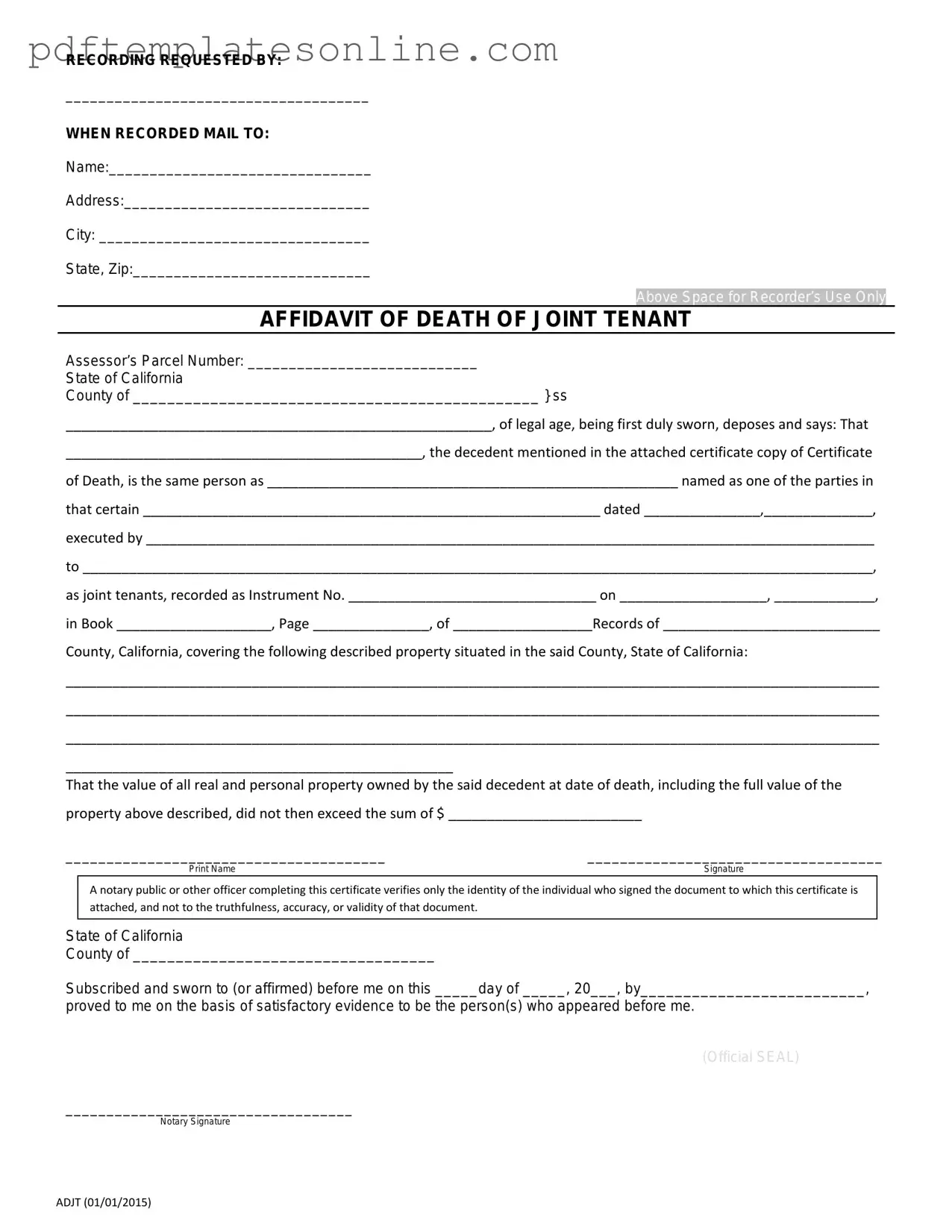

Blank California Death of a Joint Tenant Affidavit Form

Key takeaways

Filling out and using the California Death of a Joint Tenant Affidavit form is an important step for those dealing with the passing of a joint tenant. Here are key takeaways to keep in mind:

- The affidavit is used to establish the death of one joint tenant and transfer their interest to the surviving tenant.

- Ensure you have a certified copy of the deceased joint tenant's death certificate. This document is essential for completing the affidavit.

- All joint tenants must be named in the affidavit. This includes both the deceased and the surviving tenant.

- Provide accurate details about the property, including the legal description and address. This information is crucial for proper identification.

- The affidavit must be signed under penalty of perjury. This means that all information provided must be truthful and accurate.

- Once completed, the affidavit should be filed with the county recorder’s office in the county where the property is located.

- Consider consulting with a legal professional if you have questions or concerns about the process. This can help avoid potential issues.

- Keep copies of the filed affidavit and any related documents for your records. This can be important for future reference.

Common mistakes

Filling out the California Death of a Joint Tenant Affidavit form can be a straightforward process, but many people encounter common pitfalls that can complicate matters. One frequent mistake is not providing accurate information about the deceased joint tenant. This includes failing to include the correct name, date of birth, or date of death. Such inaccuracies can lead to delays in the transfer of property and may even require additional documentation.

