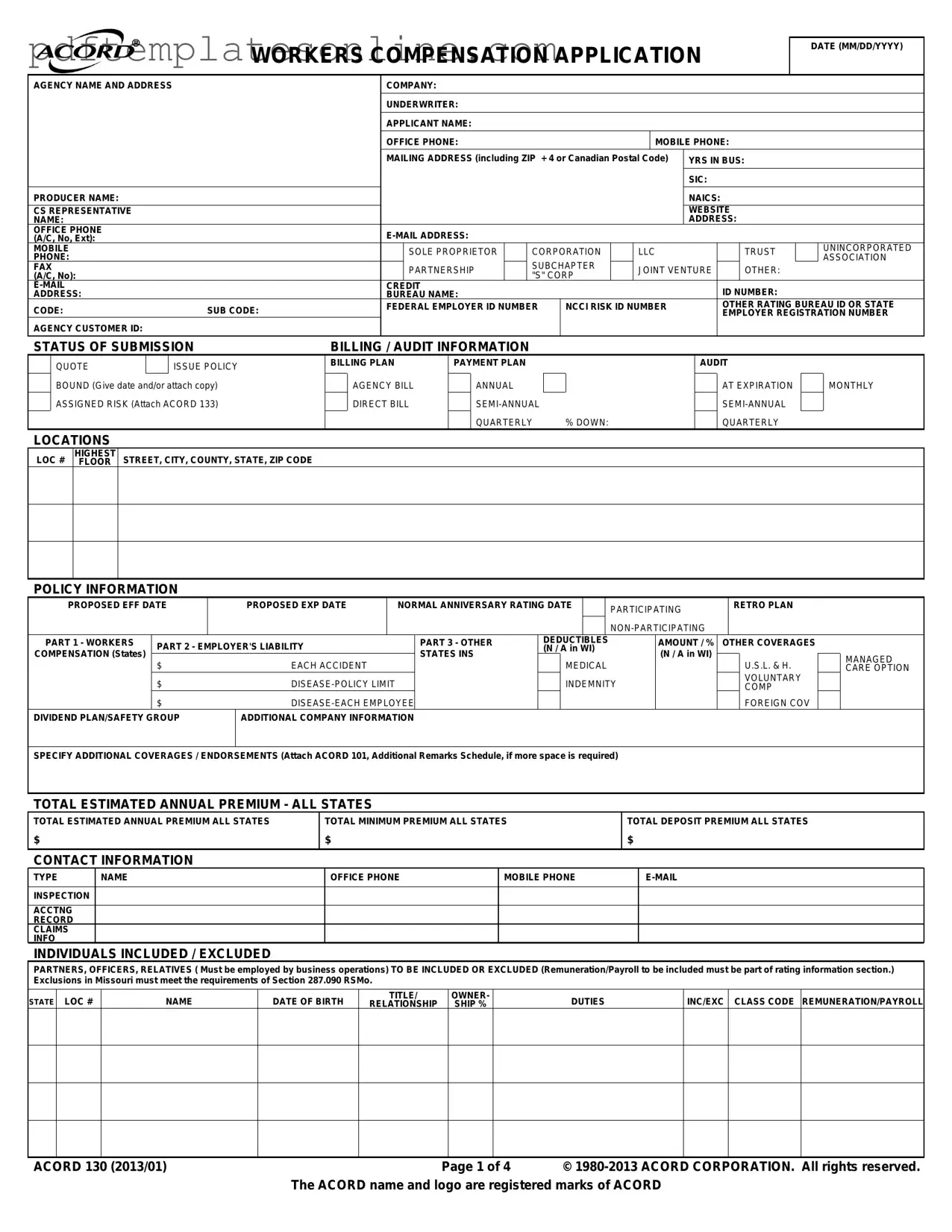

Blank Acord 130 Form

Key takeaways

Filling out the Acord 130 form accurately is essential for obtaining workers' compensation insurance. Here are key takeaways to consider:

- Ensure all contact information is complete, including the applicant's name, phone numbers, and mailing address.

- Specify the type of business entity, such as a corporation, LLC, or sole proprietorship, to clarify the applicant's legal status.

- List the number of years in business and provide the relevant SIC and NAICS codes to categorize the business accurately.

- Detail the estimated annual premium and minimum premium amounts, as these figures are crucial for underwriting decisions.

- Indicate the proposed effective and expiration dates for the policy to establish the coverage period clearly.

- Provide a thorough description of business operations, including any relevant details about products or services offered.

- Include information about employees, particularly regarding any that may be included or excluded from coverage.

- Disclose any prior insurance coverage and loss history for the past five years, as this can impact premium calculations.

- Answer all general information questions honestly, particularly those concerning hazardous materials or subcontracting practices.

- Sign the application to certify that all provided information is accurate and complete, as this is a critical step in the process.

By following these guidelines, applicants can help ensure a smoother process when seeking workers' compensation coverage.

Common mistakes

Filling out the ACORD 130 form can be a straightforward process, but many applicants make common mistakes that can lead to delays or complications in obtaining workers' compensation insurance. One frequent error is failing to provide accurate contact information. It is crucial to include correct details for both the applicant and the agency. Missing or incorrect phone numbers and email addresses can hinder communication, causing unnecessary delays in processing the application.

