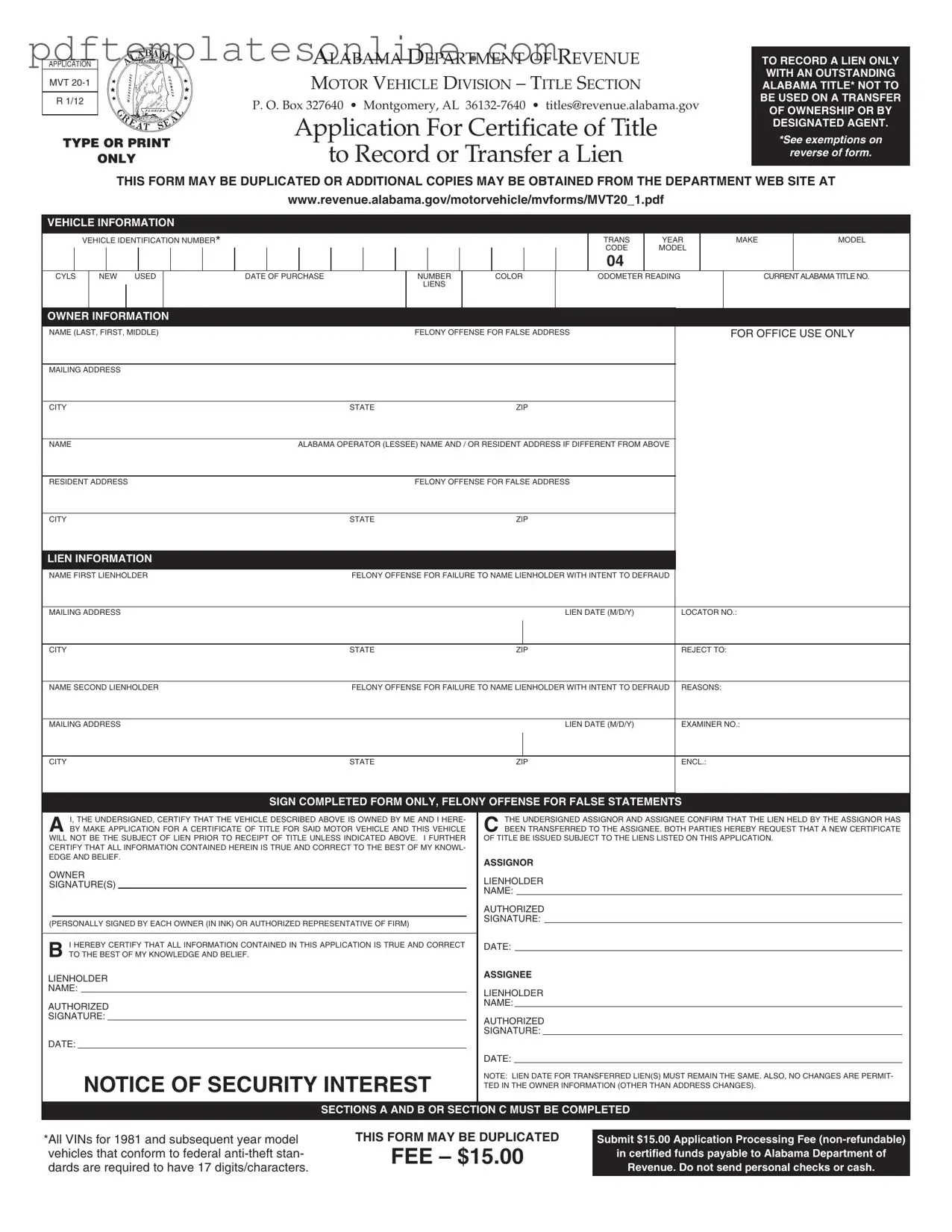

Blank Alabama Mvt 20 1 Form

Key takeaways

Filling out the Alabama MVT 20 1 form can seem daunting, but understanding its key aspects can simplify the process. Here are some essential takeaways to keep in mind:

- Purpose of the Form: The MVT 20 1 form is specifically designed for recording or transferring a lien on a vehicle that already has an Alabama title. It is not intended for transferring ownership.

- Eligibility: Only vehicles with an outstanding Alabama title can use this form. Ensure that the vehicle meets this requirement before proceeding.

- Legibility is Key: When filling out the form, it must be typed or printed clearly. Illegible submissions will be returned, causing delays.

- Supporting Documents: Always accompany the application with the current Alabama title and the required $15 application processing fee. Payments should be made in certified funds, avoiding personal checks or cash.

- Owner Information: The vehicle and owner information must match exactly with the details on the surrendered Alabama title, except for the current mailing address.

- Signatures Required: Both the assignor and assignee must sign the completed form. Each signature must be in ink to validate the application.

- Exemptions: Be aware of specific exemptions. For instance, vehicles over thirty-five years old, certain trailers, and low-speed vehicles may not require a title, which affects the necessity of this form.

By keeping these takeaways in mind, you can navigate the process of using the Alabama MVT 20 1 form with confidence. Ensuring accuracy and compliance will help facilitate a smoother experience in recording or transferring a lien.

Common mistakes

Filling out the Alabama MVT 20 1 form can be a straightforward process, but many people make common mistakes that can lead to delays or rejections. One frequent error is failing to provide a complete Vehicle Identification Number (VIN). The VIN must be exactly 17 characters for vehicles from 1981 onward. Omitting or miswriting even a single character can cause the application to be returned.

