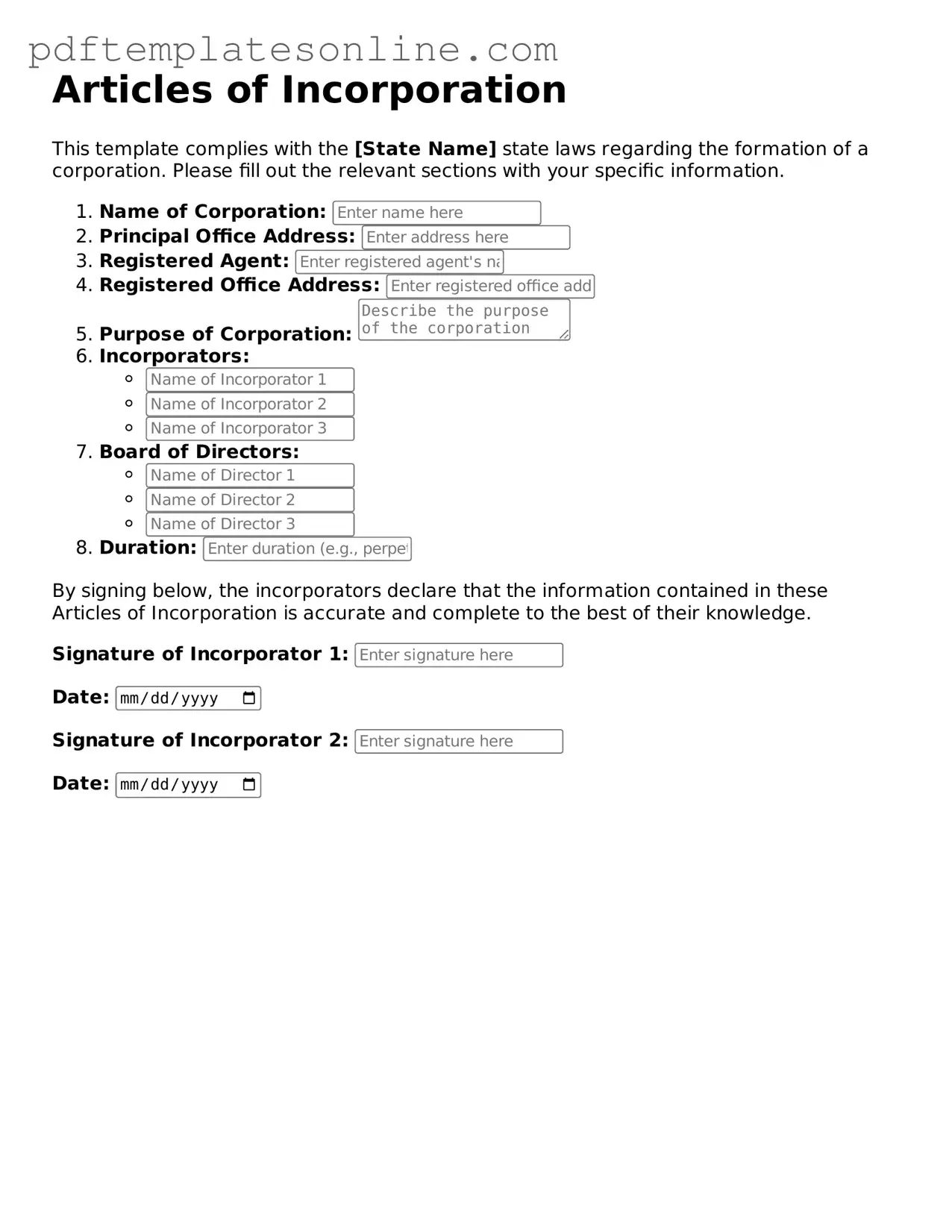

Fillable Articles of Incorporation Document

Key takeaways

When filling out and using the Articles of Incorporation form, consider the following key takeaways:

- Understand the Purpose: The Articles of Incorporation officially establish your business as a corporation. This document outlines the basic details about your company.

- Gather Required Information: Before starting, collect essential information such as the corporation's name, address, and the names of the initial directors.

- Choose a Unique Name: Ensure that your corporation’s name is unique and complies with state naming requirements. A name search can help confirm availability.

- Specify the Purpose: Clearly state the purpose of your corporation. This can be broad, but it should reflect the nature of your business activities.

- File with the Appropriate State Agency: Submit the completed Articles of Incorporation to the designated state office, usually the Secretary of State, along with any required fees.

- Keep Copies for Your Records: After filing, retain copies of the Articles of Incorporation. These documents are important for legal and tax purposes.

Articles of Incorporation Forms for Particular States

Common mistakes

Filling out the Articles of Incorporation is a critical step in establishing a business entity. However, many individuals make common mistakes that can lead to delays or complications. One frequent error is failing to provide accurate information about the business name. The name must be unique and comply with state regulations. If it closely resembles an existing company, it may be rejected.

Another mistake involves the selection of the business structure. Individuals sometimes choose the wrong type of corporation, such as an S-Corp instead of a C-Corp, without understanding the implications. This choice affects taxation and liability, so it is essential to consider the long-term goals of the business.