Another mistake often made is neglecting to specify the correct business structure. The form requires applicants to indicate whether they are a sole proprietor, corporation, LLC, or another type of business entity. Misclassifying your business type can lead to incorrect premium calculations and coverage issues. Always ensure that the selected option accurately reflects your business's legal structure.

Many applicants also overlook the importance of detailing the nature of their business operations. Providing a vague or incomplete description can result in misclassification of risk, which may affect coverage and premiums. Clearly articulate the types of work performed, the materials used, and any subcontracting arrangements. This information is vital for insurers to assess the risk accurately.

Additionally, applicants often fail to disclose all relevant employees. It is essential to list all individuals included or excluded from coverage, along with their roles and remuneration. Omitting employees or misrepresenting their duties can lead to significant issues during audits or claims. Ensure that all pertinent information is captured accurately to avoid complications later on.

Lastly, applicants sometimes skip the section regarding prior carrier information and loss history. This information is crucial for insurers to evaluate the risk associated with your business. Providing incomplete or inaccurate loss history can lead to higher premiums or even denial of coverage. Always include detailed information about past claims and losses to facilitate a smoother underwriting process.

Misconceptions

Misconceptions about the ACORD 130 form can lead to confusion during the application process. Here are seven common misunderstandings:

- It is only for large businesses. Many believe that only large corporations need to fill out the ACORD 130 form. In reality, it is applicable to businesses of all sizes, including small and sole proprietorships.

- All sections must be filled out completely. Some assume that every section of the form is mandatory. While many sections are important, not all fields require completion, especially if they do not apply to the business.

- The form is only for new applications. A common misconception is that the ACORD 130 is solely for new insurance applications. It can also be used for renewals and modifications of existing policies.

- It guarantees coverage. Filling out the ACORD 130 does not guarantee that coverage will be issued. The insurer will review the application and determine eligibility based on various factors.

- Only the owner needs to sign. Some believe that only the business owner’s signature is required. However, the form must be signed by an authorized representative, which can include partners or officers.

- It does not require any additional documentation. Many think that submitting the ACORD 130 form alone is sufficient. In some cases, insurers may require additional documents, such as loss history or financial statements.

- It is the same as other ACORD forms. Some may think that the ACORD 130 is interchangeable with other ACORD forms. Each form serves a specific purpose and should be used accordingly to ensure accurate information is conveyed.

Understanding these misconceptions can help businesses navigate the application process more effectively and ensure they provide the necessary information to obtain the appropriate coverage.

Dos and Don'ts

When filling out the ACORD 130 form, it’s essential to follow certain guidelines to ensure accuracy and completeness. Here’s a list of what you should and shouldn’t do:

- Do provide accurate information about your business operations.

- Do include all necessary contact details, including phone numbers and email addresses.

- Do specify the correct type of business entity, such as corporation or partnership.

- Do indicate the estimated annual payroll and premium amounts clearly.

- Don't leave any sections blank; fill in every applicable field.

- Don't provide false information or omit details, as this can lead to penalties.

- Don't forget to attach any required documents, such as loss history or additional remarks.

- Don't rush through the application; take your time to review all entries for accuracy.

Other PDF Forms

What Does a Dog Need to Travel - The veterinarian's signature is crucial for the validity of the certificate.

In addition to understanding the fundamental aspects of a loan agreement, borrowers can stay informed about various forms and templates available to assist in their transactions, such as the resources found in California PDF Forms, which can help streamline the process and ensure all necessary details are correctly documented.

How to Ship With Fedex - Situations involving limited access or unique delivery situations should be noted on the Bill of Lading.

Medication Label Uk - Helps to identify the patient and the prescribing physician.

Detailed Guide for Writing Acord 130

Completing the ACORD 130 form is a crucial step in applying for workers' compensation insurance. This form gathers essential information about your business, including contact details, operational history, and employee information. By accurately filling out this form, you help ensure that your application is processed smoothly and efficiently.

- Date: Enter the date of application in the format MM/DD/YYYY.

- Agency Information: Fill in the name and address of the agency handling your application.

- Company and Underwriter: Provide the name of the insurance company and the underwriter.

- Applicant Information: Input your name, office phone number, mobile phone number, and mailing address, including the ZIP + 4 code or Canadian Postal Code.

- Business Details: Indicate the number of years in business and the Standard Industrial Classification (SIC) code.

- Producer Name and Contact: Enter the producer's name, along with their contact details, including office phone and email address.

- Business Structure: Check the appropriate box to indicate your business structure (e.g., sole proprietor, corporation, LLC, etc.).

- Employer Identification: Fill in your Federal Employer ID Number and any other relevant identification numbers.

- Billing Information: Select the billing and audit information that applies to your application.

- Policy Information: Enter the proposed effective and expiration dates for the policy.

- Coverage Details: Specify the details regarding workers' compensation and employer's liability coverage, including deductibles and other coverages.

- Estimated Premiums: Provide the total estimated annual premium and any minimum or deposit premiums.

- Contact Information: List the contact details for individuals involved in various aspects of the business, such as inspection and accounting.

- Employees Information: Detail the individuals included or excluded from coverage, including their roles and remuneration.

- Rating Information: Complete the rating information for each state in which you operate, including class codes and estimated payroll.

- Prior Carrier Information: Provide information regarding your insurance coverage over the past five years, including claims history.

- General Information: Answer the general questions regarding your operations and provide explanations for any "yes" responses.

- Signature: Ensure the application is signed by an authorized representative, including the date and producer's signature.