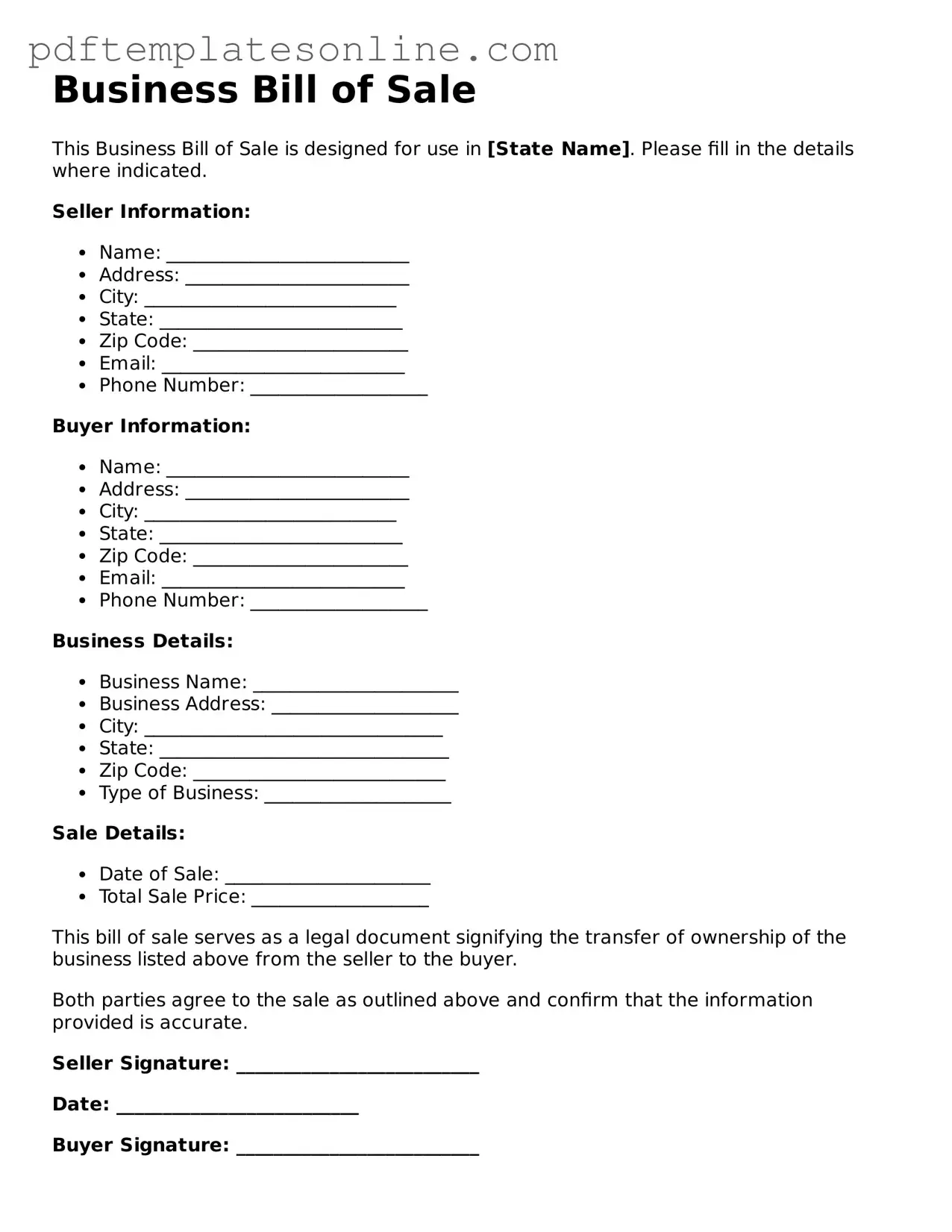

Fillable Business Bill of Sale Document

Key takeaways

When filling out and using a Business Bill of Sale form, there are several important considerations to keep in mind. This document serves as a legal record of the sale of a business or its assets, ensuring that both parties are protected. Below are key takeaways to guide you through the process.

- Identify the Parties Involved: Clearly state the names and addresses of both the seller and the buyer. This information is crucial for establishing who is involved in the transaction.

- Detail the Business Assets: Provide a comprehensive list of the assets being sold. This may include equipment, inventory, and intellectual property. Be specific to avoid any misunderstandings.

- Include the Sale Price: Clearly indicate the agreed-upon sale price. This should reflect the total amount for the business or assets being transferred.

- Specify Payment Terms: Outline the payment structure. Will it be a lump sum, or will payments be made in installments? Clarifying this helps prevent future disputes.

- Sign and Date the Document: Ensure that both parties sign and date the form. This step formalizes the agreement and makes it legally binding.

By keeping these points in mind, you can navigate the process of completing a Business Bill of Sale with confidence and clarity.