Additionally, many applicants neglect to include all necessary information about the directors and officers. Omitting details such as addresses or the number of shares can lead to the rejection of the application. Each state has specific requirements, and overlooking these can create significant hurdles.

Some people also fail to sign the Articles of Incorporation. A missing signature can render the document invalid. It is crucial to ensure that all required parties sign before submission. This oversight is often overlooked in the rush to complete the paperwork.

Inaccurate filing fees represent another common mistake. Each state requires a specific fee for processing the Articles of Incorporation. Individuals sometimes underestimate or miscalculate this fee, which can delay the incorporation process.

Furthermore, applicants often forget to check for compliance with state-specific requirements. Each state has its own regulations regarding the content of the Articles. Ignoring these can lead to unnecessary complications and delays.

Another frequent issue is the lack of clarity in the purpose statement. Some individuals write vague or overly broad descriptions of their business activities. A clear and specific purpose helps define the business and can prevent future legal issues.

Many people also overlook the importance of including a registered agent. A registered agent serves as the official point of contact for legal documents. Failing to designate one can lead to missed communications and legal challenges.

Lastly, some applicants submit their Articles of Incorporation without reviewing them thoroughly. Errors in spelling, grammar, or factual inaccuracies can undermine the credibility of the application. Taking the time to review the document can save significant time and effort in the long run.

Misconceptions

Understanding the Articles of Incorporation is crucial for anyone looking to start a business. However, several misconceptions can lead to confusion. Here are seven common misunderstandings about this important document:

- 1. The Articles of Incorporation are the same as a business plan. Many people think these two documents serve the same purpose. In reality, a business plan outlines your business strategy, while the Articles of Incorporation are a legal document that establishes your corporation.

- 2. You only need to file Articles of Incorporation once. Some believe that filing is a one-time event. However, corporations may need to amend their Articles if there are significant changes, such as a change in business name or address.

- 3. Articles of Incorporation are only for large companies. This is not true. Small businesses, startups, and nonprofits also need to file Articles of Incorporation to gain legal recognition.

- 4. Filing Articles of Incorporation guarantees tax benefits. While incorporating can offer certain tax advantages, simply filing the Articles does not automatically confer these benefits. Tax implications depend on various factors, including the type of corporation.

- 5. You can file Articles of Incorporation without legal help. While it is possible to file without a lawyer, seeking legal assistance can help ensure that all requirements are met and that the document is correctly prepared.

- 6. The Articles of Incorporation are the only requirement to start a business. This is misleading. In addition to filing the Articles, businesses may need licenses, permits, and to comply with local regulations.

- 7. Once filed, Articles of Incorporation cannot be changed. This is incorrect. Amendments can be made to the Articles, allowing businesses to adapt as they grow and change.

By clearing up these misconceptions, individuals can better navigate the process of forming a corporation and understand the importance of the Articles of Incorporation in establishing a legal business entity.

Dos and Don'ts

When completing the Articles of Incorporation form, attention to detail is crucial. Here are some key dos and don'ts to keep in mind:

- Do ensure all information is accurate and up-to-date.

- Do clearly define the purpose of your corporation.

- Do include the names and addresses of the initial directors.

- Do check for any state-specific requirements before submission.

- Don't leave any sections blank; fill in all required fields.

- Don't forget to sign and date the form before submitting.

Taking these steps will help ensure a smooth incorporation process. Pay attention to the details, and avoid common pitfalls to expedite your application.

Check out Popular Documents

Physical Exam Form for Healthcare Workers - Normal findings for various systems should be checked, with space provided for comments if needed.

Dmv Power of Attorney - Ideal for sellers wanting authorized individuals to handle their vehicle sales.

When engaging in a financial transaction, having a solid understanding of the terms of a Loan Agreement is crucial. The California Loan Agreement form serves as a legal framework that protects both parties involved. For those looking to create or modify their agreements, resources like California PDF Forms can provide the necessary tools to ensure clarity and compliance with state laws.

Printable Salon Chemical Service Waiver Form - A range of services and their associated costs are clearly outlined for client approval.

Detailed Guide for Writing Articles of Incorporation

Once you have the Articles of Incorporation form, you will need to provide specific information about your business. This process is straightforward, but attention to detail is crucial to ensure everything is accurate. Follow these steps to complete the form correctly.

- Gather Required Information: Collect details about your corporation, including the name, address, and purpose of the business.

- Choose a Name: Ensure the name you select is unique and complies with state regulations. Verify its availability through your state’s business registry.

- Provide the Principal Office Address: Enter the physical address where your corporation will operate. This should not be a P.O. Box.

- List the Registered Agent: Identify a registered agent who will receive legal documents on behalf of the corporation. Include their name and address.

- State the Purpose: Clearly define the purpose of your corporation. Be specific about the business activities you will engage in.

- Indicate the Number of Shares: Specify the total number of shares your corporation is authorized to issue and their par value, if applicable.

- Include Incorporator Information: Provide the name and address of the person or people incorporating the business.

- Review the Form: Check for any errors or omissions. Make sure all required fields are completed accurately.

- Sign and Date: The incorporator(s) must sign and date the form to validate it.

- Submit the Form: File the completed form with the appropriate state agency, along with any required filing fees.