Blank Business Credit Application Form

Key takeaways

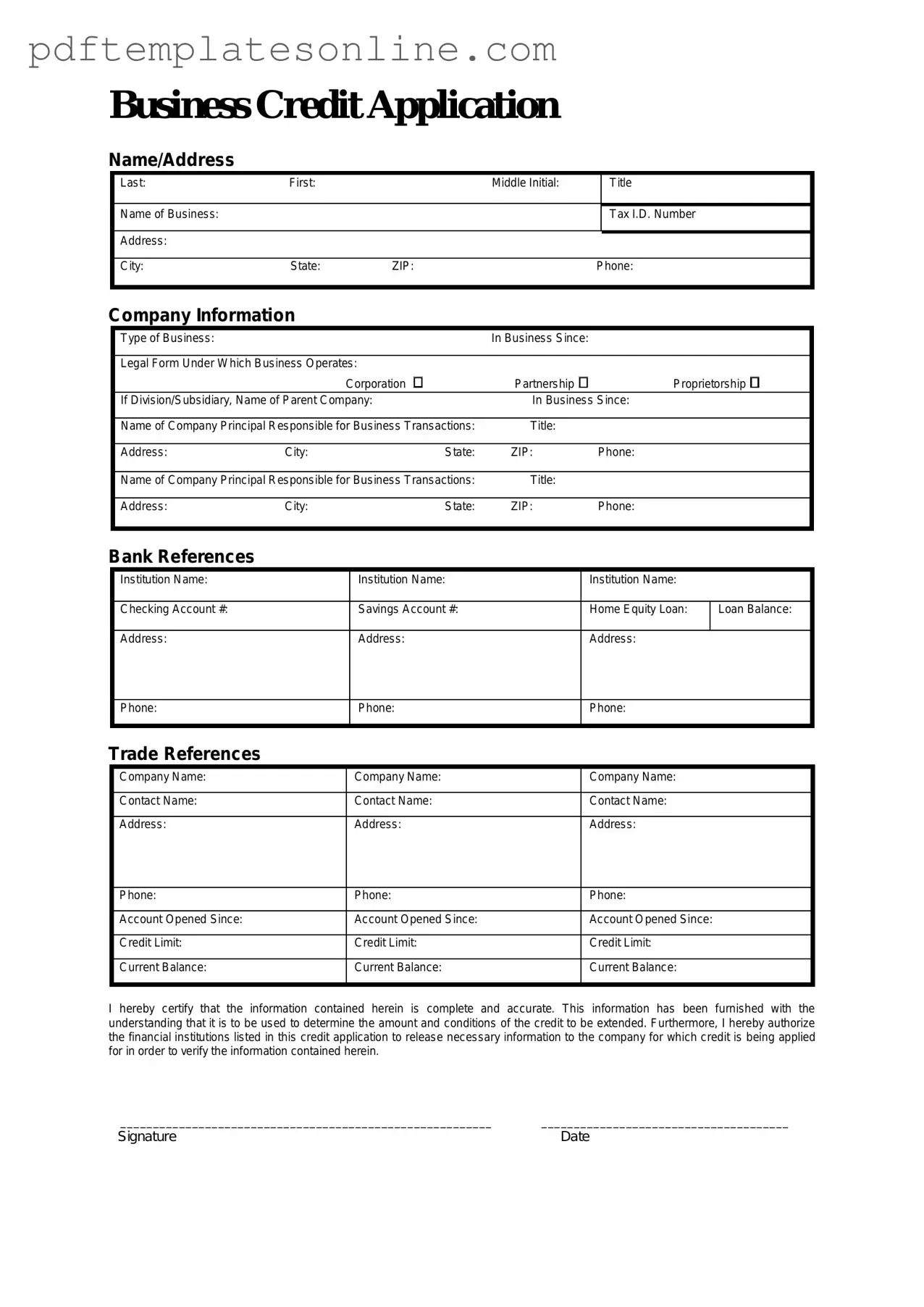

When filling out and using the Business Credit Application form, consider the following key takeaways:

- Provide accurate information about your business, including legal name, address, and contact details.

- Include the business structure, such as sole proprietorship, partnership, or corporation.

- Clearly state the purpose of the credit request and the amount needed.

- List any previous credit history, including existing loans and credit lines.

- Be prepared to supply personal guarantees if required, especially for small businesses.

- Attach any necessary financial documents, such as tax returns or profit and loss statements.

- Review the application for completeness before submission to avoid delays.

