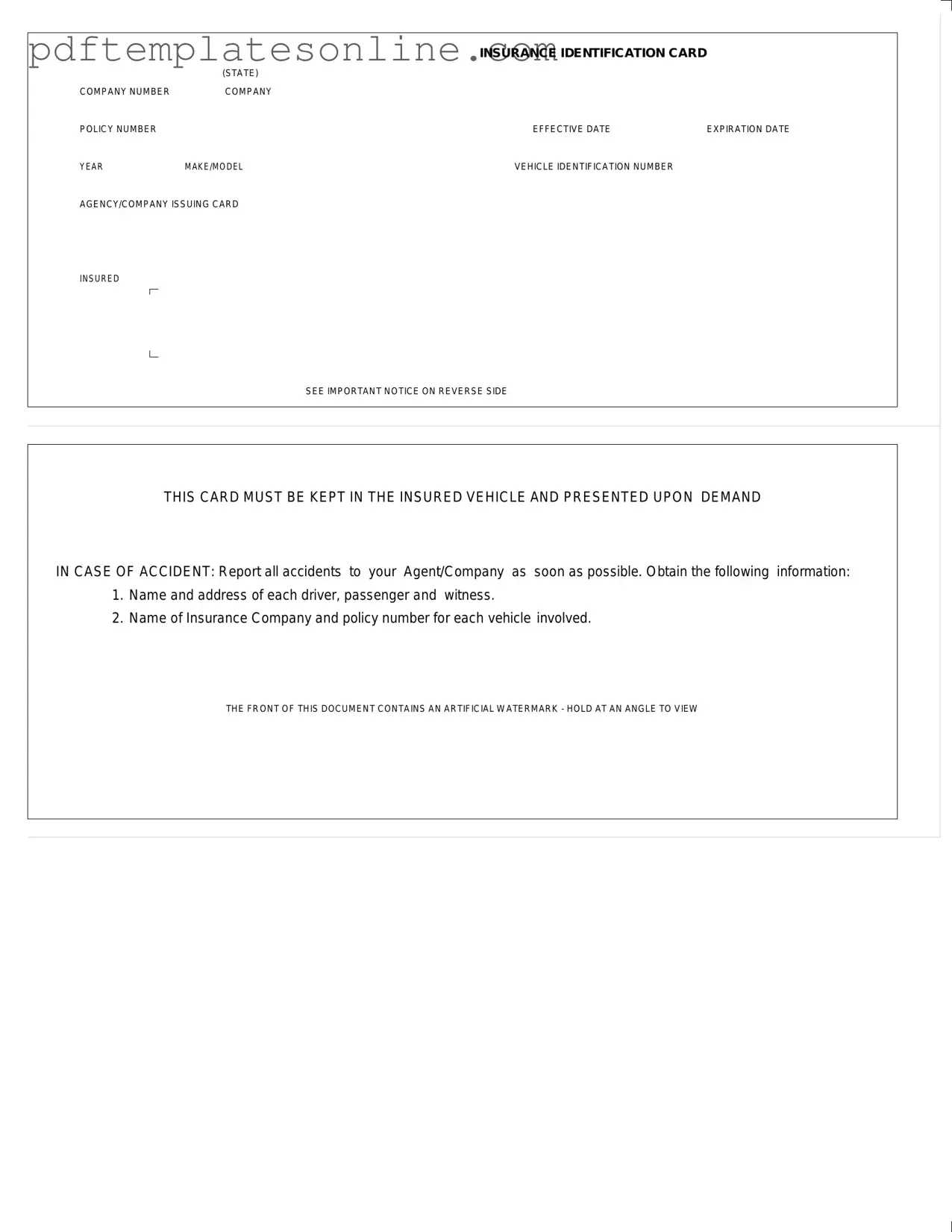

Blank Auto Insurance Card Form

Key takeaways

When filling out and using the Auto Insurance Card form, it is essential to pay attention to several key details. Below are important takeaways to ensure you understand the process clearly.

- Keep the card in your vehicle. It is a legal requirement to have the Auto Insurance Card in your car at all times.

- Present the card upon request. You must show this card if asked by law enforcement or in the event of an accident.

- Fill in all required information. Ensure that the company number, policy number, effective date, and expiration date are accurate and complete.

- Check vehicle details. Verify that the make, model, and vehicle identification number (VIN) match your vehicle.

- Report accidents promptly. Notify your insurance agent or company as soon as an accident occurs.

- Gather necessary information after an accident. Collect names and addresses of all drivers, passengers, and witnesses involved.

- Understand the watermark. The front of the card contains an artificial watermark; hold it at an angle to see it clearly.

Following these guidelines will help you navigate the requirements of the Auto Insurance Card effectively. Always keep your information updated to avoid complications.

Common mistakes

Filling out an Auto Insurance Card form may seem straightforward, but many people make common mistakes that can lead to complications down the line. One frequent error is neglecting to include the company policy number. This number is crucial because it helps identify your specific coverage. Without it, your insurance provider may struggle to assist you in case of an accident.

