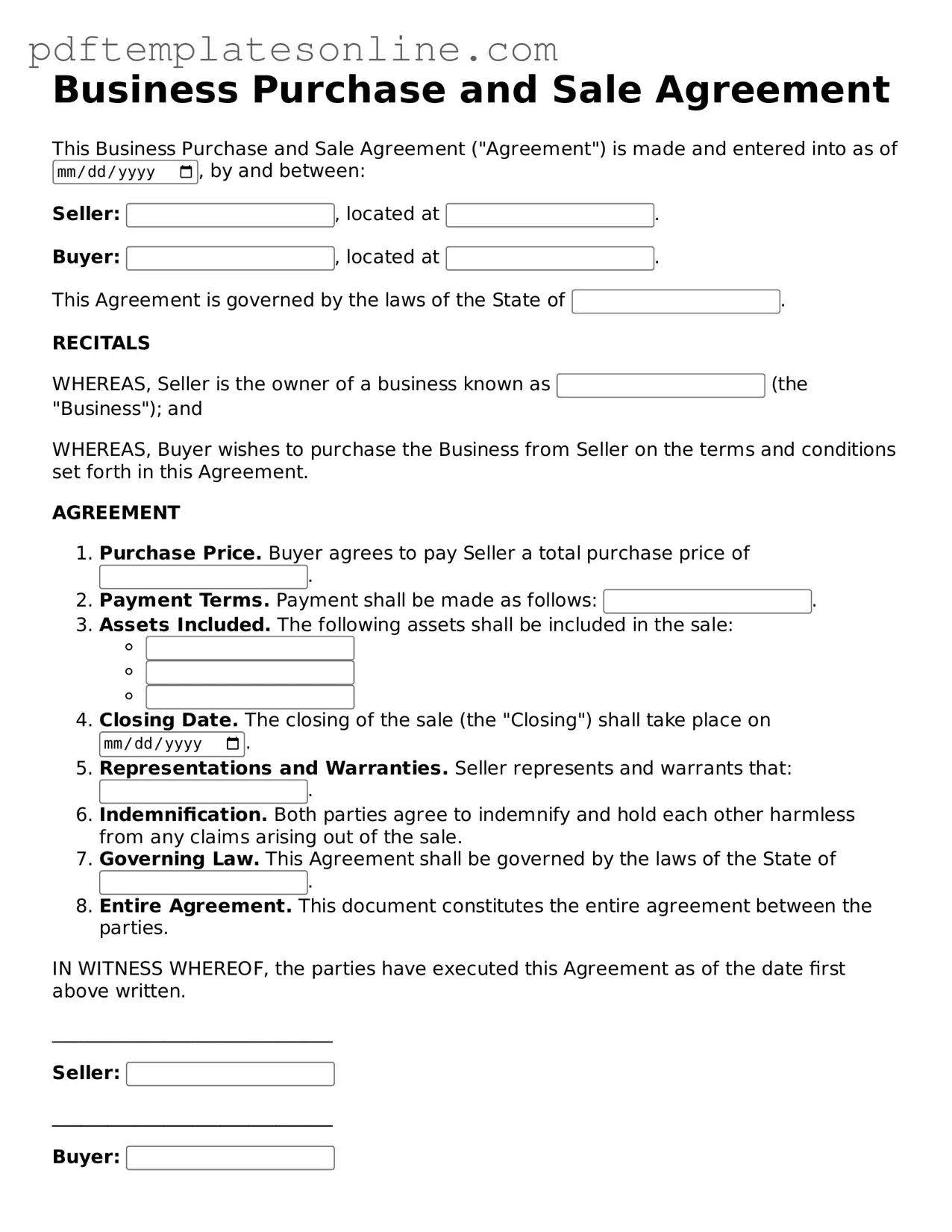

Fillable Business Purchase and Sale Agreement Document

Key takeaways

When filling out and using the Business Purchase and Sale Agreement form, keep these key takeaways in mind:

- Accuracy is crucial. Ensure that all details, including names, addresses, and business specifics, are correct to avoid disputes later.

- Understand the terms. Familiarize yourself with all the terms and conditions outlined in the agreement. Clarity prevents misunderstandings.

- Define payment terms. Clearly specify how and when payments will be made. This includes down payments, installments, and any contingencies.

- Include contingencies. Consider potential scenarios that could affect the sale, such as financing issues or regulatory approvals, and include them in the agreement.

- Consult professionals. It’s wise to have legal and financial advisors review the agreement before signing. Their insights can protect your interests.

- Be transparent. Disclose all relevant information about the business. Transparency builds trust and can prevent future legal issues.

- Document everything. Keep copies of all communications and agreements related to the sale. This documentation can be essential if disputes arise.

Common mistakes

Filling out a Business Purchase and Sale Agreement can be a daunting task. Mistakes can lead to misunderstandings or even legal issues down the line. One common mistake is not providing complete information. Buyers and sellers must ensure that all details, such as names, addresses, and business descriptions, are accurate and thorough. Missing even a small piece of information can create confusion and complications.

