Official California Deed in Lieu of Foreclosure Document

Key takeaways

When dealing with the California Deed in Lieu of Foreclosure form, it’s important to keep a few key points in mind. Here are some essential takeaways:

- Understand the Purpose: This form allows a homeowner to voluntarily transfer their property to the lender to avoid foreclosure.

- Eligibility Criteria: Not all homeowners qualify. Lenders typically require that the homeowner is facing financial hardship and unable to make mortgage payments.

- Impact on Credit: While a deed in lieu can be less damaging than a foreclosure, it may still affect your credit score.

- Release from Debt: This process may release the homeowner from the remaining mortgage debt, but it's essential to confirm this with the lender.

- Consult a Professional: It’s advisable to seek legal or financial advice before proceeding to ensure all implications are understood.

Taking these points into consideration can help navigate the process more smoothly and make informed decisions.

Common mistakes

Filling out the California Deed in Lieu of Foreclosure form can be a complex process, and mistakes can lead to significant delays or even rejection of the deed. One common mistake is not fully understanding the implications of signing the deed. This document transfers ownership of the property back to the lender, which means the homeowner gives up all rights to the property. Many people overlook this critical aspect.

Another frequent error is failing to provide accurate information. This includes incorrect property descriptions or missing signatures. Every detail matters. If the information does not match what the lender has on file, it can create complications. Ensuring all data is correct is essential for a smooth process.

Many individuals also neglect to read the entire form carefully. Skimming through the document can lead to misunderstandings about the terms and conditions. Some may not realize that they are responsible for any outstanding debts associated with the property. Taking the time to review the entire form can help avoid unexpected obligations.

Additionally, people often forget to consult with a legal professional or real estate expert. While the form may seem straightforward, the implications of signing a Deed in Lieu of Foreclosure can be significant. A qualified expert can provide valuable insights and help navigate potential pitfalls.

Another mistake is assuming that the process is automatic once the form is submitted. After filing the deed, homeowners must follow up with the lender to ensure the transfer is processed. Some may mistakenly believe that the lender will handle everything without further communication.

Some individuals fail to consider tax implications. Forgiven debt can sometimes be taxable income. Homeowners should consult a tax professional to understand how a deed in lieu of foreclosure might affect their tax situation.

Lastly, many people do not keep copies of the submitted documents. It is crucial to retain copies of everything for personal records. In case of disputes or questions, having documentation can be invaluable.

Misconceptions

Many homeowners in California face financial difficulties and may consider a deed in lieu of foreclosure as an option. However, several misconceptions surround this process. Below are nine common misunderstandings about the California Deed in Lieu of Foreclosure form.

- It automatically cancels the mortgage debt. Many believe that signing a deed in lieu of foreclosure eliminates all mortgage obligations. In reality, it may not release the borrower from any remaining debts, especially if the property is worth less than the mortgage balance.

- It is a quick and easy process. While a deed in lieu can be faster than foreclosure, it still requires paperwork and lender approval. Homeowners should be prepared for a potentially lengthy process.

- It has no impact on credit scores. Some think that a deed in lieu will not affect their credit. However, it typically results in a negative mark on credit reports, similar to a foreclosure.

- All lenders accept deeds in lieu. Not all lenders offer this option. Each lender has its own policies, and some may prefer to pursue foreclosure instead.

- It is the same as a short sale. A deed in lieu is different from a short sale. In a short sale, the property is sold for less than the mortgage balance with lender approval, while a deed in lieu involves transferring ownership directly to the lender.

- It is only for homeowners in default. While most homeowners seeking a deed in lieu are in default, some lenders may consider it even if the borrower is current on payments, especially if they anticipate future difficulties.

- Homeowners can choose when to vacate the property. After signing a deed in lieu, the lender typically sets a timeline for vacating the property. Homeowners should not assume they can stay indefinitely.

- It absolves all future liability. A deed in lieu may not protect homeowners from future legal actions, especially if there are other liens or debts related to the property.

- It is a guaranteed solution to avoid foreclosure. Although it can help some homeowners avoid foreclosure, it is not a guaranteed solution. Each situation is unique, and outcomes may vary.

Understanding these misconceptions can help homeowners make informed decisions regarding their financial situations and options available to them.

Dos and Don'ts

Filling out the California Deed in Lieu of Foreclosure form can be a crucial step for homeowners facing foreclosure. It’s important to approach this process with care. Here are some dos and don’ts to keep in mind:

- Do ensure you understand the implications of signing the deed.

- Do consult with a real estate attorney or housing counselor before proceeding.

- Do gather all necessary documents, such as your mortgage statement and property deed.

- Do provide accurate information to avoid delays in processing.

- Do consider negotiating with your lender for potential alternatives.

- Don't rush through the form; take your time to read each section carefully.

- Don't leave any sections blank; incomplete forms can lead to complications.

- Don't ignore any outstanding debts related to the property.

- Don't sign the document without fully understanding what you are agreeing to.

By following these guidelines, you can navigate the process more smoothly and make informed decisions. Remember, taking the time to do it right can save you from future headaches.

Browse Popular Deed in Lieu of Foreclosure Forms for US States

Deed in Lieu Vs Foreclosure - Some lenders might offer relocation assistance as part of the Deed in Lieu agreement.

The editable cease and desist letter form offered by California provides a vital resource for those seeking to halt unwanted actions or behaviors. This form simplifies the process of formally addressing grievances and includes important information to ensure compliance. For more details, please refer to this resource on utilizing a cease and desist letter effectively.