- Understand the terms and conditions associated with the credit being requested.

- Follow up with the lender after submission to check on the status of your application.

Common mistakes

Filling out a Business Credit Application form can be a straightforward process, but many people make common mistakes that can hinder their chances of approval. One frequent error is providing inaccurate information. This can include misspellings in the business name or incorrect addresses. Always double-check your entries to ensure they match official documents.

Another mistake is failing to disclose all relevant business information. Applicants sometimes omit details about ownership structure or financial history. Lenders need a complete picture of your business to make informed decisions. Transparency is key.

Some individuals neglect to include personal guarantees. If the business is new or lacks a strong credit history, lenders may require a personal guarantee from the owner. Omitting this can lead to automatic denial.

Inaccurate financial statements are also a common issue. Many applicants either exaggerate their financial health or fail to provide the necessary documentation. It's crucial to present honest and clear financial records to build trust with lenders.

Another error involves not understanding the credit terms. Applicants often overlook the fine print, which can lead to misunderstandings about interest rates and repayment schedules. Take the time to read and comprehend all terms before submission.

Some applicants forget to sign the application. A missing signature can result in delays or outright rejection. Always ensure that every required field is completed, including your signature.

Failure to provide references can also be detrimental. Many lenders request business and personal references to assess creditworthiness. Not providing these can signal a lack of preparedness or professionalism.

Additionally, applicants may submit the application without a business plan. A solid business plan can demonstrate your strategy and financial projections. It shows lenders that you have thought through your business's future.

Lastly, not following up after submission can be a missed opportunity. After submitting your application, checking in can help clarify any questions the lender may have. This proactive approach can positively influence their decision.

Misconceptions

Understanding the Business Credit Application form is essential for any business seeking credit. However, several misconceptions can lead to confusion. Here are five common misunderstandings:

-

Only large businesses need to fill out a Business Credit Application.

This is not true. Small businesses, startups, and even sole proprietors may also need to complete this form to establish credit with suppliers or lenders.

-

The application is only about financial history.

While financial history is important, the application also requests information about the business structure, ownership, and operational details. All these factors contribute to creditworthiness.

-

Once submitted, the application guarantees credit approval.

Submitting the form does not guarantee that credit will be granted. Lenders or suppliers will review the information and make a decision based on their criteria.

-

All Business Credit Applications are the same.

Different lenders and suppliers may have varying requirements. Each application may ask for specific information tailored to their assessment process.

-

Filling out the application is a quick process.

While some parts may be straightforward, gathering the necessary information can take time. Businesses should prepare thoroughly to ensure accuracy and completeness.

By addressing these misconceptions, businesses can approach the credit application process with greater clarity and confidence.

Dos and Don'ts

When filling out a Business Credit Application form, there are several important considerations to keep in mind. Below is a list of dos and don'ts to help ensure the application process goes smoothly.

- Do provide accurate and complete information.

- Do double-check all numbers and figures for accuracy.

- Do include all required documentation as specified in the application.

- Do read the instructions carefully before starting the application.

- Do ensure that the application is signed and dated.

- Don't leave any fields blank unless instructed to do so.

- Don't provide misleading or false information.

- Don't rush through the application; take your time to ensure accuracy.

- Don't forget to keep a copy of the completed application for your records.

- Don't submit the application without reviewing it thoroughly.

Other PDF Forms

Horse Training Agreement Template - Liability limitations and care standards during the horse's stay are discussed within this agreement.

What Is a Ub-04 Form - This form is for billing related to your hospital services.

Aia A305 - The AIA A305 can enhance a contractor's credibility in the bidding process.

Detailed Guide for Writing Business Credit Application

Completing the Business Credit Application form is an important step in securing credit for your business. This process requires careful attention to detail to ensure that all necessary information is accurately provided. Following these steps will help you fill out the form correctly and efficiently.

- Begin by entering your business name in the designated field.

- Provide the business address, including city, state, and ZIP code.

- Fill in the primary contact person's name and their position within the company.

- Enter the business phone number and email address for correspondence.

- Indicate the type of business entity (e.g., sole proprietorship, partnership, corporation).

- List the date the business was established.

- Provide the federal tax identification number (EIN) if applicable.

- Detail the business's annual revenue and number of employees.

- Include information about any other owners or partners, such as their names and ownership percentages.

- Review the application for accuracy and completeness.

- Sign and date the application where indicated.

After completing the form, submit it according to the instructions provided. Ensure that you keep a copy for your records. This will help you track the application process and provide necessary information if requested in the future.