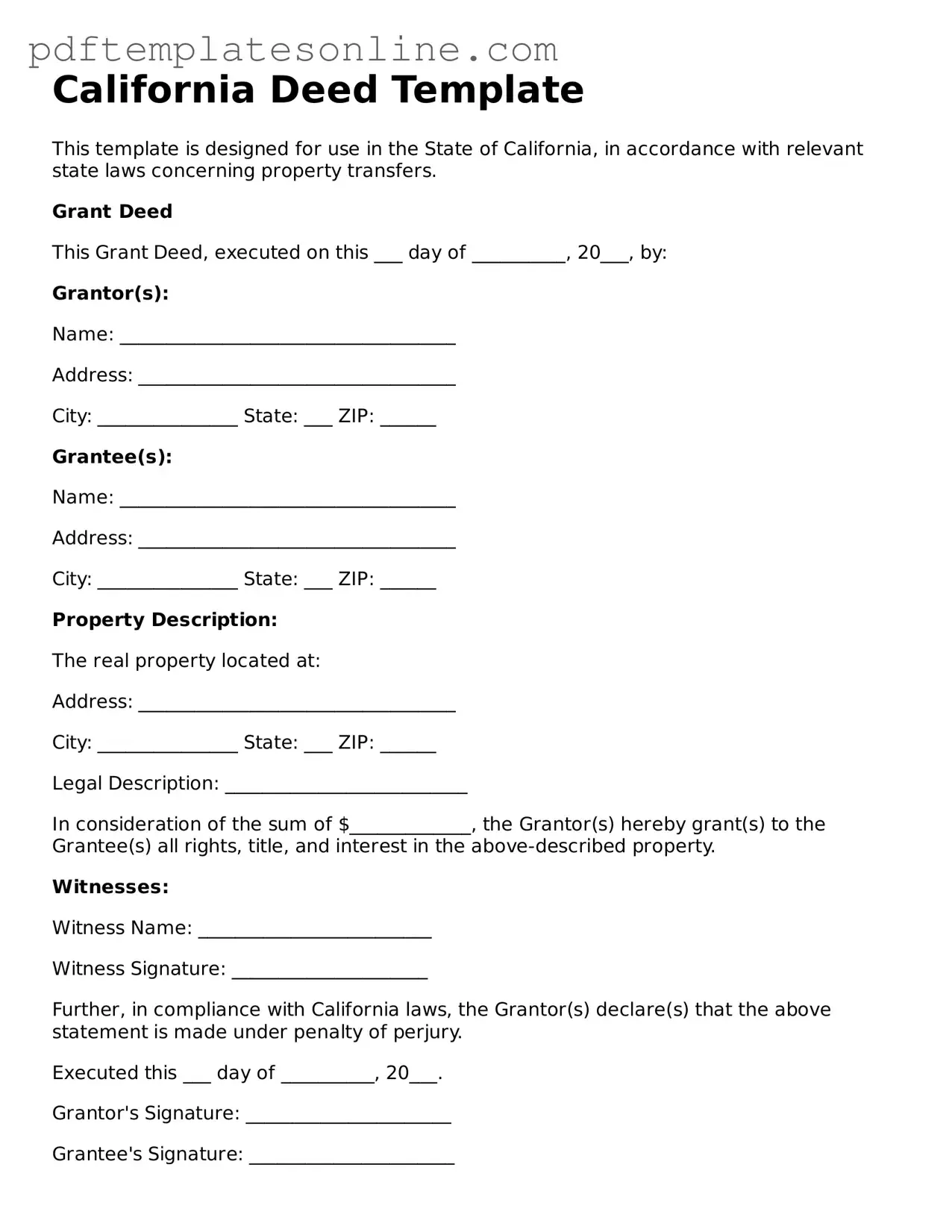

Official California Deed Document

Key takeaways

Filling out and using the California Deed form is an important process for property transfers. Here are some key takeaways to keep in mind:

- Understand the Types of Deeds: Familiarize yourself with different types of deeds, such as grant deeds and quitclaim deeds, to choose the right one for your situation.

- Provide Accurate Information: Ensure that all names, addresses, and legal descriptions of the property are accurate to avoid complications later.

- Signatures Matter: All parties involved in the transfer must sign the deed. Notarization is typically required for the deed to be valid.

- File the Deed: After completing the form, file it with the county recorder's office where the property is located. This step is crucial for making the transfer official.

- Consult a Professional: If you have any doubts or questions, consider seeking advice from a legal professional to ensure everything is done correctly.