Another mistake involves the vehicle information section. Applicants often forget to indicate whether the vehicle is new or used. This designation is crucial for processing the application correctly. Additionally, providing an incorrect or outdated title number can lead to complications, as the information must match the current Alabama title.

In the owner information section, people sometimes neglect to include the full name as it appears on the title. Missing middle names or initials can result in discrepancies that may delay the application. Furthermore, using an incorrect mailing address can hinder communication with the Alabama Department of Revenue, causing further delays.

Another common oversight is related to lienholder information. Some applicants do not provide the name and address of the first lienholder, or they mistakenly leave out the second lienholder if applicable. This omission can lead to legal issues down the line, as all lienholders must be accurately recorded.

Additionally, applicants often fail to sign the form. A signature is required to certify that the information provided is true and correct. Without a signature, the application will be considered incomplete and will not be processed.

People also make the mistake of not including the required application processing fee. The fee must be submitted in certified funds, and personal checks or cash are not accepted. Omitting this payment will result in the application being returned.

Some individuals overlook the requirement to submit the current Alabama title along with the application. This title is essential for verifying ownership and ensuring that the lien can be recorded accurately. Failing to include it can lead to significant delays.

Another issue arises when applicants do not adhere to the instructions regarding legibility. Forms that are not typed or printed clearly will be returned for re-submission. This can be frustrating and time-consuming, especially if the applicant is unaware of the issue.

Finally, applicants sometimes ignore the specific exemptions listed on the form. Understanding these exemptions is vital, as they dictate whether a title can be issued for certain vehicles. If a vehicle falls under an exemption, submitting the form without this knowledge can lead to unnecessary complications.

Misconceptions

Misconceptions about the Alabama Mvt 20 1 form can lead to confusion and delays in processing. Here are seven common misunderstandings:

- This form can be used for transferring ownership. The Mvt 20 1 form is specifically designed only for recording or transferring a lien. It cannot be used for transferring ownership of a vehicle.

- All vehicles require a title application. Some vehicles, like those older than 35 years or certain types of trailers, are exempt from titling. This means they do not need a title application.

- Any agent can submit this form on behalf of the owner. Only authorized lienholders can use this form. Designated agents must use a different form, specifically the MVT 5-1E.

- The form can be submitted with personal checks. Only certified funds are accepted for the $15 application processing fee. Personal checks and cash will not be processed.

- Illegible forms will be accepted if accompanied by supporting documents. If the form is not legible, it will be returned. Clarity is crucial for processing.

- Changes can be made to owner information after submission. Once submitted, no changes are allowed in the owner information, except for address updates.

- Supporting documents are optional. The current Alabama title must accompany the application. Without it, the form cannot be processed.

Understanding these points can help ensure that your application is completed correctly and submitted without unnecessary delays.

Dos and Don'ts

When filling out the Alabama MVT 20 1 form, it's important to follow certain guidelines to ensure your application is processed smoothly. Here are some dos and don'ts to keep in mind:

- Do type or print your information clearly. Illegible forms will be returned.

- Do ensure that the vehicle and owner information matches the surrendered Alabama title, except for address changes.

- Do include the current Alabama title with your application.

- Do submit the application fee in certified funds only, payable to the Alabama Department of Revenue.

- Don't use this form for transferring ownership or if you are a designated agent; use form MVT 5-1E instead.

- Don't forget to sign the completed form; your signature certifies the accuracy of the information provided.

Other PDF Forms

Fillable Da Form 638 - This form plays a key role in celebrating individual accomplishments in the military.

For those looking to navigate the procedural aspects of vehicle transfer, understanding the important components of a Tractor Bill of Sale is vital. You can find a well-structured template at a practical guide for the California Tractor Bill of Sale to assist you in documenting your transaction properly.

Joint Tenancy Death - The California Death of a Joint Tenant Affidavit is an invaluable resource for ensuring a smooth transition of ownership.

Detailed Guide for Writing Alabama Mvt 20 1

Completing the Alabama MVT 20-1 form is an important step in ensuring that your lien is properly recorded. Once you have filled out the form, you will need to submit it along with the required fee and any supporting documents to the Alabama Department of Revenue. This process helps protect your rights as a lienholder and ensures that all parties involved are properly informed.

- Begin by typing or printing your information clearly on the form. Illegible forms will be returned.

- Fill in the vehicle information section with the following details:

- Vehicle Identification Number (VIN)

- Year, make, and model of the vehicle

- Color and odometer reading

- Current Alabama title number

- Provide your personal information in the owner information section:

- Name (last, first, middle)

- Mailing address, city, state, and zip code

- If applicable, include information for the Alabama operator or lessee, if different from the owner.

- Complete the lien information section by entering the first lienholder's name and mailing address, along with the lien date.

- If there is a second lienholder, provide their information in the designated section.

- Sign the completed form. Ensure that all signatures are in ink and that each owner or authorized representative has signed.

- Prepare your payment. Include a $15.00 application processing fee in certified funds, payable to the Alabama Department of Revenue. Do not send personal checks or cash.

- Attach the current Alabama title for the vehicle to your application.

- Submit the completed form, payment, and any additional documents to the Alabama Department of Revenue at the address provided on the form.