Blank 14653 Form

Key takeaways

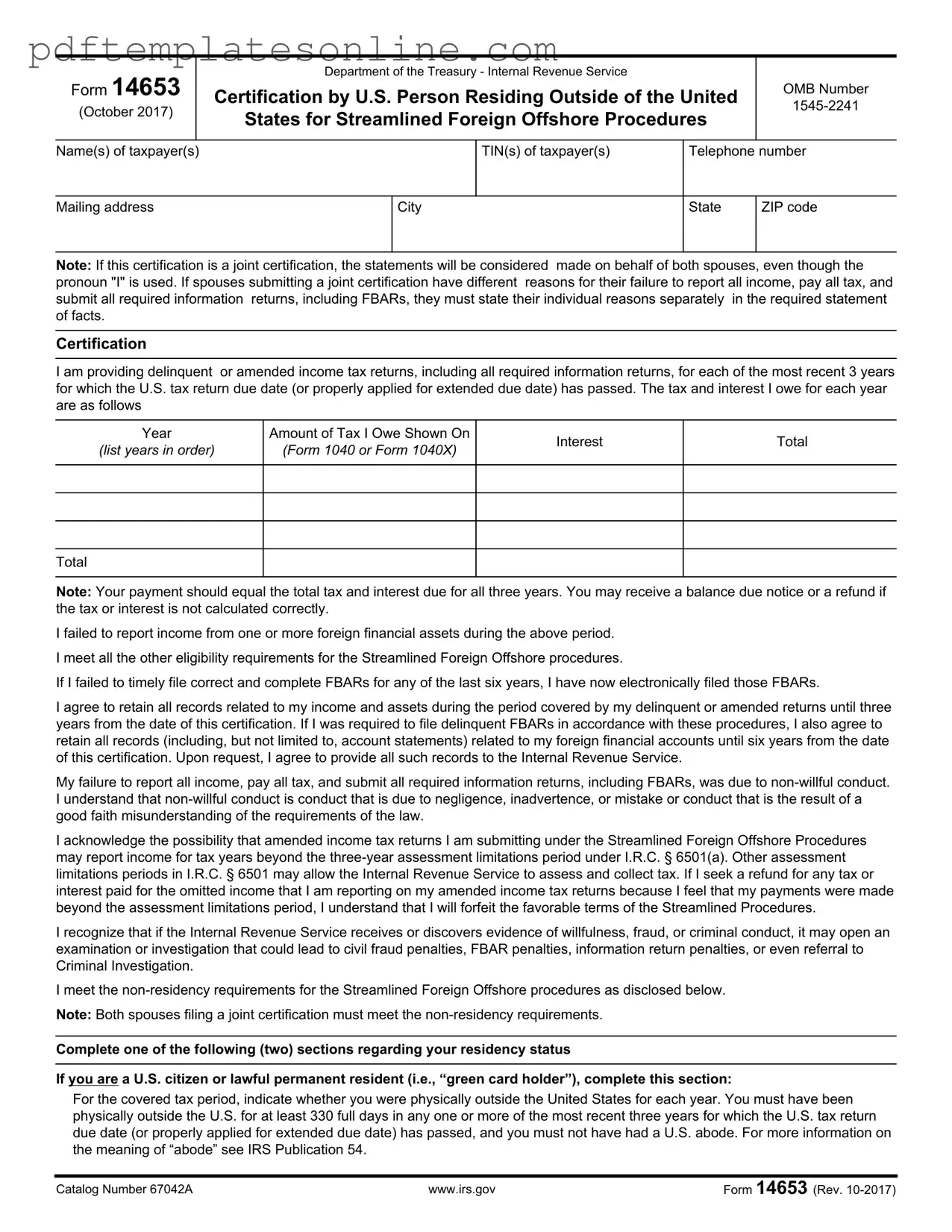

Form 14653 is used by U.S. persons living outside the United States to certify eligibility for the Streamlined Foreign Offshore Procedures.

Ensure that all information is accurate and complete. Incomplete submissions may not qualify for the streamlined penalty relief.

Both spouses must meet the non-residency requirements if filing jointly. Individual residency statuses should be clearly stated.

Provide a detailed narrative explaining the reasons for any failures to report income or file required forms. Include personal and financial backgrounds.

Retain all records related to your income and foreign financial accounts for the required periods. This is essential in case the IRS requests them.

Understand that the IRS may take action if evidence of willfulness or fraud is found. This could lead to penalties or further investigation.

Common mistakes

Filling out Form 14653 can be a daunting task, especially for those who are navigating the complexities of U.S. tax law from abroad. Mistakes can lead to delays or even disqualification from the Streamlined Foreign Offshore Procedures. Here are seven common errors to avoid when completing this important form.

One frequent mistake is failing to provide a complete narrative statement of facts. This narrative is crucial, as it explains the reasons for failing to report all income or submit required information returns. Without a thorough account, the submission may be deemed incomplete, jeopardizing eligibility for streamlined penalty relief. It’s essential to include not only the reasons for the oversight but also any relevant personal or financial background that could provide context.

Another common pitfall is inaccurately reporting the amount of tax owed. Taxpayers must ensure that the figures provided match those on their amended returns. If the total tax and interest due do not align with the amounts calculated, it can lead to a balance due notice or even a refund, complicating the process further. Double-checking these figures is a necessary step before submission.

Some individuals also mistakenly neglect to meet the non-residency requirements. To qualify for the Streamlined Foreign Offshore Procedures, taxpayers must have been physically outside the United States for at least 330 full days in any of the last three years. Failing to accurately track and report this information can result in disqualification from the program.

