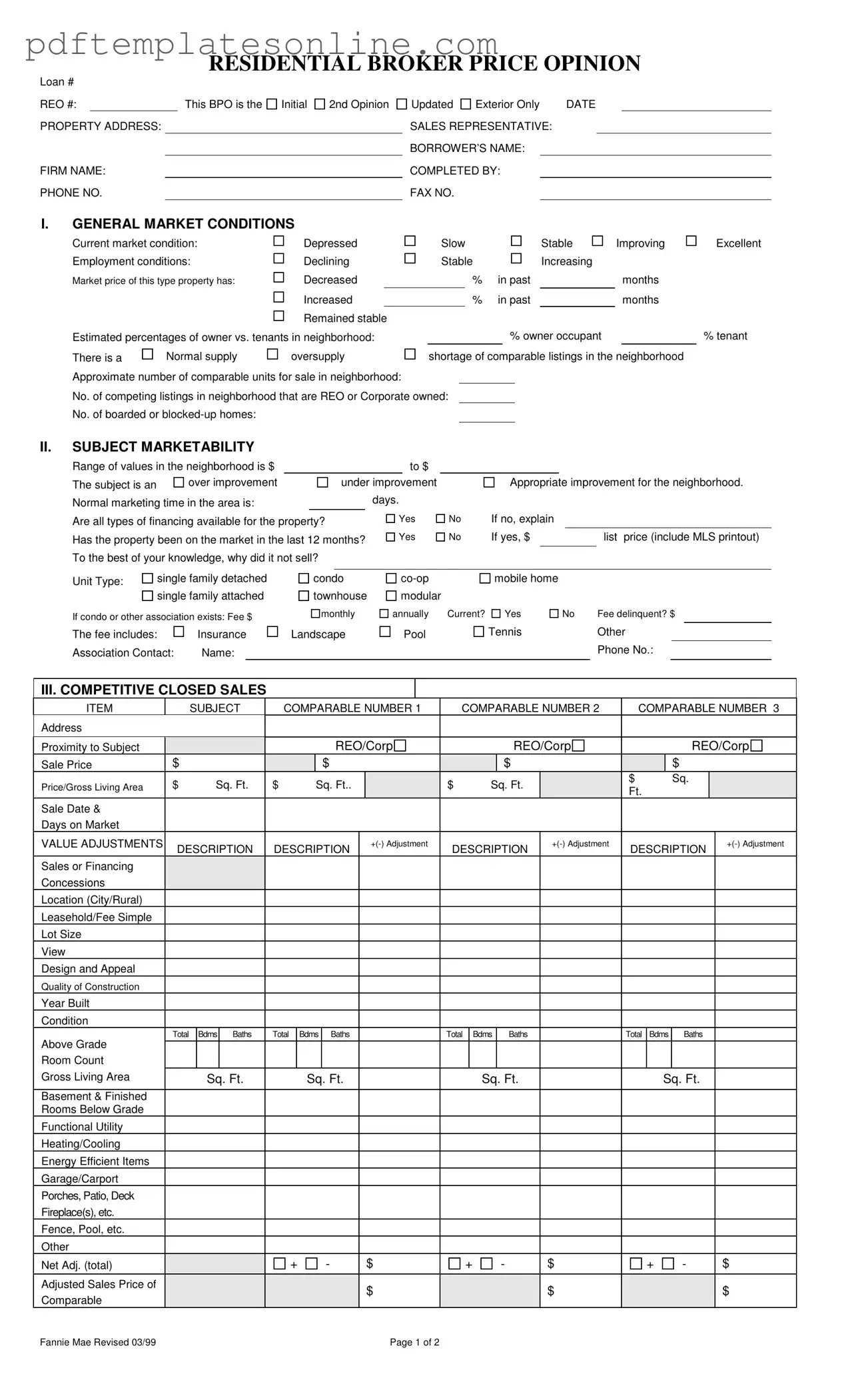

Blank Broker Price Opinion Form

Key takeaways

When filling out and using the Broker Price Opinion (BPO) form, keep these key takeaways in mind:

- Understand Market Conditions: Assess the current market conditions, including employment rates and the supply of comparable listings. This will help you determine the property's marketability.