Common mistakes

Filling out a California Deed form can be a straightforward process, but several common mistakes can lead to complications. One frequent error is the incorrect spelling of names. When individuals do not double-check the spelling of their names or the names of other parties involved, it can create issues with the validity of the deed. This mistake may require additional legal steps to correct, which can be time-consuming and costly.

Another mistake is failing to provide a complete legal description of the property. A legal description outlines the boundaries and location of the property in precise terms. Omitting this information or providing vague descriptions can lead to disputes over property lines or ownership. Ensuring that the legal description is accurate and comprehensive is essential for the deed to be enforceable.

People often overlook the requirement for signatures. All parties involved in the transaction must sign the deed for it to be valid. A common oversight occurs when one party forgets to sign or when signatures are not properly notarized. Without the necessary signatures, the deed may be considered incomplete, leading to potential challenges in the future.

Finally, individuals sometimes neglect to record the deed with the appropriate county office. Recording the deed is crucial as it provides public notice of ownership. Failing to record can result in complications if the property is sold or transferred in the future. It is important to ensure that the deed is properly filed to protect ownership rights.

Misconceptions

Understanding the California Deed form is essential for anyone involved in property transactions. However, several misconceptions often lead to confusion. Below are some common misunderstandings about this important document.

- All deeds are the same. Many people believe that all deed forms are interchangeable. In reality, different types of deeds serve different purposes. For instance, a grant deed offers certain warranties, while a quitclaim deed transfers interest without any guarantees.

- A deed must be notarized to be valid. While notarization is a common requirement, not all deeds require it to be legally binding. Some deeds may be valid without a notary, depending on state laws and specific circumstances.

- Only the seller needs to sign the deed. A common misconception is that only the seller's signature is necessary for a deed to be valid. In fact, both parties—the seller and the buyer—often need to sign the deed for it to be legally effective.

- Deeds automatically transfer ownership. Many assume that once a deed is signed, ownership is automatically transferred. However, the transfer of ownership may require additional steps, such as recording the deed with the county recorder’s office.

- All deeds are permanent. Some individuals think that once a deed is executed, it cannot be changed. In truth, deeds can be revoked or modified under certain conditions, such as through mutual agreement or legal action.

- You don’t need a deed if there’s a will. There is a belief that a will alone is sufficient for property transfer. However, a deed is often necessary to formally transfer ownership during the probate process, ensuring that the property is legally conveyed to the heirs.

Awareness of these misconceptions can help individuals navigate property transactions more effectively. Proper understanding of the California Deed form is crucial for ensuring that property rights are accurately conveyed and protected.

Dos and Don'ts

When filling out the California Deed form, attention to detail is crucial. Here are ten important dos and don'ts to keep in mind:

- Do ensure that all names are spelled correctly.

- Don't use nicknames; use full legal names as they appear on identification.

- Do provide accurate property descriptions, including the address and parcel number.

- Don't leave any sections blank; fill out every required field.

- Do sign the document in the presence of a notary public.

- Don't forget to include the date of signing.

- Do keep a copy of the completed deed for your records.

- Don't submit the form without verifying that all information is correct.

- Do check for any local requirements that may apply to your specific county.

- Don't rush through the process; take your time to ensure accuracy.

Browse Popular Deed Forms for US States

House Deed Template - Different types of deeds include warranty, quitclaim, and grant deeds.

In California, utilizing a Self-Proving Affidavit form can significantly enhance the efficiency of the probate process by confirming the authenticity of a will. This document not only affirms the will's validity through the signatures of its author and witnesses but also eliminates the necessity for witnesses to appear in court, thus simplifying estate administration. For those looking for more resources, you can find helpful options at California PDF Forms.

Quick Claim Deeds Georgia - Realtors often assist in preparing or reviewing deeds.

Detailed Guide for Writing California Deed

After obtaining the California Deed form, the next step involves accurately completing the necessary fields to ensure the document is legally valid. Attention to detail is crucial during this process, as errors may lead to complications in property transfer. Follow the steps outlined below to fill out the form correctly.

- Begin by entering the date at the top of the form where indicated.

- Provide the name of the grantor, the person transferring the property, in the designated space.

- List the name of the grantee, the person receiving the property, following the grantor's information.

- Include the property description. This should be detailed and may require a legal description from a previous deed or a title report.

- Specify the address of the property, ensuring it matches official records.

- Indicate the consideration, or the amount paid for the property, in the appropriate section.

- Sign the document in the space provided. The grantor's signature is essential for validity.

- Have the signature notarized. This step is important to confirm the identity of the grantor.

- Complete any additional required fields, such as tax information, if applicable.

- Submit the completed deed to the county recorder's office for filing.