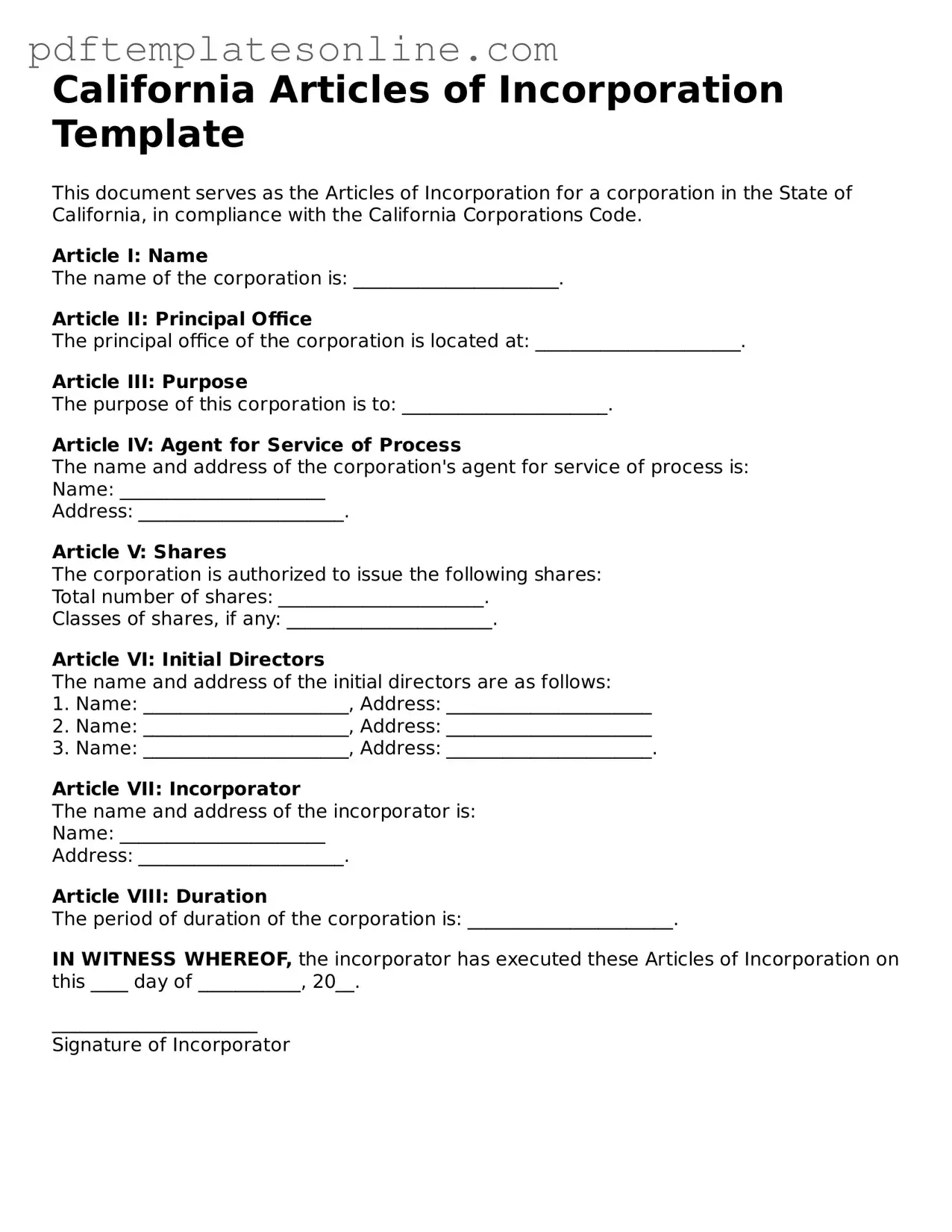

Official California Articles of Incorporation Document

Key takeaways

Filling out and using the California Articles of Incorporation form is a crucial step for anyone looking to establish a corporation in the state. Here are some key takeaways to keep in mind:

- The form is essential for legally establishing your corporation in California.

- Basic information required includes the corporation's name, address, and purpose.

- Choosing a unique name is important; it must not be similar to existing corporations.

- You must designate an agent for service of process who will receive legal documents on behalf of the corporation.

- Filing fees are required, and they vary based on the type of corporation you are forming.

- Once submitted, the Articles of Incorporation become a public record, so accuracy is vital.

- Consider consulting with a legal expert to ensure compliance with all state requirements.

Common mistakes

Filling out the California Articles of Incorporation form is a crucial step for anyone looking to establish a corporation in the state. However, many individuals make common mistakes that can lead to delays or complications. One frequent error is failing to provide a clear and accurate name for the corporation. The name must be unique and not too similar to existing entities. If the name is not properly checked against state records, it may be rejected.