Additionally, many taxpayers overlook the importance of documenting foreign financial accounts. It is vital to explain the source of funds in these accounts, whether they were inherited, opened while residing abroad, or used for business purposes. Providing a complete story about these accounts can help clarify any misunderstandings and strengthen the case for non-willful conduct.

Moreover, joint filers often forget to specify differing reasons for non-compliance. If spouses have different circumstances surrounding their failures to report income or file returns, each must clearly articulate their individual reasons. Neglecting to do so can lead to confusion and may result in the rejection of the joint submission.

Another error involves incomplete computations for non-U.S. citizens. Non-citizens must attach a detailed computation showing that they did not meet the substantial presence test. Failing to include this information renders the submission incomplete, which can prevent qualification for the Streamlined Foreign Offshore Procedures.

Lastly, not retaining records as required can be a significant oversight. Taxpayers must agree to keep all records related to their income and assets for three years from the date of certification, and for six years if FBARs were required. This documentation is essential should the IRS request it later. Keeping thorough records can save time and stress in the future.

By being aware of these common mistakes and taking steps to avoid them, individuals can navigate the complexities of Form 14653 more effectively, ensuring a smoother path through the Streamlined Foreign Offshore Procedures.

Misconceptions

Here are seven common misconceptions about Form 14653, along with clarifications for each:

- Misconception 1: Only U.S. citizens can use Form 14653.

- Misconception 2: Filing Form 14653 guarantees no penalties.

- Misconception 3: You must file all tax returns for the past six years.

- Misconception 4: You can submit the form without a narrative statement of facts.

- Misconception 5: You don't need to retain records after filing.

- Misconception 6: You can file Form 14653 if you were physically present in the U.S. for more than 330 days.

- Misconception 7: The form is only for those with foreign bank accounts.

This form is available to both U.S. citizens and lawful permanent residents (green card holders) who reside outside the United States.

While the form aims to provide relief from certain penalties, it does not guarantee immunity from all penalties. The IRS may still impose penalties if evidence of willfulness or fraud is found.

Form 14653 requires the filing of delinquent or amended returns for only the most recent three years for which the due date has passed.

A complete narrative statement explaining your failure to report income and file returns is essential. Submissions lacking this information will be deemed incomplete.

Taxpayers must retain all relevant records for three years from the date of certification and six years for FBARs, as the IRS may request these documents later.

To qualify, you must have been physically outside the U.S. for at least 330 full days during the relevant years. Failing to meet this requirement will disqualify your submission.

Form 14653 applies to any U.S. person who has failed to report income from foreign financial assets, not just bank accounts. This includes investments and other financial holdings.

Dos and Don'ts

When filling out Form 14653, it's essential to approach the task with care. Here are seven important things to keep in mind:

- Do ensure accuracy. Double-check all information provided, including names, tax identification numbers, and financial details.

- Don't omit details. Every required piece of information must be included. Incomplete submissions may lead to delays or disqualification.

- Do provide a clear narrative. Explain your reasons for failing to report income or submit returns. Include both favorable and unfavorable facts.

- Don't ignore the residency requirements. Confirm that you meet the non-residency criteria before submitting the form.

- Do retain supporting documents. Keep all records related to your income and foreign financial accounts for the required time periods.

- Don't rush the process. Take your time to understand the form and its requirements. Mistakes can lead to complications.

- Do seek help if needed. If you're unsure about any part of the form, consider consulting a tax professional for guidance.

Other PDF Forms

Baseball Tryout Form - Catchers are evaluated on their receiving skills and throwing accuracy to bases.

For those looking to navigate the complexities of real estate transactions, an extensive guide on the Land Purchase Agreement is invaluable. This document serves as a formal contract, detailing responsibilities and terms that protect both the buyer and seller in a real estate deal, ensuring a smooth transaction. For more information, you can explore an in-depth resource on the Land Purchase Agreement.

Eagle Scout Paperwork - Scouts should document their roles and responsibilities in the project.

Detailed Guide for Writing 14653

Filling out Form 14653 is an important step for individuals seeking to comply with U.S. tax laws while residing outside the United States. Once the form is completed, it should be submitted to the Internal Revenue Service (IRS) along with any necessary documentation. Ensure that all information is accurate and complete to avoid delays in processing.

- Begin by entering the name(s) of the taxpayer(s) in the designated field.

- Provide the Tax Identification Number(s) (TINs) of the taxpayer(s).

- Fill in the telephone number of the taxpayer(s).

- Complete the mailing address, including city, state, and ZIP code.

- If this is a joint certification, remember that the statements apply to both spouses, even if "I" is used.

- In the certification section, confirm that you are providing delinquent or amended income tax returns for the last three years.

- List the years for which you are filing returns, along with the amount of tax owed, interest, and total for each year.

- Indicate whether you failed to report income from foreign financial assets during the specified period.

- Confirm that you meet all eligibility requirements for the Streamlined Foreign Offshore procedures.

- State whether you have electronically filed any delinquent FBARs for the last six years.

- Agree to retain all records related to your income and assets for the required time periods.

- Confirm that your failure to report income, pay tax, and submit information returns was due to non-willful conduct.

- Complete the residency status section according to whether you are a U.S. citizen or lawful permanent resident, or not.

- If applicable, provide a computation showing that you did not meet the substantial presence test.

- Provide a narrative statement of facts explaining your failure to report income, including personal and financial background.

- Detail the source of funds in your foreign financial accounts/assets.

- If applicable, include information about any professional advisors you relied on.

- Sign and date the form where indicated, ensuring that both spouses sign if submitting a joint certification.

- If a paid preparer assists with the form, they must also provide their information and signature.

- Indicate whether you want to allow another person to discuss this form with the IRS.