Blank Adp Pay Stub Form

Key takeaways

When it comes to understanding your ADP pay stub, several important points can enhance your experience and ensure you make the most of this essential document.

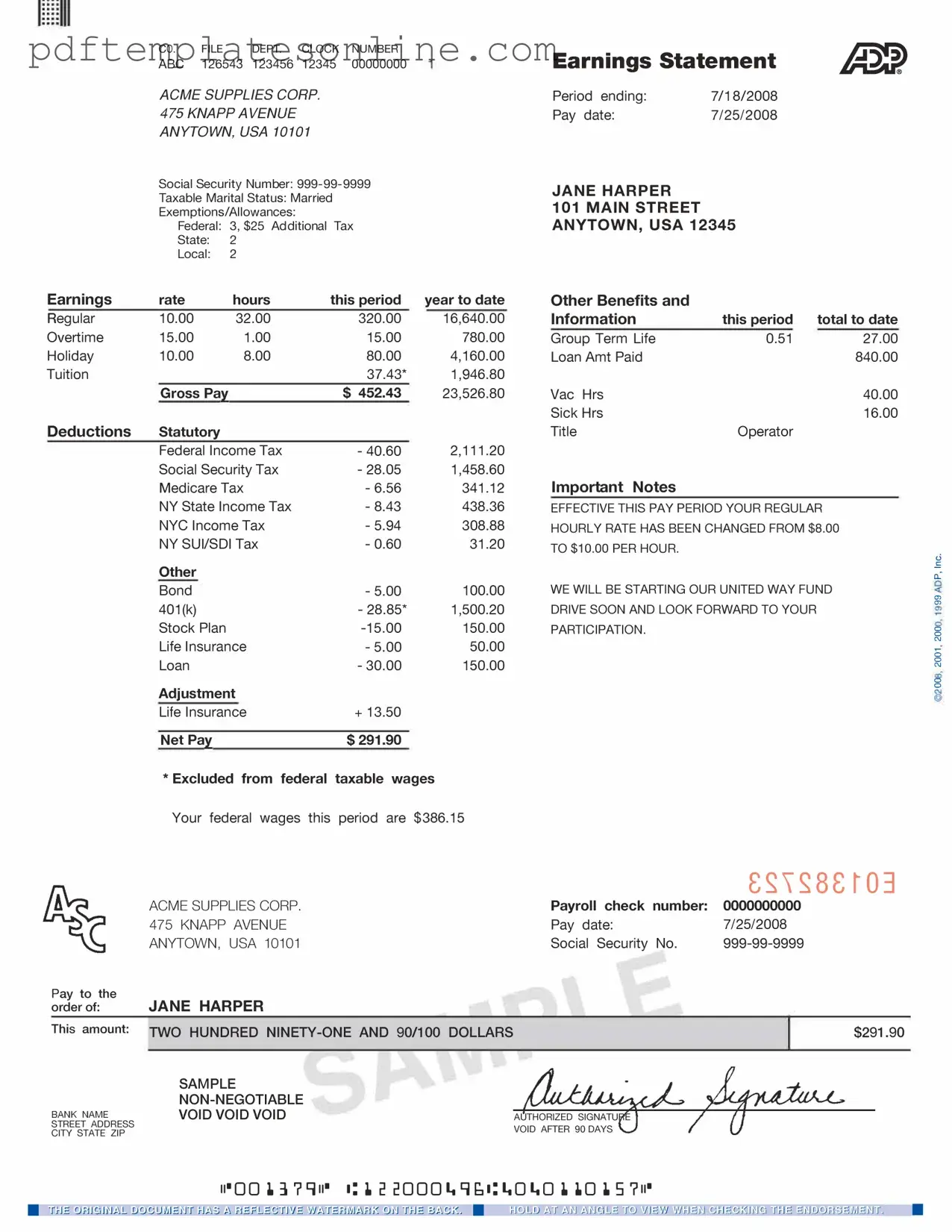

- Familiarize Yourself with the Layout: The ADP pay stub features distinct sections that provide crucial information about your earnings, deductions, and taxes. Recognizing these sections can help you quickly locate the details you need.

- Review Your Earnings: Your gross pay, which is the total amount earned before any deductions, is prominently displayed. Be sure to verify that this amount aligns with your expectations based on your hours worked or salary.

- Understand Deductions: Deductions can include taxes, retirement contributions, and health insurance premiums. Knowing what each deduction is for will help you manage your finances more effectively.

- Check Year-to-Date Totals: The year-to-date (YTD) section summarizes your earnings and deductions from the beginning of the year to the current pay period. This information is invaluable for budgeting and tax preparation.

- Keep Records: It’s wise to save your pay stubs for future reference. They can serve as proof of income when applying for loans, renting an apartment, or filing your taxes.

