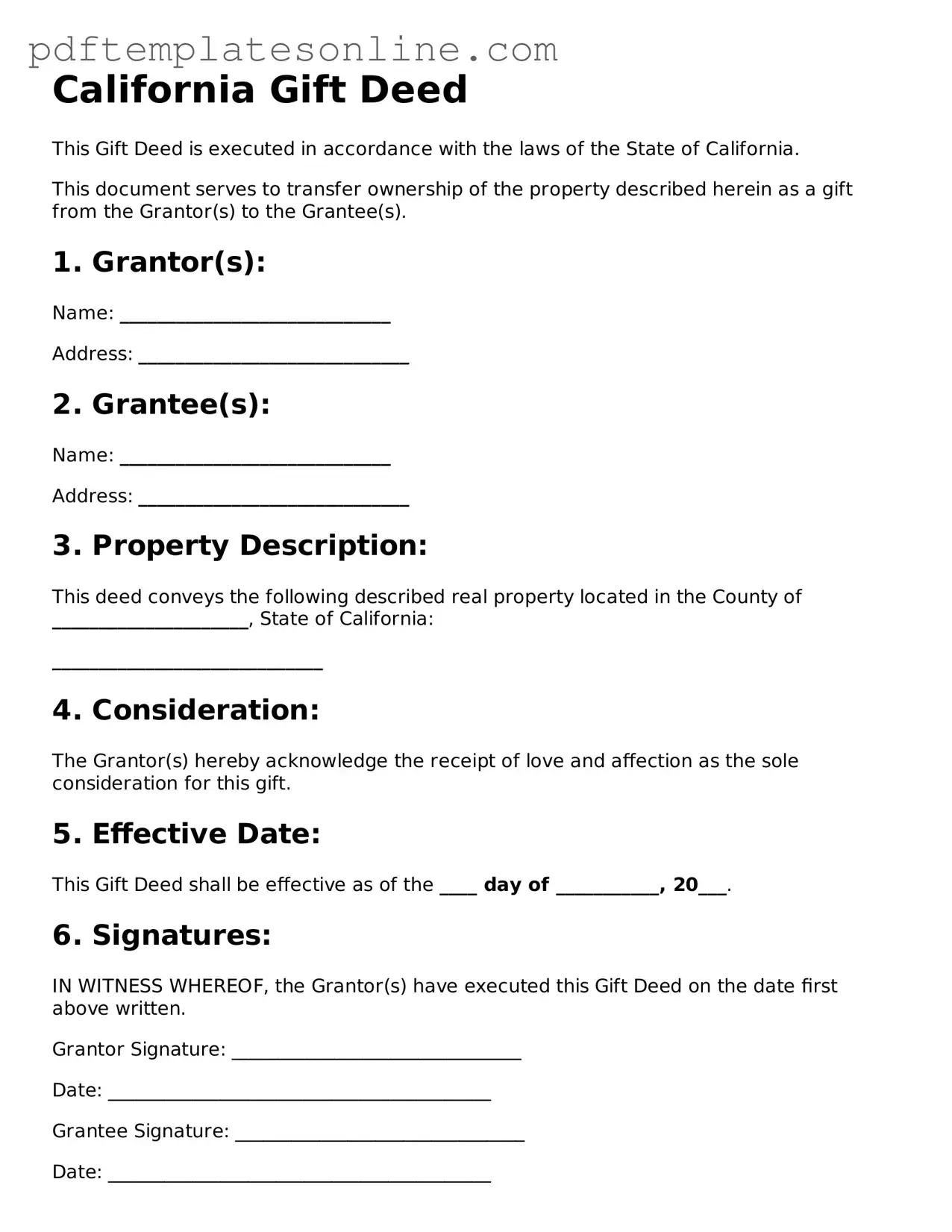

Official California Gift Deed Document

Key takeaways

When filling out and using the California Gift Deed form, consider the following key takeaways:

- Clear Intent: Ensure that the intent to make a gift is clearly stated. The donor must express their desire to transfer ownership without expecting anything in return.

- Property Description: Provide a detailed description of the property being gifted. This includes the address and any relevant legal descriptions to avoid confusion.

- Signatures Required: Both the donor and the recipient must sign the deed. Notarization is also necessary to validate the document.

- Record the Deed: After completion, the Gift Deed should be recorded with the county recorder's office. This step is crucial for establishing legal ownership and protecting the gift against future claims.

Common mistakes

Completing the California Gift Deed form can be straightforward, but several common mistakes can complicate the process. One frequent error is failing to provide accurate property descriptions. A vague or incomplete description may lead to confusion or disputes later. It is essential to include the full address and any relevant details about the property to ensure clarity.

Another mistake involves not properly identifying the parties involved. The grantor (the person giving the gift) and the grantee (the person receiving the gift) must be clearly stated. Omitting names or using incorrect names can create legal issues down the line. Always double-check that the names match official identification documents.

People often overlook the importance of signatures. The Gift Deed must be signed by the grantor to be valid. In some cases, individuals may assume that a witness or notary is sufficient without the grantor’s signature. It is critical to ensure that all necessary signatures are present before submitting the form.

