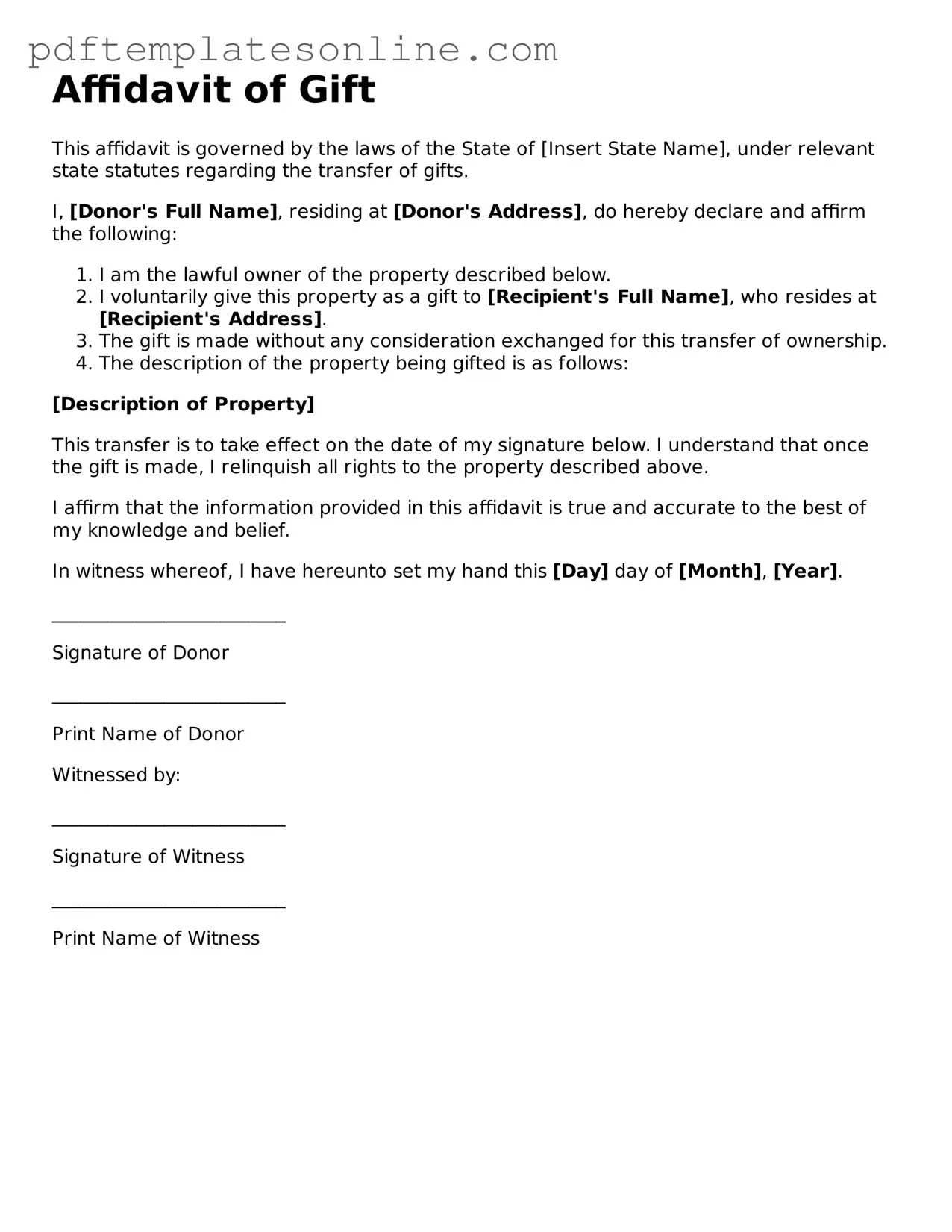

Fillable Affidavit of Gift Document

Key takeaways

When dealing with the Affidavit of Gift form, it is important to keep several key points in mind. This form is typically used to document the transfer of property or assets without any exchange of money. Here are some essential takeaways:

- Understand the Purpose: The Affidavit of Gift serves to confirm that a gift has been made, outlining the donor's intent and the recipient's acceptance.

- Gather Necessary Information: Before filling out the form, collect all relevant details about the donor, recipient, and the item or property being gifted.

- Be Clear and Accurate: Provide precise information. Any inaccuracies may lead to complications in the future.

- Signature Requirements: The form typically requires the donor's signature. In some cases, a witness or notary may also be necessary.

- Check State Laws: Different states may have specific rules regarding the use of the Affidavit of Gift. Always verify local requirements.

- Keep Copies: After completing the form, make copies for both the donor and the recipient. This ensures that both parties have a record of the transaction.

- Tax Implications: Be aware that gifting may have tax consequences. Consult with a tax professional if the value of the gift exceeds certain limits.

