Blank Act 221 Disclosure Form

Key takeaways

Filling out and using the Act 221 Disclosure form is essential for anyone involved in the resale of a condominium or townhome in Illinois. Here are some key takeaways to keep in mind:

- Understand the Purpose: This form is designed to provide potential buyers with crucial information about the financial and legal status of the condominium association.

- Accurate Financial Reporting: Ensure that all financial details, such as monthly assessments and any past due amounts, are reported accurately to avoid misunderstandings.

- Special Assessments: Be clear about whether there are any special assessments currently under consideration. Transparency in this area can prevent disputes later.

- Budget Attachments: Always attach the most recent approved budget. This document gives potential buyers insight into the financial health of the association.

- Pending Legal Matters: Disclose any pending lawsuits or judgments involving the association. This information can significantly impact a buyer's decision.

- Insurance Information: Provide details about the insurance carrier for the association. Buyers want to know that the property is adequately protected.

- Compliance with Regulations: Confirm that there have been no unauthorized improvements or alterations to the unit or common areas. This helps maintain compliance with the association's rules.

By keeping these points in mind, you can ensure that the Act 221 Disclosure form is filled out correctly and serves its purpose effectively.

Common mistakes

Filling out the Act 221 Disclosure form is a crucial step for condominium and townhome associations in Illinois. However, many make common mistakes that can lead to confusion or legal issues. One frequent error is failing to provide complete financial information. When indicating the monthly assessment status, it's essential to specify if the dues are paid in full and detail any past due amounts. Incomplete financial disclosures can mislead potential buyers and may result in legal repercussions for the association.

Another mistake involves the misrepresentation of assessments. The form requires the officer or managing agent to clearly state whether there are any other monthly, special, or additional assessments due. Omitting this information or incorrectly stating that there are no pending assessments can create significant misunderstandings. Buyers rely on this information to assess their financial obligations and future costs, so accuracy is paramount.

Additionally, many associations neglect to address pending lawsuits or judgments. The form explicitly asks for this information, and failing to disclose ongoing legal issues can lead to serious consequences. Not only does this reflect poorly on the association, but it can also expose the association to liability if the buyer later discovers undisclosed legal troubles.

Lastly, associations often overlook the importance of attaching the most recent approved budget. This document provides transparency about the financial health of the association. Without it, potential buyers may question the association's management and financial stability. Including a complete and accurate budget is not just a best practice; it is a legal requirement that protects both the association and its members.

Misconceptions

Here are nine common misconceptions about the Act 221 Disclosure form, along with clarifications for each:

- Misconception 1: The form is optional for condominium associations.

- Misconception 2: The form guarantees that there are no financial issues with the association.

- Misconception 3: All assessments are disclosed on the form.

- Misconception 4: The form includes detailed information about the association’s budget.

- Misconception 5: The form only addresses issues related to the unit being sold.

- Misconception 6: A lack of pending lawsuits means the association is in good standing.

- Misconception 7: The form is only relevant for buyers.

- Misconception 8: The form is filled out by the seller.

- Misconception 9: The form is the only document needed for a real estate transaction.

This form is mandatory under Illinois law. Associations must provide it to prospective buyers to ensure transparency about the property's condition and financial obligations.

The form outlines current financial conditions but does not guarantee future stability. Buyers should still conduct their own due diligence.

While the form requires disclosure of known assessments, it may not cover every potential future assessment. Buyers should inquire about any anticipated costs.

The form states that a copy of the most recent approved budget is attached, but it does not provide a detailed breakdown within the form itself.

The form also covers common elements and the overall financial health of the condominium association, not just the individual unit.

While no pending lawsuits may seem positive, it does not reflect the overall financial or operational health of the association.

Current owners should also understand the implications of the disclosures, as they affect property values and future assessments.

The form must be completed by an officer or managing agent of the association, not the seller. This ensures an unbiased perspective on the property’s condition.

The Act 221 Disclosure form is just one part of a larger set of documents required for a real estate transaction. Buyers should review all relevant paperwork.

Dos and Don'ts

When filling out the Act 221 Disclosure form, it is important to follow specific guidelines to ensure accuracy and compliance. Below is a list of things you should and shouldn't do.

- Do provide complete and accurate information regarding the unit's assessment status.

- Do indicate whether there are any pending lawsuits or judgments related to the association.

- Do attach the most recent approved budget for the association.

- Do confirm whether any capital expenditures are anticipated within the next two fiscal years.

- Don't leave any sections blank; all relevant fields must be filled out.

- Don't provide misleading information about the unit's condition or assessments.

- Don't forget to include contact information for the insurance carrier of the association.

Other PDF Forms

Vics Bol - This form is aligned with industry standards for shipping.

Dd 214 - It may also include any time lost during the period of active duty.

The importance of having a well-drafted Loan Agreement cannot be overstated, as it creates a clear framework for the transaction between the borrower and lender. It is advisable to utilize resources like California PDF Forms to ensure that all legal requirements are met and the agreement is tailored to reflect the specific needs of both parties involved.

Florida 4 Point Inspection - The 4-Point Inspection Form standardizes the process for consistency.