Another mistake often seen is failing to write down the effective and expiration dates correctly. These dates indicate when your coverage starts and ends. If they are inaccurate, you might find yourself in a situation where you think you’re covered, but your insurance has actually lapsed. Always double-check these dates before submitting your form.

People also frequently overlook the vehicle identification number (VIN). This unique code is essential for identifying your vehicle. If it's missing or incorrect, it could create problems when you need to file a claim. Make sure to locate the VIN on your vehicle and enter it accurately.

Another common pitfall is not including the make and model of the vehicle. This information is vital for your insurance company to assess the risk associated with insuring your car. If this detail is omitted, your policy might not be valid, leading to potential issues if you need to file a claim.

Additionally, many individuals forget to check the agency or company issuing the card. This detail is important because it confirms who your insurance provider is. If there’s any confusion about your coverage, having this information clearly stated can save time and frustration.

Lastly, some people neglect to read the important notice on the reverse side of the card. This section contains critical information about what to do in case of an accident. Ignoring it could leave you unprepared during a stressful situation. Always take a moment to read through all the information provided to ensure you understand your responsibilities and rights.

Misconceptions

Understanding the Auto Insurance Card is crucial for vehicle owners. However, several misconceptions can lead to confusion. Here are eight common misunderstandings about the Auto Insurance Card form:

- It is optional to keep the card in the vehicle. Many believe they can leave the card at home. However, it is mandatory to keep the card in the insured vehicle and present it upon demand in case of an accident.

- The card is only needed for accidents. Some think the card is only required if an accident occurs. In reality, it should be available whenever you are driving, as law enforcement may request it during routine stops.

- All information on the card is the same for every vehicle. This is not true. Each Auto Insurance Card is specific to the vehicle listed, including details like the policy number and vehicle identification number.

- Expiration dates are irrelevant. Some individuals overlook expiration dates, thinking their coverage is continuous. In fact, you must renew your policy and update the card before the expiration date to ensure you remain covered.

- The card is not a legal document. This misconception can lead to serious issues. The Auto Insurance Card is indeed a legal document that serves as proof of insurance, and it can be used in legal situations.

- Only the primary driver needs to be listed. Some believe only the primary driver needs to be mentioned on the card. However, it is essential to report all drivers of the vehicle to ensure coverage is valid.

- Watermarks on the card are just for decoration. The artificial watermark may seem like a design element, but it serves a purpose. It helps to prevent fraud and confirms the authenticity of the card.

- Accident reporting is optional. Many think they can choose whether or not to report an accident. This is a misconception; reporting all accidents to your insurance agent or company as soon as possible is crucial for maintaining coverage.

By clarifying these misconceptions, vehicle owners can better understand the importance of the Auto Insurance Card and ensure they are compliant with insurance regulations.

Dos and Don'ts

When filling out the Auto Insurance Card form, keep these important tips in mind:

- Do provide accurate information for each section.

- Do double-check the vehicle identification number (VIN) for accuracy.

- Do ensure that the effective and expiration dates are clearly stated.

- Do keep a copy of the filled form for your records.

- Do read any important notices or instructions provided on the form.

- Don't leave any sections blank unless instructed.

- Don't use abbreviations or shorthand that may cause confusion.

- Don't forget to sign the form if required.

- Don't ignore the requirement to keep the card in the vehicle.

- Don't hesitate to ask for help if you are unsure about any part of the form.

Other PDF Forms

Futa Chart - Employers should be aware of the differences between FUTA and SUTA taxes when completing the form.

Australian Passport Renewal Form - Cheques are not accepted for passport fees.

The use of the California Transfer-on-Death Deed form can greatly facilitate the transfer of property by allowing homeowners to designate a beneficiary, making it easier for family members to inherit without facing the lengthy probate process. For those looking to utilize this form, resources such as California PDF Forms provide the necessary documentation and guidance to ensure compliance with California's legal requirements, thereby providing peace of mind during a challenging time.

Dd Form 2870 Army Pubs - Healthcare personnel utilize the DD 2870 to coordinate care efficiently.

Detailed Guide for Writing Auto Insurance Card

Filling out the Auto Insurance Card form is straightforward. This card is essential for proving you have insurance coverage while driving. Make sure to have all necessary information ready before you begin. Follow these steps to complete the form accurately.

- Locate the form: Ensure you have the correct Auto Insurance Card form in front of you.

- Fill in the insurance identification card: Start with the COMPANY NUMBER provided by your insurance company.

- Enter your policy details: Next, write your COMPANY POLICY NUMBER on the designated line.

- Note the effective dates: Fill in the EFFECTIVE DATE and EXPIRATION DATE of your policy.

- Provide vehicle information: Enter the YEAR, MAKE/MODEL, and VEHICLE IDENTIFICATION NUMBER (VIN) of your vehicle.

- Identify the issuing agency: Write the name of the AGENCY/COMPANY ISSUING CARD at the bottom of the form.

- Review your information: Double-check all entries for accuracy before finalizing.

- Keep the card handy: Remember, this card must be kept in your vehicle and presented upon demand in case of an accident.

Once you have completed the form, make sure to store it in your vehicle. It’s also wise to familiarize yourself with the important notice on the reverse side, as it contains crucial information about what to do in case of an accident.