- Accurate Comparables: Choose comparable properties wisely. Their sale prices, conditions, and features should closely match the subject property to ensure a reliable valuation.

- Document Repairs: Clearly itemize all necessary repairs needed to bring the property to a marketable condition. This transparency can influence the buyer's perception and the property's final value.

- Marketing Strategy: Decide on a marketing strategy based on the property's condition. Whether you choose to sell as-is or after repairs can significantly affect the sale price.

- Provide Detailed Comments: Use the comments section to highlight specific positives and negatives about the property. Mention any special concerns that could impact its value, like environmental issues or easements.

Common mistakes

Filling out a Broker Price Opinion (BPO) form can be a critical step in determining property value. However, several common mistakes can undermine the accuracy and effectiveness of the submission. Awareness of these pitfalls is essential for anyone involved in the process.

One frequent error is neglecting to provide accurate market condition assessments. The section asking for the current market condition—whether it is depressed, slow, stable, or improving—requires careful consideration. Failing to assess this accurately can lead to misleading conclusions about the property’s value. A thorough evaluation of employment conditions and comparable listings is crucial.

Another mistake involves incomplete or vague descriptions of the property’s marketability. The form asks for a range of values and details about the property’s condition. Omitting specifics, such as whether the property has been on the market in the last 12 months or failing to specify the reasons it did not sell, can significantly impact the final valuation. This information is vital for understanding the property’s potential.

Inaccuracies in comparable sales data represent a third mistake. The BPO form requires detailed information about comparable properties, including sale prices, adjustments, and characteristics. If this data is incorrect or not reflective of the current market, it can skew the valuation. It is essential to ensure that all comparable listings are recent and relevant.

Additionally, overlooking the repairs needed to bring the property to marketable condition can lead to inflated expectations. A detailed itemization of necessary repairs is critical. If this section is neglected or inaccurately filled out, it may misrepresent the property's condition to potential buyers, affecting the overall market strategy.

Lastly, failing to provide comprehensive comments and insights about the property can diminish the quality of the BPO. This section allows for the inclusion of specific concerns such as encroachments or environmental issues. Omitting these details can lead to misunderstandings or complications later in the process. A complete and thoughtful approach is necessary to convey the full picture.

Misconceptions

-

Misconception 1: A Broker Price Opinion (BPO) is the same as a formal appraisal.

While both BPOs and appraisals estimate property value, a BPO is typically less formal and often quicker. Appraisals are conducted by licensed appraisers and follow strict guidelines, whereas BPOs are usually performed by real estate brokers or agents based on market analysis.

-

Misconception 2: BPOs are only used for distressed properties.

Though BPOs are frequently requested for properties in distress, they can also be used for various real estate transactions, including sales and refinances. Their purpose is to provide a current market value based on comparable sales.

-

Misconception 3: The BPO form is a standard document that does not vary.

In reality, BPO forms can differ significantly depending on the lender or institution requesting them. Each may have unique sections or requirements tailored to specific needs.

-

Misconception 4: A BPO guarantees a specific selling price.

A BPO provides an estimated value based on current market conditions and comparable properties. However, it does not guarantee that a property will sell at that price. Market dynamics can lead to different outcomes.

-

Misconception 5: The BPO process is always quick and straightforward.

Although BPOs are generally faster than appraisals, the complexity of the property and market conditions can affect the time it takes to complete a BPO. Detailed analysis may require more time and effort.

-

Misconception 6: All brokers are equally qualified to complete a BPO.

Not all real estate brokers have the same level of experience or expertise in conducting BPOs. It is crucial to choose a broker who is knowledgeable about the local market and has a proven track record in performing BPOs.

-

Misconception 7: A BPO can replace a home inspection.

A BPO focuses on estimating the market value of a property, while a home inspection assesses the condition of the property. Both serve different purposes and should not be seen as interchangeable.