- Use Clear Language: Avoid legal jargon. Use straightforward language to describe the gift and the parties involved.

- Submit When Necessary: If the gift involves real estate or significant assets, you may need to file the affidavit with local authorities.

- Review Before Submission: Double-check the completed form for any errors or omissions before finalizing it. This can prevent potential issues later on.

By keeping these points in mind, you can ensure that the process of using the Affidavit of Gift form is smooth and effective.

Affidavit of Gift Forms for Particular States

Common mistakes

Filling out the Affidavit of Gift form can be straightforward, but several common mistakes often occur. One frequent error is providing incomplete information. Each section of the form requires specific details, such as the names of the donor and recipient, the relationship between them, and a description of the gift. Omitting any of this information can lead to delays or complications in processing the gift.

Another mistake is failing to sign and date the form. Both the donor and recipient must sign the affidavit to validate the gift. Without these signatures, the form may be considered invalid, which can create issues later on. It is essential to double-check that all required signatures are present before submitting the form.

People also often overlook the importance of accurate descriptions of the gift. Describing the gift too vaguely can lead to misunderstandings. It is crucial to provide a clear and detailed description, including the value of the gift if applicable. This clarity helps ensure that all parties understand the nature of the gift and can prevent disputes in the future.

Additionally, individuals sometimes forget to include any necessary supporting documentation. Depending on the nature of the gift, additional paperwork may be required, such as proof of ownership or valuation. Not including these documents can result in the form being rejected or delayed.

Lastly, many people fail to review the completed form before submission. Errors in spelling, numbers, or other details can occur easily. Taking the time to carefully review the entire form can help catch mistakes that might otherwise go unnoticed, ensuring a smoother process for all involved.

Misconceptions

The Affidavit of Gift form is often misunderstood. Here are four common misconceptions about this important document:

- It is only for large gifts. Many people believe that the Affidavit of Gift is only necessary for substantial gifts, such as real estate or large sums of money. In reality, this form can be used for any gift, regardless of size, to clarify the intent of the giver.

- It is not legally binding. Some think that the Affidavit of Gift is merely a formality with no legal weight. However, when properly completed and signed, it serves as a legal declaration of the gift, which can protect both the giver and the recipient in case of disputes.

- It only applies to family members. Many assume that this affidavit is only relevant for gifts among family members. In truth, it can be used for gifts between friends, colleagues, or any individuals, helping to document the intent behind the transfer.

- It is unnecessary if there is a written agreement. Some individuals think that if there is a separate written agreement regarding the gift, the Affidavit of Gift is redundant. However, the affidavit provides a straightforward and specific declaration of the gift, which can simplify matters should any questions arise later.

Dos and Don'ts

When filling out the Affidavit of Gift form, it's important to approach the process with care. Here’s a list of things you should and shouldn’t do to ensure accuracy and compliance.

- Do provide accurate information about the gift and the donor.

- Do sign the affidavit in the presence of a notary public.

- Do include all required documentation to support the gift claim.

- Do keep a copy of the completed affidavit for your records.

- Do ensure that the affidavit is submitted within the appropriate timeframe.

- Don't leave any sections of the form blank unless instructed.

- Don't use white-out or make alterations to the form.

- Don't forget to double-check for spelling errors and inaccuracies.

- Don't submit the form without verifying that all information is correct.

- Don't overlook the importance of understanding the tax implications of the gift.

Browse Common Types of Affidavit of Gift Templates

Good Faith Marriage Affidavit Letter Sample - The overall impression of the affidavits should depict a strong, united partnership.

A Straight Bill of Lading is a document used in the shipping industry that serves as a receipt for goods and a contract between the shipper and the carrier. This form is essential for ensuring smooth transportation and delivery of cargo, as it provides important details about the shipment. To get started with your shipping needs, fill out the Straight Bill Of Lading form.

Florida Declaration of Domicile Requirements - This affidavit can assist in confirming voter registration residency.

Detailed Guide for Writing Affidavit of Gift

Filling out the Affidavit of Gift form is an important step in documenting the transfer of property or assets. Once you have completed the form, you will need to sign it in the presence of a notary public, who will verify your identity and ensure that the document is executed properly. This step is crucial for the legal validity of the affidavit.

- Begin by gathering all necessary information, including the names and addresses of both the donor (the person giving the gift) and the recipient (the person receiving the gift).

- Locate the section of the form that requires you to describe the gift. Clearly outline what is being given, whether it is cash, property, or another type of asset.

- Fill in the date on which the gift is being made. This is important for record-keeping purposes.

- In the designated area, provide any additional details that may be required, such as the value of the gift or any conditions attached to it.

- Sign the form in the appropriate section. Make sure your signature matches the name you provided earlier.

- Find a notary public to witness your signature. They will need to verify your identity and may ask for identification.

- Once notarized, keep a copy of the completed form for your records and provide the original to the recipient.