Another frequent error is failing to clearly define the terms of the sale. This includes the purchase price, payment terms, and any contingencies. Without clear definitions, parties may have different interpretations, leading to disputes. It’s essential to be specific about what is included in the sale, such as inventory, equipment, and intellectual property.

People often overlook the importance of including warranties and representations. These statements assure the buyer that certain conditions about the business are true. If these are missing, the buyer may find themselves in a difficult situation if issues arise after the sale. It’s wise to address these aspects thoroughly to protect both parties.

Not considering the legal implications of the agreement is another significant mistake. While it may seem straightforward, the agreement is a legally binding document. Individuals should seek legal advice to ensure compliance with local laws and regulations. This can prevent future complications that arise from misunderstandings of legal obligations.

Additionally, some individuals neglect to account for the transition period after the sale. A smooth transition is vital for maintaining business operations. It’s important to outline the seller’s responsibilities during this time, such as training the new owner or introducing them to key clients. Failing to do so can disrupt the business and affect its value.

People also sometimes forget to include a clause for dispute resolution. In the event of a disagreement, having a predetermined method for resolving disputes can save time and money. Whether it’s mediation or arbitration, specifying this in the agreement can help avoid lengthy legal battles.

Another common oversight is not reviewing the agreement before signing. Rushing through the process can lead to missed errors or unclear terms. Taking the time to review the entire document ensures that both parties understand their rights and obligations. It’s a crucial step that should never be skipped.

Lastly, individuals may fail to keep copies of the signed agreement. Having a record of the final document is essential for both parties. It serves as a reference point in case any questions or issues arise later. Always ensure that both parties have a copy for their records.

Misconceptions

When dealing with a Business Purchase and Sale Agreement, several misconceptions can arise. Understanding these can help both buyers and sellers navigate the process more effectively.

- It’s just a simple form. Many believe that this agreement is a straightforward document. In reality, it involves complex terms and conditions that require careful consideration.

- Only large businesses need this agreement. Smaller businesses also benefit from a formal agreement. It protects both parties, regardless of the size of the transaction.

- All agreements are the same. Each Business Purchase and Sale Agreement is unique. Customization is often necessary to reflect the specific terms of the sale.

- It’s only necessary if there’s a dispute. This agreement is essential even before a dispute arises. It sets clear expectations and responsibilities from the start.

- Verbal agreements are enough. Relying on verbal agreements can lead to misunderstandings. A written contract provides legal protection and clarity.

- Once signed, it can’t be changed. While the agreement is binding, it can be amended if both parties agree. Changes should be documented in writing.

- It only covers the sale price. The agreement includes various elements, such as payment terms, liabilities, and assets included in the sale.

- Legal help isn’t necessary. Consulting a legal professional is advisable. They can ensure that the agreement meets all legal requirements and protects your interests.

Dos and Don'ts

When filling out a Business Purchase and Sale Agreement form, it is essential to approach the task with care and attention to detail. Here are some important guidelines to follow.

- Do ensure that all parties involved are clearly identified, including their legal names and contact information.

- Do provide a detailed description of the business being sold, including its assets, liabilities, and any relevant financial information.

- Do specify the purchase price and payment terms, including any deposits or financing arrangements.

- Do include any contingencies that may affect the sale, such as inspections or approvals.

- Don't rush through the agreement; take the time to review each section carefully.

- Don't omit important terms or conditions that could lead to misunderstandings later.

- Don't forget to consult with legal or financial professionals if you have any questions or concerns about the agreement.

By following these guidelines, you can help ensure that the Business Purchase and Sale Agreement is completed accurately and effectively, paving the way for a smooth transaction.

Check out Popular Documents

Vics Bol - Connects customer orders directly to the shipping process.

In order to clearly define the expectations and obligations, it is essential for both landlords and tenants to utilize the appropriate documentation when entering into a rental agreement, such as the California Room Rental Agreement form. This comprehensive form not only details the rental terms but also reinforces the importance of understanding one's legal rights. For easy access to this and other essential forms, you can visit California PDF Forms.

2023 W9 - There is no deadline to submit the W-9, but it should be done promptly when requested.

Detailed Guide for Writing Business Purchase and Sale Agreement

Filling out the Business Purchase and Sale Agreement form is an important step in finalizing a business transaction. This document outlines the terms of the sale and protects both the buyer and seller. Follow these steps carefully to ensure accuracy and completeness.

- Start with the date: Write the date on which the agreement is being executed.

- Identify the parties: Clearly list the names and addresses of both the buyer and the seller.

- Describe the business: Provide a detailed description of the business being sold, including its name, location, and any relevant identifiers.

- Outline the purchase price: Specify the total purchase price and any payment terms, including deposits or financing arrangements.

- Detail the assets included: List all assets that are part of the sale, such as inventory, equipment, and intellectual property.

- Include contingencies: Note any conditions that must be met for the sale to proceed, such as financing approval or inspections.

- Define the closing date: State the date when the sale will be finalized and ownership will transfer.

- Signatures: Ensure both parties sign and date the agreement to make it legally binding.

After completing the form, review it for accuracy. Make sure all information is correct and both parties have a copy for their records. This step is crucial to avoid any misunderstandings in the future.