Foreclosure Process in Georgia - This alternative can allow homeowners to maintain a more favorable relationship with the lender.

Will I Owe Money After a Deed in Lieu of Foreclosure - Both parties may agree to certain conditions before signing the deed.

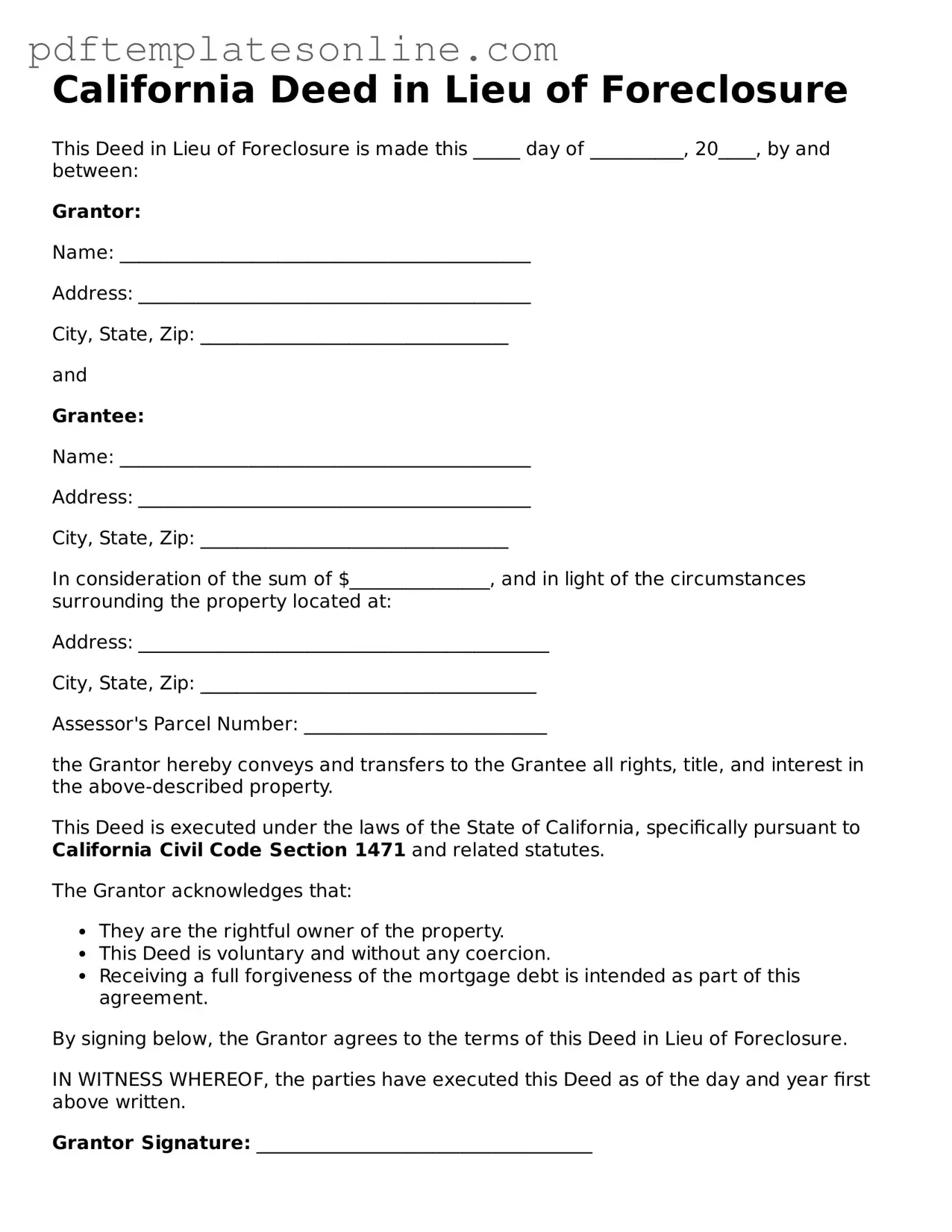

Detailed Guide for Writing California Deed in Lieu of Foreclosure

Once you have gathered all necessary information and documents, the next step involves accurately filling out the California Deed in Lieu of Foreclosure form. This process requires attention to detail to ensure that all parties involved are properly identified and that the terms are clearly outlined. Following these instructions will help facilitate a smoother transition in the event of a deed in lieu of foreclosure.

- Obtain the California Deed in Lieu of Foreclosure form from a reliable source, such as a legal website or your local county recorder's office.

- Fill in the date at the top of the form, indicating when the document is being executed.

- Identify the Grantor, which is typically the borrower or property owner. Include the full legal name and address.

- Specify the Grantee, usually the lender or financial institution. Again, provide the full legal name and address.

- Provide a description of the property. This includes the street address, city, and any relevant parcel number or legal description.

- Include any necessary information regarding the existing mortgage or deed of trust that is being relinquished.

- Sign the form in the presence of a notary public. Ensure that the signature is dated and that the notary completes their section accordingly.

- Make copies of the signed form for your records and for the lender.

- Submit the original signed form to the appropriate county recorder's office for official recording.

After completing the form and submitting it for recording, it is important to keep track of any communications from the lender regarding the status of the deed in lieu of foreclosure. This will help ensure that all obligations are fulfilled and that the process is finalized without complications.