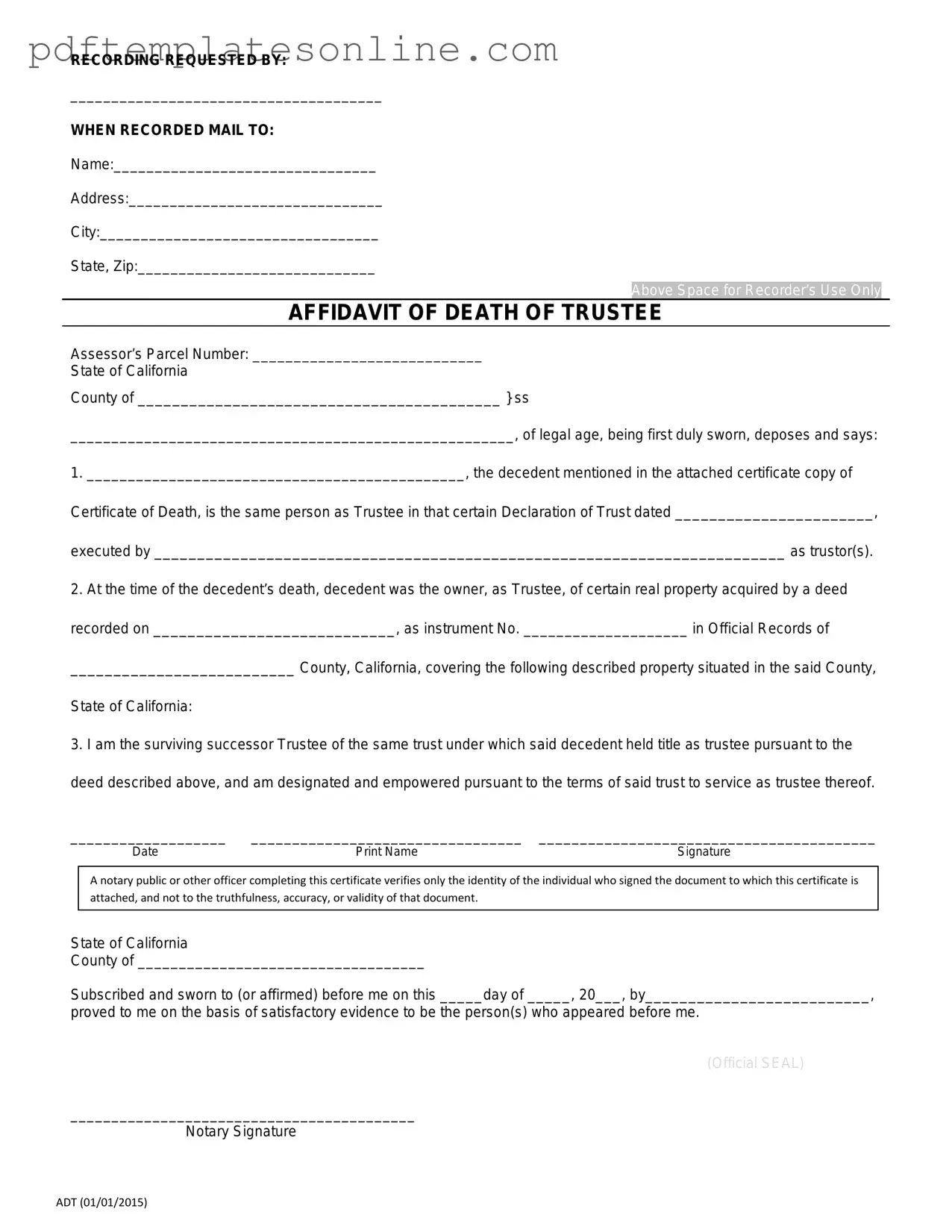

Blank California Affidavit of Death of a Trustee Form

Key takeaways

Filling out the California Affidavit of Death of a Trustee form is a crucial step in managing a trust after the passing of a trustee. Here are some key takeaways to keep in mind:

- The form is used to formally acknowledge the death of a trustee and to update trust records accordingly.

- Ensure that you have the correct legal name and date of death of the trustee before starting the form.

- Gather all necessary documents, such as the trust agreement and death certificate, to support your affidavit.

- Complete the form accurately, providing all required information to avoid delays in processing.

- Sign the affidavit in the presence of a notary public to validate the document.

- Submit the completed affidavit to the appropriate parties, including the successor trustee and financial institutions managing trust assets.

- Keep copies of the affidavit and any supporting documents for your records.

- Consult with a legal professional if you have questions about the trust or the affidavit process.

