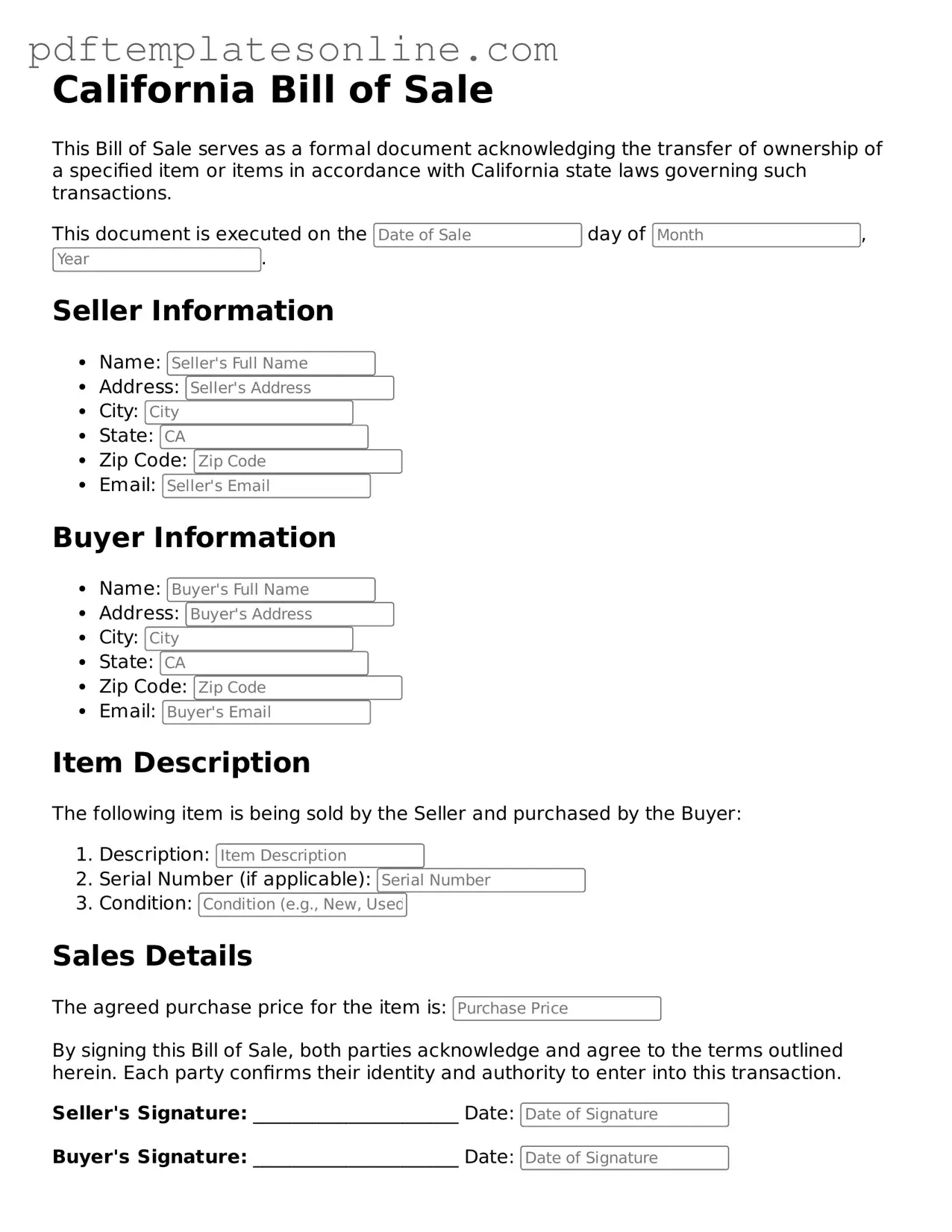

Official California Bill of Sale Document

Key takeaways

When filling out and using the California Bill of Sale form, there are several important points to keep in mind.

- Complete Information: Ensure that all required fields are filled out accurately. This includes details about the buyer, seller, and the item being sold.

- Signatures Required: Both the buyer and seller must sign the document. This confirms that both parties agree to the terms of the sale.

- Record Keeping: Keep a copy of the Bill of Sale for your records. This serves as proof of the transaction and may be needed for future reference.

- Legal Protection: Using a Bill of Sale can provide legal protection for both parties. It helps clarify the terms of the sale and can prevent disputes later on.

Common mistakes

Filling out the California Bill of Sale form can be a straightforward process, yet many individuals encounter common pitfalls that can lead to complications later on. One frequent mistake is failing to include all necessary details about the item being sold. Buyers and sellers alike should ensure that they provide a complete description, including the make, model, year, and Vehicle Identification Number (VIN) for vehicles. Omitting this information can create confusion or disputes regarding ownership.