Detailed Guide for Writing Act 221 Disclosure

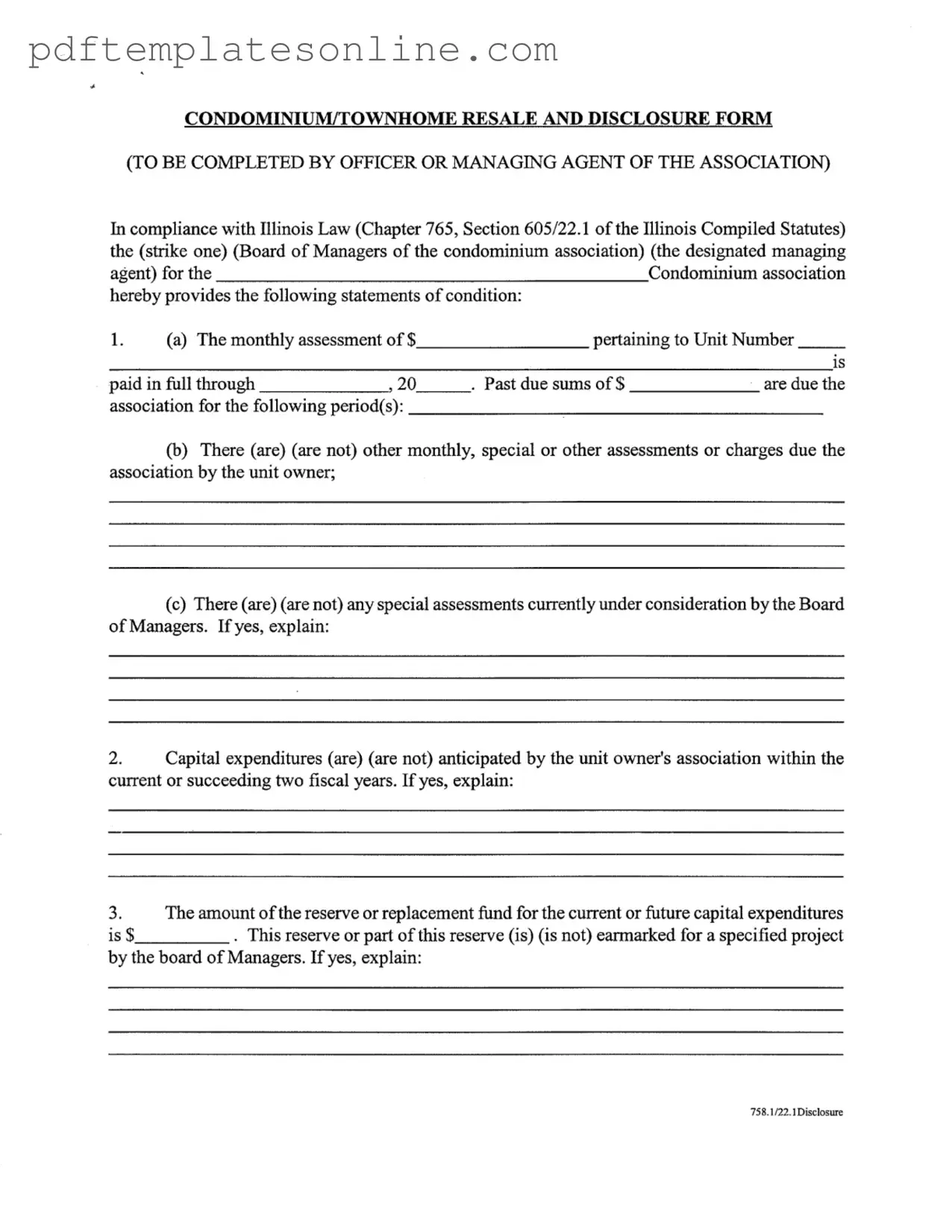

Filling out the Act 221 Disclosure form is an important step in ensuring that all necessary information is communicated clearly and accurately. This form must be completed by an officer or managing agent of the condominium association. It is essential to gather all relevant details before starting, as this will help streamline the process and ensure compliance with Illinois law.

- Identify the Association: At the top of the form, indicate whether the Board of Managers of the condominium association or the designated managing agent is completing the form.

- Monthly Assessment Information: Fill in the unit number and state whether the monthly assessment is paid in full through a specific date. If there are any past due sums, list the amounts and the periods they cover.

- Assessments and Charges: Check the appropriate box to indicate whether there are any other monthly, special, or other assessments due to the association by the unit owner. If applicable, note if there are any special assessments currently under consideration and provide an explanation.

- Capital Expenditures: Indicate whether any capital expenditures are anticipated within the current or next two fiscal years. If yes, provide a brief explanation.

- Reserve Fund Information: State the amount of the reserve or replacement fund for current or future capital expenditures. Indicate if any part of this reserve is earmarked for a specific project and explain if applicable.

- Attach the Budget: Ensure that a complete copy of the association's most recent approved budget is attached to the form.

- Pending Lawsuits: Check the appropriate box to indicate whether there are any pending lawsuits or judgments involving the unit owner's association. If yes, provide details.

- Insurance Information: Fill in the name of the insurance carrier for the unit owner's association, along with the address, contact name, telephone number, and facsimile number.

- Improvements or Alterations: Confirm that there are no known improvements or alterations made to the unit or the limited common elements that violate the condominium declarations, bylaws, rules, or regulations.

- Signature: Finally, include the name of the association and the managing agent's name (if applicable). An authorized agent of the association must sign the form.

Once the form is filled out completely, it should be submitted as required by your condominium association's policies. Make sure to keep a copy for your records as well.