Common mistakes

Filling out a Business Bill of Sale form can seem straightforward, but many people make critical mistakes that can lead to complications down the line. One common error is failing to include the correct date of the transaction. Without a clear date, it can be difficult to establish when the ownership transfer occurred, which may create legal issues later.

Another frequent mistake is not providing complete information about the buyer and seller. This includes names, addresses, and contact information. Incomplete details can result in disputes over ownership or difficulties in reaching either party if issues arise after the sale.

People often overlook the need to describe the business being sold thoroughly. A vague description may lead to misunderstandings about what is included in the sale. It's crucial to list all assets, inventory, and any liabilities clearly to avoid confusion.

Many individuals forget to include the purchase price. This is a critical detail that must be documented. Without it, the transaction may be questioned, and tax implications could arise. Always ensure that the price is clearly stated and agreed upon by both parties.

Another mistake is neglecting to sign the document. Both the buyer and seller must provide their signatures for the Bill of Sale to be valid. Failing to do so can render the document unenforceable, leaving both parties vulnerable.

Some people fail to have witnesses or notarization when required. Depending on the state, certain transactions may need to be witnessed or notarized to be legally binding. Check local laws to ensure compliance.

Additionally, individuals sometimes make the mistake of not keeping copies of the completed Bill of Sale. Both parties should retain a copy for their records. This documentation can be vital if disputes arise in the future.

Another common oversight is not checking for typos or errors in the document. Simple mistakes can lead to significant misunderstandings. Take the time to review the form carefully before finalizing it.

People may also forget to include any contingencies or conditions of the sale. If there are specific terms that need to be met before the transaction is complete, these should be clearly outlined in the Bill of Sale.

Finally, failing to consult with a legal professional can be a significant mistake. While it may seem unnecessary, getting legal advice can help ensure that the Bill of Sale meets all legal requirements and protects both parties involved.

Misconceptions

A Business Bill of Sale form is an important document in the transfer of business ownership. However, several misconceptions exist about its purpose and usage. Below are four common misconceptions:

- It is only necessary for large businesses. Many believe that only large businesses require a Bill of Sale. In reality, any business transfer, regardless of size, can benefit from this document to ensure clarity and legality.

- It does not need to be notarized. Some people think that a Bill of Sale does not require notarization. While notarization is not always mandatory, having the document notarized can provide additional legal protection and verification.

- It is the same as a purchase agreement. Many confuse a Bill of Sale with a purchase agreement. While both documents relate to the sale of a business, a Bill of Sale specifically transfers ownership, whereas a purchase agreement outlines the terms of the sale.

- It is only for tangible assets. There is a belief that a Bill of Sale only applies to physical items. However, it can also be used for intangible assets, such as intellectual property or business goodwill.

Understanding these misconceptions can help ensure that business transactions are conducted smoothly and legally.

Dos and Don'ts

When filling out a Business Bill of Sale form, it's important to ensure accuracy and clarity. Here are some essential do's and don'ts to keep in mind:

- Do provide accurate information about the business being sold, including its name and address.

- Do include the sale price clearly, specifying the currency.

- Do ensure that both parties sign the document, indicating their agreement to the sale.

- Do keep a copy of the completed form for your records.

- Don't leave any fields blank; incomplete forms can lead to confusion or disputes later.

- Don't use vague terms; be specific about what is being sold, including any assets or liabilities.

- Don't forget to date the document; this helps establish the timeline of the transaction.

- Don't overlook local laws; ensure the sale complies with any applicable regulations in your area.

Browse Common Types of Business Bill of Sale Templates

Equine Bill of Sale - It is advisable to have witness signatures on the Bill of Sale for added validity.

When engaging in the sale of a motorcycle in Arkansas, it is important to utilize the appropriate documentation to ensure a smooth transaction. The Arkansas Motorcycle Bill of Sale form serves as a legal record of this sale, capturing crucial information about both parties involved. For those looking to create this essential document, you can find a helpful resource through the Bill Of Sale for a Motorcycle which guides users through the necessary steps for proper ownership transfer and registration.

Detailed Guide for Writing Business Bill of Sale

Filling out the Business Bill of Sale form is an important step in transferring ownership of a business. This document serves as a legal record of the transaction, ensuring that both the buyer and seller have a clear understanding of the terms involved. To complete this process smoothly, follow the steps outlined below.

- Begin by entering the date of the sale at the top of the form.

- Provide the full name and address of the seller. Ensure that all details are accurate.

- Next, enter the full name and address of the buyer. Double-check this information as well.

- Describe the business being sold. Include the name of the business, its location, and any relevant identification numbers.

- Clearly state the purchase price of the business. This amount should reflect the agreed-upon value.

- If applicable, list any included assets, such as equipment, inventory, or intellectual property.

- Both parties should sign and date the form to confirm their agreement. Ensure that signatures are legible.

- Finally, make copies of the completed form for both the buyer and seller for their records.

By following these steps, you can ensure that the Business Bill of Sale form is filled out correctly, paving the way for a smooth transfer of ownership.