Another common error is neglecting to include the date of the sale. This seemingly minor detail is crucial, as it establishes when the transaction occurred. Without a date, there may be ambiguity regarding the timeline of ownership transfer, which can complicate matters if any issues arise post-sale.

Many people also overlook the importance of signatures. Both the seller and the buyer must sign the Bill of Sale to validate the transaction. Failing to obtain the necessary signatures can render the document ineffective, potentially leading to disputes over ownership and liability.

Inaccurate information can create significant problems. For instance, entering the wrong names or addresses can lead to confusion about who is responsible for the item after the sale. It is essential to double-check that all personal information is correct and matches official documents.

Some individuals forget to provide the purchase price. This omission can lead to complications, especially in the case of tax assessments or disputes regarding the value of the item. Clearly stating the purchase price helps to establish the financial aspect of the transaction and can be important for record-keeping purposes.

Additionally, many sellers neglect to mention any warranties or guarantees associated with the item. If the item comes with a warranty, it should be clearly stated in the Bill of Sale. This ensures that both parties are aware of any obligations or protections that accompany the sale.

It is also important to note that not including a statement about the condition of the item can lead to misunderstandings. Sellers should consider adding a clause that outlines the condition, whether it is sold "as is" or with certain guarantees. This can help set clear expectations for the buyer and protect the seller from future claims.

Another mistake involves not keeping a copy of the Bill of Sale for personal records. After completing the form, both parties should retain a signed copy. This document serves as proof of the transaction and can be vital for future reference, especially in cases of disputes or if the buyer needs to register the item.

Lastly, individuals sometimes fail to verify if the Bill of Sale form is the appropriate document for their specific transaction. While this form is commonly used for vehicles, it may not be suitable for other types of sales. It is essential to ensure that the correct form is used to avoid any legal complications down the line.

Misconceptions

When dealing with the California Bill of Sale form, several misconceptions can lead to confusion. Understanding these misconceptions can help individuals navigate the process more effectively.

- A Bill of Sale is only necessary for vehicles. Many people believe that a Bill of Sale is only required when buying or selling a car. In reality, this document can be used for various transactions involving personal property, including boats, trailers, and even furniture.

- It must be notarized to be valid. Some think that notarization is a requirement for a Bill of Sale to be legally binding. However, in California, notarization is not necessary. As long as both parties sign the document, it is generally considered valid.

- A Bill of Sale serves as proof of ownership. While a Bill of Sale does provide evidence of a transaction, it does not automatically transfer ownership. To officially transfer ownership, especially for vehicles, the appropriate title transfer process must also be completed with the Department of Motor Vehicles (DMV).

- It can be a verbal agreement. Some individuals believe that a verbal agreement is sufficient for a sale. However, having a written Bill of Sale is crucial. It serves as a clear record of the transaction and can protect both parties in case of disputes.

- All Bills of Sale must be the same. There is a misconception that there is a one-size-fits-all Bill of Sale template. In fact, the content of a Bill of Sale can vary based on the type of transaction and the items being sold. Tailoring the document to fit the specific sale is important.

- Once signed, it cannot be changed. Some people think that once a Bill of Sale is signed, it cannot be altered. While it is true that changes should be made with caution, amendments can be made if both parties agree to the modifications and initial the changes.

By addressing these misconceptions, individuals can approach the Bill of Sale process with greater confidence and clarity.

Dos and Don'ts

When completing the California Bill of Sale form, attention to detail is crucial. Here are five important guidelines to follow:

- Do ensure all information is accurate and complete.

- Do include the date of the transaction.

- Do provide both the buyer's and seller's signatures.

- Do specify the item being sold, including any identification numbers.

- Do keep a copy for your records after submission.

Conversely, avoid these common mistakes:

- Don't leave any sections blank unless instructed.

- Don't use incorrect or outdated forms.

- Don't sign the form without reviewing all entries.

- Don't forget to check for any local requirements that may apply.

- Don't overlook the need for notarization if required.

Browse Popular Bill of Sale Forms for US States

Sample of Car Bill of Sale - Serves as proof of sale for owned property.

Georgia Dmv Bill of Sale - It is essential for legally documenting the sale of high-value items.

Handwritten Bill of Sale Example - For used vehicles, a Bill of Sale is often a necessary requirement for title transfer.

Detailed Guide for Writing California Bill of Sale

Once you have the California Bill of Sale form ready, it is essential to fill it out accurately to ensure a smooth transaction. After completing the form, both the buyer and seller should retain copies for their records. This document serves as proof of the sale and can be important for future reference.

- Begin by entering the date of the sale at the top of the form.

- Fill in the seller's full name and address in the designated fields.

- Provide the buyer's full name and address next.

- Clearly describe the item being sold. Include details such as make, model, year, and any identifying numbers.

- Indicate the sale price of the item in the appropriate section.

- Sign and date the form at the bottom, ensuring both the buyer and seller do so.

- Make copies of the completed form for both parties to keep for their records.