Dos and Don'ts

When filling out the Broker Price Opinion (BPO) form, there are several important practices to keep in mind. Here’s a list of what you should and shouldn’t do:

- Do ensure that all information is accurate and up-to-date.

- Do provide clear explanations for any "No" answers, especially regarding financing availability.

- Do include detailed descriptions of the property’s condition and necessary repairs.

- Do compare the subject property with recent sales in the area to support your pricing.

- Don't omit any sections of the form; every part is important for a complete assessment.

- Don't use vague language; be specific about the property's features and market conditions.

By following these guidelines, you can help ensure that the BPO form is filled out effectively, providing a clear picture of the property's value and marketability.

Other PDF Forms

How to File a No Trespassing Order - Designed to make your intentions clear, this letter is both firm and respectful.

In order to navigate the complexities of vehicle ownership, utilizing the California Motor Vehicle Power of Attorney form is essential, as it permits another individual to manage all necessary transactions on the owner's behalf. This document is particularly useful in situations where the owner is unable to attend to these administrative duties personally. For more resources and information, you can refer to California PDF Forms, which provides additional guidance on drafting and utilizing such forms effectively.

Durable Power of Attorney Florida - A properly completed Vehicle POA form can ease the burden of managing vehicle assets.

Detailed Guide for Writing Broker Price Opinion

Filling out the Broker Price Opinion (BPO) form requires careful attention to detail. Each section of the form gathers important information about the property and its market conditions. Follow these steps to ensure you complete the form accurately.

- Begin with the top section. Fill in the Loan #, REO #, and PROPERTY ADDRESS.

- Provide your FIRM NAME and PHONE NO.. Indicate whether this is an Initial, 2nd Opinion, or Updated report.

- Enter the DATE and the name of the SALES REPRESENTATIVE.

- Complete the BORROWER’S NAME and COMPLETED BY sections, along with FAX NO..

Next, move on to the general market conditions. This section requires you to assess the current market and employment conditions. You will also need to estimate the market price trends and the ratio of owner-occupants versus tenants in the neighborhood.

- Describe the Current market condition as Depressed, Slow, Stable, or Improving.

- Assess the Employment conditions: Declining, Stable, or Increasing.

- Indicate the market price trend: Decreased, Increased, or Remained stable.

- Estimate the percentage of owner-occupants in the neighborhood.

- Determine if there is a normal supply, oversupply, or shortage of comparable listings.

- List the approximate number of comparable units for sale.

- Count the number of competing listings that are REO or Corporate owned.

- Note the number of boarded or blocked-up homes.

Proceed to evaluate the subject property’s marketability. This involves determining its value range, improvement status, and marketing time.

- Provide the range of values in the neighborhood.

- Assess if the subject property is an over improvement, under improvement, or appropriate for the neighborhood.

- State the normal marketing time in days.

- Indicate if all types of financing are available for the property.

- Note if the property has been on the market in the last 12 months and provide the list price if applicable.

- Identify the unit type (e.g., single family detached, condo, etc.).

- If applicable, fill in the association fee details.

Next, you will analyze competitive closed sales. This section requires you to gather data on comparable properties.

- List details for up to three comparable properties, including address, proximity, sale price, and sale date.

- Make value adjustments based on various factors such as location, size, and condition.

- Calculate the adjusted sales price for each comparable.

Now, focus on the marketing strategy and repairs needed. This part helps determine how to present the property effectively.

- Choose the marketing strategy: As-is, Minimal, or Lender Required Repairs.

- Indicate the occupancy status of the property.

- Identify the most likely buyer.

- Itemize all repairs needed to make the property marketable.

- Calculate the grand total for all repairs.

Finally, analyze competitive listings and determine the market value. This section summarizes your findings.

- List details for comparable properties, including address and list price.

- Make necessary value adjustments.

- Determine the market value and suggested list price.

- Provide comments on the property, including any concerns or notable features.

- Sign and date the form to complete the process.

Once you have filled out the form, review it for accuracy before submission. This thorough process will help ensure that you provide a reliable opinion on the property's value.