another common error is not specifying the purchase price clearly. Both parties must agree on the amount, and this should be clearly stated in the agreement. Ambiguities can create confusion and potential legal issues.

Many individuals overlook the importance of including contingencies. These are conditions that must be met for the sale to proceed. Without them, buyers may find themselves locked into an agreement without the ability to back out if certain conditions are not satisfied.

Additionally, failing to include earnest money can be problematic. This deposit shows the buyer's commitment to the purchase. Not specifying the amount or the terms of the deposit can raise questions about the seriousness of the offer.

Another mistake is neglecting to outline the closing date. This date is crucial for both parties to plan accordingly. Without a specified timeline, delays can occur, leading to frustration and potential financial loss.

Many people also forget to address who is responsible for closing costs. This can lead to misunderstandings and disputes. Clearly stating who will pay these costs in the agreement can prevent issues later.

Some individuals fail to sign the document correctly. All required parties must sign the agreement for it to be valid. Missing signatures can invalidate the contract, leaving both parties unprotected.

Not reviewing the document thoroughly before submission is another common mistake. It's vital to check for errors or omissions. A careful review can save time and prevent legal complications in the future.

Lastly, many overlook the importance of legal advice. Consulting with a professional can provide clarity and ensure that all aspects of the agreement are properly addressed. Taking this step can help protect your interests and facilitate a successful transaction.

Misconceptions

Understanding the California Land Purchase Agreement form is crucial for anyone involved in real estate transactions in the state. However, several misconceptions can lead to confusion and potentially costly mistakes. Here are eight common misconceptions about this important document:

- The form is only for residential properties. Many believe that the California Land Purchase Agreement is exclusively for residential transactions. In reality, it can be used for both residential and commercial properties, making it versatile for various types of real estate deals.

- It is a legally binding contract as soon as it is signed. While signing the agreement does create a binding contract, it is essential to understand that all parties must have a clear understanding of the terms. A contract can be voided if there is a lack of mutual consent or if it is signed under duress.

- All terms are negotiable. Although many terms in the agreement can be negotiated, some aspects, such as certain legal requirements and disclosures, are mandated by law and cannot be altered. Understanding which terms are flexible and which are not is vital.

- Once signed, the agreement cannot be changed. This is a misconception. Parties can amend the agreement if both agree to the changes and document them properly. However, any amendments should be made in writing to avoid future disputes.

- The seller is always responsible for repairs. Many assume that the seller must handle all repairs before closing. However, the agreement can specify who is responsible for repairs, and buyers should carefully review these terms.

- It is unnecessary to have a lawyer review the agreement. While it is possible to complete the transaction without legal assistance, having a lawyer review the agreement can help identify potential issues and ensure that all legal requirements are met.

- The purchase price is the only important term. While the purchase price is significant, other terms, such as contingencies, timelines, and financing arrangements, are equally important. Neglecting these can lead to complications down the line.

- Once the agreement is signed, the buyer cannot back out. This is not entirely true. Buyers may have the right to back out under certain conditions, such as if they discover issues during inspections or if contingencies are not met. Understanding these conditions is crucial for protecting one’s interests.

Awareness of these misconceptions can empower individuals to navigate the California Land Purchase Agreement more effectively. It is essential to approach the process with a clear understanding of the terms and implications involved.

Dos and Don'ts

When filling out the California Land Purchase Agreement form, attention to detail is crucial. Here are some important dos and don'ts to consider:

- Do read the entire agreement thoroughly before filling it out. Understanding every section can prevent misunderstandings later.

- Do provide accurate information. Ensure that all names, addresses, and property details are correct to avoid legal complications.

- Do consult with a real estate attorney if you have any questions. Professional guidance can clarify complex terms and conditions.

- Do keep a copy of the completed agreement for your records. This can be helpful for future reference and in case of disputes.

- Don't rush through the form. Taking your time can help you catch errors and omissions that could lead to issues.

- Don't leave any sections blank unless instructed. Missing information can delay the process or invalidate the agreement.

- Don't ignore deadlines. Timely submission of the agreement is essential to ensure that the transaction proceeds smoothly.

- Don't sign the agreement without fully understanding its terms. Signing without comprehension can lead to unintended obligations.

Detailed Guide for Writing California Land Purchase Agreement

Once you have the California Land Purchase Agreement form in hand, it’s important to approach the filling out process methodically. This ensures that all necessary information is accurately recorded, which can help facilitate a smooth transaction. Follow these steps carefully to complete the form.

- Read the Instructions: Before you start, familiarize yourself with any specific instructions provided with the form.

- Identify the Parties: Fill in the names and addresses of the buyer(s) and seller(s). Make sure to include all relevant details.

- Describe the Property: Clearly specify the property being purchased. Include the address, legal description, and any other identifying information.

- Purchase Price: Enter the agreed-upon purchase price for the property. Be clear and precise.

- Deposit Information: Indicate the amount of the initial deposit and how it will be held.

- Contingencies: Outline any contingencies that must be met before the sale can proceed, such as financing or inspections.

- Closing Date: Specify the anticipated closing date for the transaction.

- Signatures: Ensure that all parties sign and date the agreement. This is crucial for its validity.

After filling out the form, review it carefully to ensure all information is correct. Once completed, you will typically need to provide copies to all parties involved and possibly submit it to a real estate agent or attorney for further processing. Keep a copy for your records as well.