By paying attention to these key aspects, you can navigate your ADP pay stub with confidence and clarity.

Common mistakes

When filling out the ADP Pay Stub form, many individuals overlook crucial details that can lead to significant errors. One common mistake is not verifying personal information. A simple misspelling of a name or an incorrect Social Security number can create complications in payroll processing. Always double-check these details to ensure accuracy.

Another frequent error involves misunderstanding the pay period. Employees sometimes fail to indicate the correct start and end dates for the pay period. This oversight can result in receiving an incorrect paycheck amount, which may lead to financial discrepancies. It’s essential to be clear about the pay period to avoid such issues.

Many people also neglect to update their withholding allowances. Life changes, such as marriage or the birth of a child, can affect tax withholding. Failing to adjust these allowances may lead to under-withholding or over-withholding of taxes, which can have financial repercussions come tax season.

In addition, individuals often forget to account for deductions. Whether it’s for health insurance, retirement plans, or other benefits, not including these deductions can skew the final pay amount. Review the deductions carefully to ensure they reflect the current selections.

Another mistake is not keeping a copy of the completed form. Without a record, discrepancies can arise later, making it difficult to resolve issues. Maintaining a copy provides a reference point for future inquiries or corrections.

Lastly, some individuals rush through the process without fully understanding the form's sections. Each part of the ADP Pay Stub form serves a purpose, and taking the time to comprehend each section can prevent errors. A thorough review can save time and frustration in the long run.

Misconceptions

Understanding the ADP pay stub form can be challenging. Here are five common misconceptions about it.

-

All deductions are mandatory.

Many people believe that every deduction listed on their pay stub is required by law. However, some deductions, like certain insurance premiums or retirement contributions, may be optional depending on the employer's policies.

-

Pay stubs are only for full-time employees.

Another misconception is that only full-time employees receive pay stubs. In reality, part-time and temporary workers also receive pay stubs, reflecting their earnings and deductions.

-

Gross pay and net pay are the same.

Some individuals think gross pay and net pay are interchangeable terms. Gross pay refers to the total earnings before any deductions, while net pay is what employees take home after deductions are made.

-

Pay stubs are not important.

Some people underestimate the importance of pay stubs. They serve as official records of income and deductions, which can be crucial for tax purposes, loan applications, and verifying employment.

-

All pay stubs look the same.

It is a common belief that all pay stubs follow a uniform format. In reality, the layout and information presented can vary significantly between different employers and payroll systems.

Dos and Don'ts

When filling out the ADP Pay Stub form, it's essential to approach the task with care and attention to detail. Here are ten important guidelines to follow, divided into things you should do and things you should avoid.

Things You Should Do:

- Review your personal information for accuracy, including your name and address.

- Ensure your Social Security number is correct to avoid tax issues.

- Double-check your pay period dates to confirm they match your work schedule.

- Verify your earnings and deductions to ensure they align with your expectations.

- Keep a copy of the completed form for your records.

Things You Shouldn't Do:

- Do not leave any sections blank; all fields should be filled out completely.

- Avoid using incorrect or outdated information, as this can lead to complications.

- Do not ignore discrepancies; report any errors immediately to your payroll department.

- Refrain from making assumptions about deductions; clarify any uncertainties.

- Do not submit the form without a final review to catch any mistakes.

By following these guidelines, you can ensure that your ADP Pay Stub form is filled out correctly, minimizing the risk of errors and ensuring your payroll information is accurate.

Other PDF Forms

Act of Donation Form Louisiana - Individuals considering a donation are encouraged to seek advice to ensure the form meets all necessary legal requirements for validation.

How Do I Qualify for the $16728 Social Security Bonus? - Beneficiaries need to communicate honestly about their income on the SSA-44 for the best outcomes.

5707 Imm - Section A clearly states the applicant’s need to provide full names and vital information for family verification.

Detailed Guide for Writing Adp Pay Stub

Filling out the ADP Pay Stub form is a straightforward process that requires careful attention to detail. Once you have gathered the necessary information, you will be ready to complete the form accurately. Follow these steps to ensure that all required fields are filled out correctly.

- Begin by entering your employee information. This typically includes your name, address, and employee ID number.

- Next, fill in the pay period dates. Make sure to specify the start and end dates for the pay period you are documenting.

- Input your earnings details. This section usually requires you to list your gross pay, which is the total amount earned before any deductions.

- Record any deductions that apply. Common deductions include taxes, health insurance, and retirement contributions. Be sure to list each deduction clearly.

- Calculate your net pay by subtracting total deductions from your gross pay. This is the amount you take home.

- Finally, review all the information you have entered for accuracy. Double-check for any typos or missing details.

Once you have completed these steps, you will have a filled-out ADP Pay Stub form that reflects your earnings and deductions for the specified pay period. Ensure to keep a copy for your records.