Another common error is neglecting to sign the affidavit. A signature is crucial for the affidavit to be considered valid. Without it, the form may be rejected by the county recorder's office. Additionally, some individuals forget to have the affidavit notarized. In California, notarization is often required to ensure the authenticity of the document. Skipping this step can result in the form being deemed incomplete.

People sometimes overlook the importance of including all necessary supporting documents. For instance, a death certificate must typically accompany the affidavit. Failing to attach this essential document can lead to complications and prolong the process of transferring property ownership.

Another mistake involves misunderstanding the role of joint tenancy. Some individuals mistakenly believe that joint tenancy automatically transfers property without any documentation. While it does simplify the transfer process, an affidavit is still necessary to formalize the change in ownership. Ignoring this requirement can lead to confusion and potential disputes among heirs.

Inaccurate descriptions of the property can also cause issues. The affidavit should clearly identify the property in question, including its legal description. Omitting this information or providing vague details can create confusion and hinder the transfer process.

People often fail to check for any outstanding debts or liens against the property. If there are existing financial obligations, these may need to be addressed before the property can be transferred. Ignoring this aspect can lead to complications that affect the heirs’ ability to take full ownership.

Another mistake is not being aware of the local requirements for filing the affidavit. Different counties may have specific rules or additional forms that need to be submitted. Failing to research these local requirements can result in delays or rejections.

Additionally, individuals sometimes underestimate the importance of keeping copies of all submitted documents. It’s wise to maintain a record of the affidavit and any supporting materials. Without these copies, it can be challenging to resolve any issues that may arise later.

Lastly, some people rush through the process, leading to careless errors. Taking the time to carefully review each section of the affidavit can prevent mistakes that might otherwise cause delays. Patience and attention to detail are key when completing this important document.

Misconceptions

The California Death of a Joint Tenant Affidavit form is often misunderstood. Here are ten common misconceptions about this form, along with clarifications.

-

It only applies to married couples.

This form can be used by any joint tenants, regardless of their marital status.

-

It is the same as a will.

This affidavit is not a substitute for a will. It specifically addresses the transfer of property upon the death of a joint tenant.

-

Only one signature is needed.

All surviving joint tenants must sign the affidavit to validate the transfer of property.

-

It eliminates the need for probate.

While it simplifies the process, it does not eliminate the need for probate in all cases.

-

The form is optional.

Filing the affidavit is necessary to officially transfer ownership of the property after a joint tenant's death.

-

It can be filed at any time.

The affidavit must be filed promptly after the death of the joint tenant to avoid complications.

-

All joint tenants must be present to file.

Only the surviving joint tenant(s) need to file the affidavit; the deceased tenant does not need to be present.

-

It requires a court appearance.

Filing the affidavit does not typically require a court appearance, making it a straightforward process.

-

It is a public document.

The affidavit becomes part of the public record, which may raise privacy concerns for some individuals.

-

It can be used for any type of property.

This affidavit is specifically for real property held in joint tenancy, not for personal property or other assets.

Dos and Don'ts

When filling out the California Death of a Joint Tenant Affidavit form, it is important to follow specific guidelines to ensure accuracy and compliance. Here are six things you should and shouldn't do:

- Do ensure that all information is accurate and complete.

- Do provide the correct names of all joint tenants involved.

- Do sign the affidavit in the presence of a notary public.

- Do keep a copy of the completed affidavit for your records.

- Don't leave any sections blank; fill in all required fields.

- Don't submit the affidavit without verifying the signatures.

Other PDF Forms

Minor Travel Consent Letter - This form serves as an assurance for parents regarding their child's safety.

For those looking to understand the implications of a Deed in Lieu of Foreclosure process, this guide provides insightful information about its significance and application. To explore more about the document, visit our resource on the necessary steps to complete a Deed in Lieu of Foreclosure.

Pay Rate Form - Ensure all approvals are obtained to finalize the change in pay rate.

Detailed Guide for Writing California Death of a Joint Tenant Affidavit

After the passing of a joint tenant, it is important to properly complete the California Death of a Joint Tenant Affidavit form to facilitate the transfer of property ownership. This process ensures that the surviving joint tenant can establish their legal rights to the property without unnecessary complications.

- Obtain the California Death of a Joint Tenant Affidavit form. You can find it online or at a local courthouse.

- Begin by filling in the name of the deceased joint tenant at the top of the form.

- Provide the date of death for the deceased tenant. This information is typically found on the death certificate.

- List the property details, including the address and legal description. This information can be found on the property deed.

- Identify yourself as the surviving joint tenant. Include your full name and contact information.

- Sign and date the affidavit in the designated area. Ensure that your signature is consistent with the name provided on the form.

- Have the affidavit notarized. This step adds credibility and validity to the document.

- Make copies of the completed and notarized affidavit for your records and any relevant parties.

- File the original affidavit with the county recorder’s office where the property is located. Check for any specific filing requirements or fees.