Another common error is neglecting to date the document. A Gift Deed should include the date of execution. Without a date, it may be difficult to establish when the transfer took place, which can affect the legality of the gift. Including the date helps maintain a clear record of the transaction.

In some instances, individuals fail to consider tax implications. While the Gift Deed itself may not trigger immediate tax consequences, understanding the potential tax liabilities associated with gifting property is essential. Consulting with a tax professional can provide clarity on this matter.

Many people also forget to record the Gift Deed with the county recorder's office. Recording the deed is crucial for public notice and protecting the grantee's rights. Without recording, the gift may not be recognized against claims from third parties. It is advisable to complete this step promptly after the form is signed.

Lastly, some individuals may not seek legal advice when needed. While the Gift Deed form is accessible, the nuances of property law can be complex. Consulting with a legal expert can help ensure that all aspects of the deed are properly handled, preventing potential issues in the future.

Misconceptions

Understanding the California Gift Deed form can be challenging. Here are nine common misconceptions about it:

- Gift Deeds are only for family members. Many believe that a Gift Deed can only be used to transfer property between family members. In reality, anyone can give a gift of property to another person, regardless of their relationship.

- Gift Deeds are the same as sales. Some people think that a Gift Deed functions like a sales contract. However, a Gift Deed involves no exchange of money or consideration; it is a voluntary transfer of property without compensation.

- A Gift Deed requires notarization. While notarization is recommended for a Gift Deed to ensure its validity, it is not a strict legal requirement in California. However, having it notarized can help avoid disputes later.

- Gift Deeds are irrevocable. Many assume that once a Gift Deed is executed, it cannot be undone. In fact, the donor can revoke the gift before the deed is recorded, provided they meet certain conditions.

- There are no tax implications for Gift Deeds. Some believe that transferring property through a Gift Deed has no tax consequences. However, the donor may be subject to gift tax if the value exceeds the annual exclusion limit set by the IRS.

- All types of property can be gifted using a Gift Deed. While real property can be transferred through a Gift Deed, personal property typically requires different documentation. A Gift Deed is specifically for real estate.

- Gift Deeds are not legally binding. There is a misconception that Gift Deeds lack legal enforceability. In fact, once properly executed and recorded, they create a legal obligation for the transfer of property.

- A Gift Deed must be filed immediately. Some think that a Gift Deed must be recorded right after it is signed. Although it is advisable to record it promptly to protect against claims, it is not mandatory to do so immediately.

- Gift Deeds cannot include conditions. There is a belief that Gift Deeds must be unconditional. In reality, donors can impose certain conditions on the gift, as long as they are clearly stated in the deed.

Clarifying these misconceptions can help individuals better navigate the process of using a Gift Deed in California.

Dos and Don'ts

When filling out the California Gift Deed form, it is essential to approach the process with care. Below are some key do's and don'ts to keep in mind.

- Do ensure that the names of both the donor and the recipient are clearly stated.

- Do provide a complete legal description of the property being gifted.

- Do sign the form in front of a notary public to validate the deed.

- Do check for any applicable taxes or fees related to the gift.

- Do keep a copy of the completed deed for your records.

- Don't leave any sections of the form blank, as this may cause delays.

- Don't use informal names or nicknames; legal names are required.

- Don't forget to include the date of the gift on the form.

- Don't submit the form without verifying that all information is accurate.

- Don't overlook the need for witnesses, if applicable in your situation.

Browse Popular Gift Deed Forms for US States

How to Transfer Deed of House - A Gift Deed should be simple to understand, enhancing the accessibility of property transfer for all stakeholders.

For those responsible for handling vehicle ownership issues, the California Motor Vehicle Power of Attorney form provides a vital solution, allowing a trusted individual to manage important transactions when the owner is unavailable. To simplify this process, you can access necessary resources and templates through California PDF Forms, ensuring everything is completed correctly and efficiently.

Gift Deed Form - Understanding the responsibilities that come with receiving a gift is important.

Detailed Guide for Writing California Gift Deed

Once you have the California Gift Deed form ready, it's time to fill it out accurately. Ensure you have all necessary information on hand, including the details of both the giver and the recipient. Follow the steps below to complete the form correctly.

- Begin by entering the name of the giver (the person making the gift) at the top of the form.

- Provide the address of the giver, including city, state, and ZIP code.

- Next, enter the name of the recipient (the person receiving the gift).

- Fill in the recipient's address, including city, state, and ZIP code.

- Describe the property being gifted. Include details such as the address and any identifying information like APN (Assessor's Parcel Number).

- Indicate the date of the gift.

- Sign the form in the designated area. The giver must sign and date the document.

- Have the form notarized. A notary public must witness the signature and provide their seal.

- Make copies of the completed form for your records.

- File the original Gift Deed with the county recorder's office where the property is located.

After completing the form and filing it, keep track of any confirmation or receipt from the county recorder. This will serve as proof of the transfer and may be needed for future reference.