Common mistakes

Filling out the California Affidavit of Death of a Trustee form can be a straightforward process, but many people stumble along the way. One common mistake is failing to provide complete and accurate information about the deceased trustee. The form requires specific details such as the trustee's full name, date of death, and the date the trust was created. Omitting any of this information can lead to delays or even rejection of the affidavit.

Another frequent error is neglecting to sign the affidavit. It might seem like a small detail, but without a signature, the document is incomplete. Additionally, if the affidavit is not notarized, it may not be considered valid. A notary public must witness the signature to ensure that the affidavit meets legal standards. Double-checking for a signature and notarization can save time and frustration.

Many individuals also overlook the importance of including the correct trust information. The form asks for the name of the trust and the trustee's role within it. If this information is inaccurate or mismatched, it can cause complications down the line. It’s essential to cross-reference the trust documents to ensure everything aligns properly.

Another mistake arises from misunderstanding the purpose of the affidavit. Some people assume that it only serves to declare the trustee's death, but it also provides proof for the successor trustee to take over. Failing to recognize this can lead to confusion about the next steps in managing the trust. Understanding the broader implications of the affidavit helps ensure that the trust administration proceeds smoothly.

Lastly, many individuals forget to keep copies of the completed affidavit. Once the form is submitted, it’s easy to lose track of it. Having a copy on hand is vital for record-keeping and can be helpful if any questions arise later. Maintaining organized records helps in managing the trust effectively and can prevent future issues.

Misconceptions

The California Affidavit of Death of a Trustee form can often be misunderstood. Here are nine common misconceptions about this document:

- It is only needed if the trust is being dissolved. Many people believe that this affidavit is only necessary when a trust is terminated. In reality, it serves to update the trust's records and clarify the trustee's status, regardless of whether the trust continues.

- Only the successor trustee can file the affidavit. While the successor trustee typically files the affidavit, any interested party can do so. This includes beneficiaries who may want to ensure proper administration of the trust.

- The affidavit must be filed with the court. This is not accurate. The affidavit is usually recorded with the county recorder's office, not filed with the court. This helps to provide public notice of the trustee's death.

- The affidavit is only for revocable trusts. This form can be used for both revocable and irrevocable trusts. It applies to any trust where a trustee has passed away, regardless of its type.

- The affidavit requires a death certificate. While a death certificate is commonly attached to the affidavit, it is not always a strict requirement. Some counties may have different practices regarding this.

- Filing the affidavit is a complex legal process. In truth, the process is straightforward. Most individuals can complete the affidavit with minimal assistance, provided they have the necessary information.

- The affidavit can be filed at any time after the trustee's death. While there is no strict deadline, it is advisable to file the affidavit promptly. Delays can complicate trust administration and create issues for beneficiaries.

- All beneficiaries must agree before filing the affidavit. This is a misconception. The affidavit can be filed by the successor trustee without needing unanimous consent from all beneficiaries.

- The affidavit automatically transfers trust assets. Filing the affidavit does not transfer assets by itself. It merely updates the trustee's status, allowing the successor trustee to manage the trust's assets moving forward.

Understanding these misconceptions can help clarify the purpose and process of the California Affidavit of Death of a Trustee form.

Dos and Don'ts

When filling out the California Affidavit of Death of a Trustee form, it is important to follow certain guidelines to ensure the process goes smoothly. Here are four things you should and shouldn't do:

- Do provide accurate information about the deceased trustee, including their full name and date of death.

- Do sign the affidavit in the presence of a notary public to validate the document.

- Don't leave any sections of the form blank; all required fields must be completed.

- Don't submit the form without double-checking for errors or omissions that could delay processing.

Other PDF Forms

Create Own Invoice - Keep clients happy with timely and accurate invoices.

Understanding the importance of a Mechanics Lien California form is vital for anyone involved in property improvements, as this legal document allows contractors, subcontractors, and suppliers to secure the payment owed for their labor or materials. For those looking to streamline the process, utilizing resources such as California PDF Forms can be extremely beneficial, ensuring that all necessary documentation is accurately completed.

Miscellaneous Information - Get organized ahead of tax season to ensure accurate 1099-MISC forms.

Detailed Guide for Writing California Affidavit of Death of a Trustee

After completing the California Affidavit of Death of a Trustee form, the next step is to file it with the appropriate county office. This will help ensure that the trust administration process continues smoothly and any necessary changes to the trust are officially recorded.

- Obtain the California Affidavit of Death of a Trustee form. You can find it online or at your local county clerk's office.

- Fill in the name of the deceased trustee at the top of the form.

- Provide the date of death of the trustee in the designated space.

- Include the name of the trust that the deceased was managing.

- List the names of the current trustees, if applicable, in the appropriate section.

- Sign the form in the presence of a notary public. The notary will then complete their section to validate the signature.

- Make copies of the completed and notarized form for your records.

- File the original form with the county clerk's office in the county where the trust is administered.