Another mistake involves incorrect designation of the corporation's purpose. The Articles require a statement of purpose, and being vague or overly broad can lead to confusion. A specific and concise purpose statement helps ensure that the corporation is aligned with its intended activities.

Many people also overlook the importance of including the correct number of shares the corporation is authorized to issue. This section must clearly state the number of shares and the par value, if any. Inaccuracies here can lead to complications in future fundraising efforts or shareholder agreements.

Additionally, some individuals fail to designate a registered agent. A registered agent is necessary for receiving legal documents on behalf of the corporation. Not providing this information can result in legal challenges and notifications not being properly received.

Another common oversight is neglecting to include the names and addresses of the initial directors. This information is essential for the formation of the corporation. Omitting it can lead to delays in processing the Articles and may require resubmission.

People often forget to sign the Articles of Incorporation. The signature of the incorporator is mandatory for the document to be valid. Without it, the filing will be incomplete, and the state will reject the submission.

Some individuals also misinterpret the requirements for filing fees. Each filing incurs a specific fee, and failing to include the correct amount can result in rejection. It is crucial to check the current fee schedule to avoid this mistake.

Moreover, many applicants do not keep a copy of the submitted Articles of Incorporation. Retaining a copy is important for future reference and for maintaining accurate records of the corporation’s formation.

Lastly, individuals may not be aware of the need for additional filings after submitting the Articles. Once the corporation is established, there are ongoing compliance requirements, such as annual reports and tax filings, that must be adhered to in order to maintain good standing.

Misconceptions

When it comes to the California Articles of Incorporation, many people hold misconceptions that can lead to confusion or errors during the incorporation process. Understanding these misconceptions is crucial for anyone looking to establish a business in California.

- Misconception 1: You need a lawyer to file the Articles of Incorporation.

- Misconception 2: The Articles of Incorporation are the only documents needed to start a business.

- Misconception 3: You can change the purpose of your corporation later without any formalities.

- Misconception 4: Filing the Articles of Incorporation guarantees your business will succeed.

- Misconception 5: The filing fee is the only cost associated with incorporation.

- Misconception 6: Once filed, the Articles of Incorporation cannot be changed.

While having legal assistance can be beneficial, it is not a requirement. Many individuals successfully complete the process on their own by following the instructions provided by the California Secretary of State.

This is not entirely true. While the Articles of Incorporation are essential, other documents, such as bylaws and an operating agreement, may also be necessary for the smooth operation of your business.

Changing the purpose of your corporation requires an amendment to your Articles of Incorporation. This is a formal process that must be followed to ensure compliance with state laws.

Incorporation is just one step in starting a business. Success depends on various factors, including market research, business planning, and effective management.

In addition to the filing fee, there may be other costs such as taxes, legal fees, and ongoing compliance expenses. It’s important to budget for these additional costs when planning your business.

This is incorrect. Amendments can be made to the Articles of Incorporation if necessary. However, this requires a formal process and should be done in accordance with state regulations.

Dos and Don'ts

When filling out the California Articles of Incorporation form, there are important guidelines to follow. Here are four things you should and shouldn't do:

- Do provide accurate and complete information.

- Do ensure the name of your corporation is unique and complies with state regulations.

- Don't leave any required fields blank.

- Don't forget to include the correct filing fee with your submission.

Browse Popular Articles of Incorporation Forms for US States

Certificate of Incorporation New York - The form can vary slightly between different states in the U.S.

Pa Articles of Amendment - Details conflict of interest policies for directors and officers.

Detailed Guide for Writing California Articles of Incorporation

Once you have gathered all necessary information, you are ready to fill out the California Articles of Incorporation form. This form is essential for establishing your corporation in California, and completing it accurately is crucial for a smooth incorporation process. After filling out the form, you will submit it to the California Secretary of State along with the required filing fee.

- Obtain the California Articles of Incorporation form. You can find it on the California Secretary of State's website or at their office.

- Begin by entering the name of your corporation. Ensure that the name complies with California naming requirements.

- Provide the purpose of your corporation. This should be a brief description of the business activities your corporation will engage in.

- Indicate the name and address of your corporation’s initial agent for service of process. This person or entity will receive legal documents on behalf of your corporation.

- Fill in the address of your corporation's initial principal office. This is where your business will operate.

- Include the number of shares your corporation is authorized to issue. Specify the par value of these shares, if applicable.

- Sign and date the form. The signature must be from the incorporator, who is responsible for filing the form.

- Prepare your filing fee. Check the current fee schedule on the California Secretary of State's website.

- Submit the completed form along with the filing fee to the California Secretary of State, either by mail or in person.